Millbank FX-Some important Details about This Broker

Sommario:Millbank FX, namely MILLBANK FX LIMITED, is a commercial foreign exchange institution offering tailor-made services including risk management and instant execution with the aim of adding values for every organization it works with, which was registered in the United Kingdom with its registered resident at One Canada Square, Canary Wharf, London E14 5AB.

| Millbank FX Review Summary | |

| Founded | 2016 |

| Registered Country/Region | United Kindom |

| Regulation | Exceeded(FCA) |

| Services | FX Risk Management, International Payments, Multi-Currency Accounts, FX Market Analysis, Institutional FX Rates |

| Demo Account | ❌ |

| Exchange rates | Institutional-grade rates(1.2003 for GBP to EUR conversions) |

| Customer Support | Email: support@millbankfx.com, |

| Phone: +44 (0) 203 889 8840 | |

| 24/7 live chat: yes | |

| Physical Address: 46 Gresham Street, London, EC2V 7AY | |

Millbank FX Information

Payment institution Millbank FX provides customised FX solutions to companies all around the world. The business offers international payments, institutional FX rate access, and currency risk management. Having knowledge in 22 different fields, Millbank FX handles over 80 currencies and makes payments to 120+ countries, guaranteeing safe and reasonably priced transactions for businesses all around.

Pros and Cons

| Pros | Cons |

| Access to 80+ currencies in 120+ countries | No demo account available for practice |

| 2 accounts for corporate and private clients | Exceeded license |

| Receive payments in 38 currencies |

Is Millbank Legit or not?

Millbank has an exceeded license provided by FCA.

| Regulatory Agency | Financial Conduct Authority (FCA) |

| Current Status | Exceeded |

| License Type | Payment License |

| Regulated By | United Kingdom |

| License No. | 787366 |

| Licensed Institution | MILLBANK FX LIMITED |

| Effective Date | 2018/2/8 |

What Service Does Millbank FX Provide?

Emphasizing currency management and foreign payments, Millbank FX specializes in services catered to companies and individuals.

| Service Type | Supported |

| Currency Risk Management | ✔ |

| International Payments | ✔ |

| Multi-Currency Accounts | ✔ |

| FX Market Analysis | ✔ |

| Institutional FX Rates | ✔ |

| Market Orders & Stop Losses | ✔ |

- Currency Risk Management: offers specifically designed hedging techniques to reduce volatility in exchange rates and safeguard profit margins.

- International Payments: provides priced worldwide transactions in more than 80 currencies spread across more than 120 countries.

- Multi-Currency Account: provides centralized solutions for handling of 38 currencies, therefore lightening administrative tasks.

- Institutional FX Rates: gives wholesale FX rates access, reducing transaction costs for either regular or high-value transactions.

- Market Orders & Stop Losses: provides some insurance against negative market fluctuations and targets aimed at particular currency rates.

- FX Market Analysis: Provides real-time insights and thorough data to back up decisions.

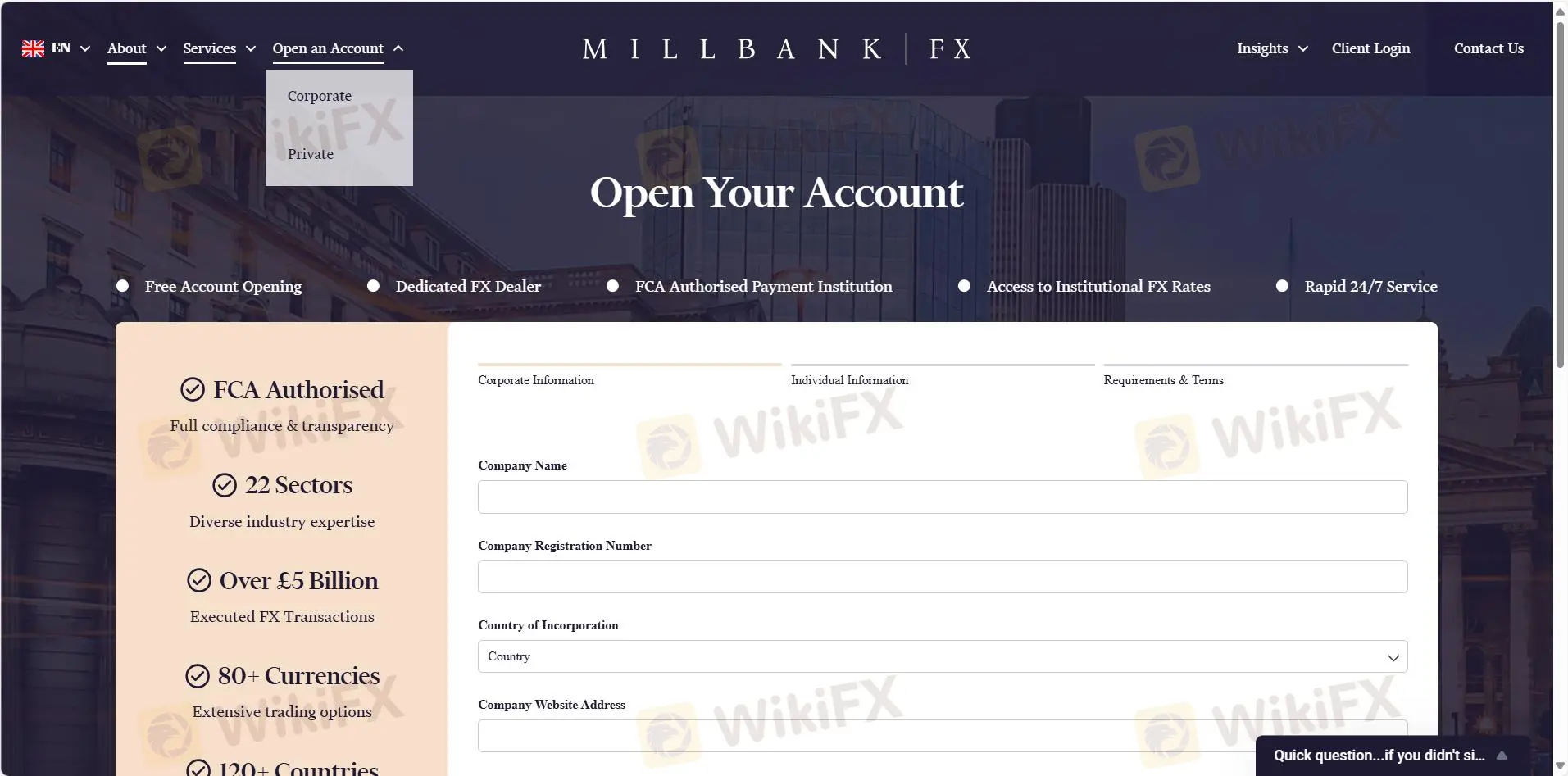

Account Types

Millbank FX offers two types of accounts: corporate and private.

| Corporate | Designed for businesses requiring high-volume FX transactions |

| Private | Tailored for individual clients managing personal FX needs |

Millbank FX Fees

With institutional-grade exchange rates, including 1.2003 for GBP to EUR conversions, Millbank FX generates a recipient amount of €600,150 for £500,000.

| Fee Type | Details |

| Exchange Rate | Example: 1.2003 (GBP to EUR conversion) |

| Recipient Gets | €600,150 for £500,000 |

Leggi di più

Aggiornamenti broker dal 7-13 dicembre

La bolletta denominata Stablecoin Tethering and Bank Licensing Enforcement Act., proposto da Rashida Tlaib, un democratico del Michigan, insieme ai membri del Congresso, Jesus García e Stephen Lynch, mira a proteggere i consumatori dalle minacce emergenti associate al mercato delle criptovalute e richiederà a chiunque che offre stablecoin l'approvazione della Federal Deposit Insurance Corporation (FDIC) e di altre agenzie governative competenti.

Aggiornamenti broker dal 30 novembre-6 dicembre

Le autorità cinesi hanno confiscato criptovalute per un valore di oltre 4,2 miliardi di dollari in relazione alla famigerata truffa Plus Token, rivelano i file del tribunale locale.

Aggiornamenti broker dal 23-29 novembre

Matthew Piercey, l'uomo dietro due società di investimento - Zolla e Family Wealth Legacy, è stato arrestato dagli agenti dell'FBI a Sacramento con l'accusa di frode telematica, manomissione di testimoni, frode postale e riciclaggio di denaro, che si è appropriata indebitamente di circa 35 milioni di dollari di fondi degli investitori, come affermato dalla corte degli Stati Uniti.

Aggiornamenti dei broker dal 9-15 novembre

Salgono a 323 i domini dei servizi finanziari bloccati da Consob.

WikiFX Trader

FXTM

Exness

DBG Markets

ATFX

HTFX

EBC

FXTM

Exness

DBG Markets

ATFX

HTFX

EBC

WikiFX Trader

FXTM

Exness

DBG Markets

ATFX

HTFX

EBC

FXTM

Exness

DBG Markets

ATFX

HTFX

EBC

Rate Calc