WWM-Some important Details about This Broker

Sommario:WWM, or WorldWide Markets, is a brokerage firm registered in the United Kingdom. It provides access to the popular MetaTrader 4 trading platform. While WWM operates under the regulation of the FSC, its current status and operations are unclear due to its revoked FCA regulation and the lack of a functional official website.

NOTE: WWMs official site - https://www.waihui168.com/ is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

| WWM Review Summary | |

| Registered Country/Region | United Kingdom |

| Regulation | FCA (Revoked), FSC (Offshore Regulatory) |

| Trading Platforms | Meta Trader 4 |

| Customer Support | Email: support@waihui168.com |

What is WWM?

WWM, or WorldWide Markets, is a brokerage firm registered in the United Kingdom. It provides access to the popular MetaTrader 4 trading platform. While WWM operates under the regulation of the FSC, its current status and operations are unclear due to its revoked FCA regulation and the lack of a functional official website.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

|

Pros:

Access to MetaTrader 4: WWM offers the MetaTrader 4 trading platform, which is highly regarded in the industry for its advanced charting tools, technical analysis capabilities, and ease of use.

FSC Regulation: WWM is still regulated by the FSC, providing a level of oversight and enhancing trustworthiness.

Cons:

Revoked FCA Regulation: The fact that WWM's FCA regulation has been revoked raises questions about its adherence to regulatory standards and risks to traders.

Website Unavailability: The non-functional official website indicates issues with the broker's operations or transparency.

Limited Information: Due to the lack of information available, it's unclear what the current status and operations of WWM are, which is concerning for clients.

Exposure of Inability to Withdraw: There are eight pieces of exposure of inability to withdraw funds or other issues on WikiFX, strengthening the case against WWM.

Is WWM Safe or Scam?

It is challenging to definitively classify WWM as either safe or a scam. With a Retail Forex License of No.SIBA/L/11/0960, WWM is regulated by the British Virgin Islands Financial Services Commission (Offshore Regulatory). However, the Investment Advisory License of No.604779 issued by the Financial Conduct Authority (FCA) has been revoked. Furthermore, concerns related to the non-functional website, and reports of withdrawal issues also raise questions about its operational integrity.

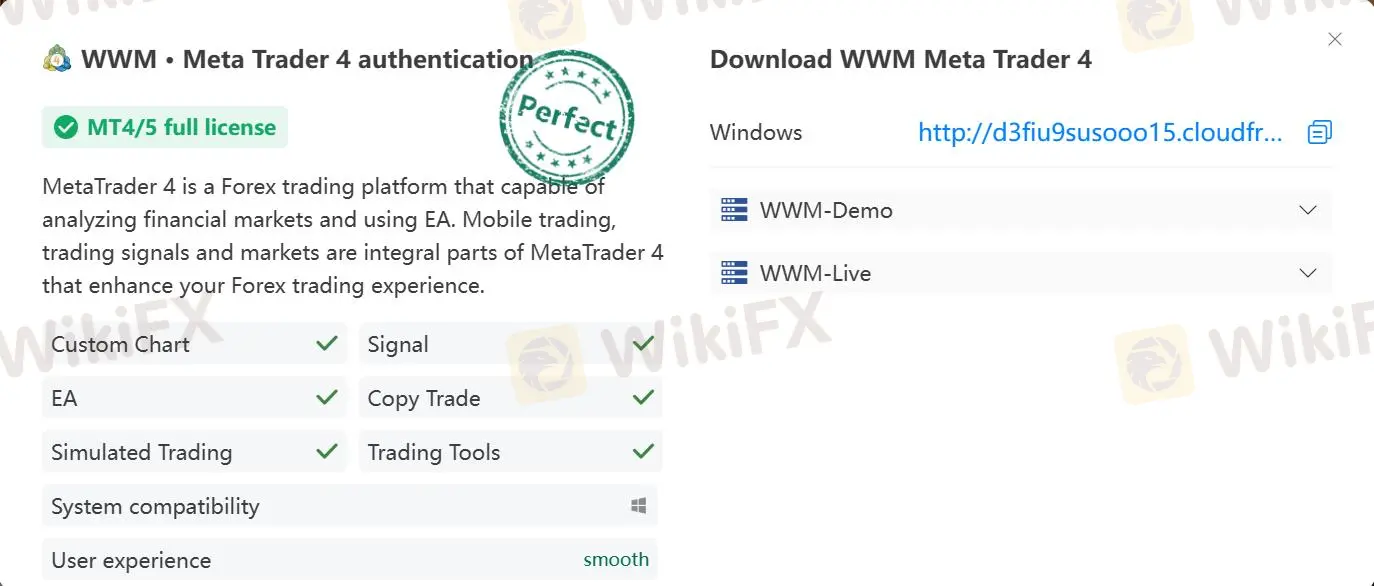

Trading Platforms

WWM offers the MetaTrader 4 (MT4) trading platform, which is a popular choice among traders for its user-friendly interface, advanced charting tools, and customizable features. MT4 allows traders to execute trades, analyze market data, and manage their accounts efficiently. Overall, the use of MT4 by WWM provides traders with a reliable and feature-rich platform for their trading activities.

Customer Service

WWM's customer support can be reached via email at support@waihui168.com.

Conclusion

WWM is a broker offering the popular MetaTrader 4 platform. While it holds FSC regulation, a red flag is its revoked FCA license, raising doubts about its adherence to financial regulations. Further concerns include a non-functional website and reports of withdrawal difficulties. We strongly advise you to avoid it and consider researching more established brokers with a solid regulatory track record and a functional online presence.

Frequently Asked Questions (FAQs)

Q: Is WWM regulated?

A: Yes, WWM is regulated by the FSC (Offshore Regulatory). However, its previous FCA regulation has been revoked.

Q: What trading platform does WWM offer?

A: WWM offers the MetaTrader 4 (MT4) trading platform.

Q: Can I contact WWM's customer support?

A: Yes, you can contact WWM's customer support via email at support@waihui168.com.

Q: Is WWM safe to trade with?

A: Trading with WWM involves significant risks due to its revoked FCA regulation and the non-functional website.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Leggi di più

Aggiornamenti broker dal 7-13 dicembre

La bolletta denominata Stablecoin Tethering and Bank Licensing Enforcement Act., proposto da Rashida Tlaib, un democratico del Michigan, insieme ai membri del Congresso, Jesus García e Stephen Lynch, mira a proteggere i consumatori dalle minacce emergenti associate al mercato delle criptovalute e richiederà a chiunque che offre stablecoin l'approvazione della Federal Deposit Insurance Corporation (FDIC) e di altre agenzie governative competenti.

Aggiornamenti broker dal 30 novembre-6 dicembre

Le autorità cinesi hanno confiscato criptovalute per un valore di oltre 4,2 miliardi di dollari in relazione alla famigerata truffa Plus Token, rivelano i file del tribunale locale.

Aggiornamenti broker dal 23-29 novembre

Matthew Piercey, l'uomo dietro due società di investimento - Zolla e Family Wealth Legacy, è stato arrestato dagli agenti dell'FBI a Sacramento con l'accusa di frode telematica, manomissione di testimoni, frode postale e riciclaggio di denaro, che si è appropriata indebitamente di circa 35 milioni di dollari di fondi degli investitori, come affermato dalla corte degli Stati Uniti.

Aggiornamenti dei broker dal 9-15 novembre

Salgono a 323 i domini dei servizi finanziari bloccati da Consob.

WikiFX Trader

FXTM

Exness

DBG Markets

XM

MultiBank Group

EBC

FXTM

Exness

DBG Markets

XM

MultiBank Group

EBC

WikiFX Trader

FXTM

Exness

DBG Markets

XM

MultiBank Group

EBC

FXTM

Exness

DBG Markets

XM

MultiBank Group

EBC

Rate Calc