12/30 Market report

Sommario:EURUSD/GBPUSD/USOIL/BITCOIN/

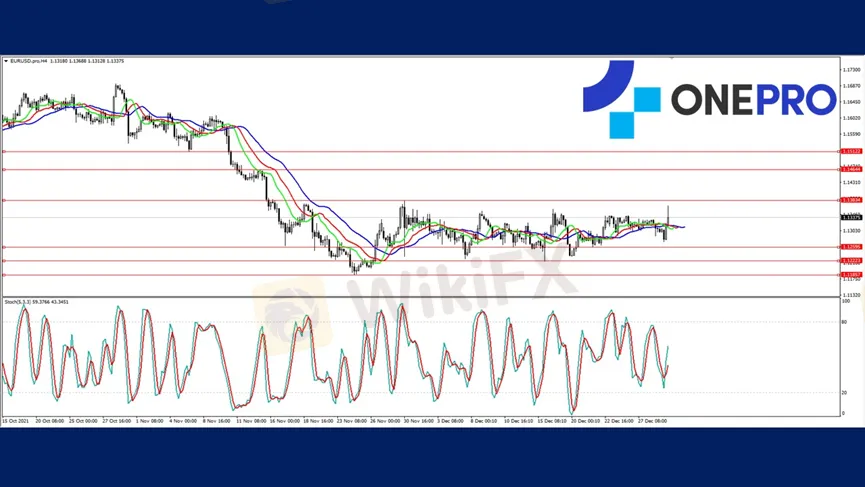

【EURUSD】

In a survey of 40 economists on the economic outlook of the euros, it is predicted that inflation in the euro area will continue to rise next year. The continued spread of the epidemic and inflation news will pose serious challenges to the economic recovery of the euro area. The Eurozone added 10,528 to the CFTC's speculative open positions, including a 7,065 increase in long open positions. This indicates that investors are placing a long euro position. However, the layout of the CFTC is more biased towards the long-term. Alligator tangled but the KD indicator shows a low-end position of the golden cross. The probability of challenging the high-end range in the short term is still quite high.

EURUSD -H4

Resistance 1: 1.13800 / Resistance 2: 1.14800 / Resistance 3: 1.15200

Support 1: 1.12500/ Support 2: 1.12200/ Support 3: 1.11800

【GBPUSD】

The pound's recent breakthrough in the consolidation range is followed by a sustained rise and challenging the resistance point. Last week's CFTC data looks speculative where long orders reduced is by 8673. The overall net position decreased by 6938 and this indicates that investors have gradually taken profits in the process of the continuous rise of the pound as the buying strength slowed. However, technical analysis shows both Alligator and KD golden crosses. This indicates that the buying force of the short-term can be read as very strong. It is still likely to challenge the new high of 3 months.

GBPUSD-H4

Resistance 1: 1.35200 / Resistance 2: 1.35800

Support 1: 1.34780 / Support 2: 1.33750 / Support 3: 1.32780

【USOIL】

U.S. crude inventories last week were smaller than expected. This led the market to believe that the crude shortage could be worse than expected. Crude oil prices are currently challenging the price of $78 per barrel. In last week's CFTC data, speculative long orders for crude oil decreased by nearly 5,000 and net open positions by 6,882. This indicates that investors believe that oil prices are uncertain or high. From the perspective of technical analysis, Alligator and KD are both golden crosses. This indicates that the short-term buying force is still very strong.

USOIL – H4

Resistance 1: 76.680 / Resistance 2: 78.420 / Resistance 3: 79.850

Support 1: 69.380/ Support point 2: 66.300/ Support point 3: 64.300

【BITCOIN】

Bitcoin extended its decline and fell 7.2% in just one day to below 50,000 each. Some analysts in the market believe that it is unusual to be sold off at the end of 2021 but this does not affect the fact that Bitcoin will remain a big profit in 2021 on overall. At present, technical analysis shows an Allligator death cross and the KD gold cross. Both analysis contradicts each other so the short-term opportunity to oscillate in the range of 47,000 to 52,000 is still relatively high.

BITCOIN – H4

Resistance 1: 51937.20 / Resistance 2: 53491.80 / Resistance 3: 55644.00

Support 1: 47273.50/ Support 2: 45479.80/ Support 3: 41773.00

OnePro Special Analyst

Buy or sell or copy trade at www.oneproglobal.com

The foregoing is a personal opinion only and does not represent any opinion of OnePro Global, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

WikiFX Trader

FXTM

Exness

DBG Markets

MultiBank Group

TMGM

ATFX

FXTM

Exness

DBG Markets

MultiBank Group

TMGM

ATFX

WikiFX Trader

FXTM

Exness

DBG Markets

MultiBank Group

TMGM

ATFX

FXTM

Exness

DBG Markets

MultiBank Group

TMGM

ATFX

Rate Calc