4X Capital-Some important Details about This Broker

Sommario:4X Capital is an online forex broker registered in the United Kingdom, with the founding time and the company behind it not disclosed to all. Since 4X Capitals official website cannot be opened at the moment, we could get minimal information.

| Aspect | Information |

| Registered Country/Area | United Kingdom |

| Founded Year | 2-5 years (exact founding year not disclosed) |

| Company Name | 4X Capital |

| Regulation | No valid regulation |

| Minimum Deposit | Classic: 250 EUR Gold: at least 5,000 EUR Platinum: 25,000 EURVIP: at least 50,000 EUR |

| Maximum Leverage | Not provided |

| Spreads | Not provided |

| Trading Platforms | Not provided |

| Tradable Assets | Not provided |

| Account Types | Classic, Gold, Platinum, VIP |

| Demo Account | Not mentioned |

| Customer Support | Telephone: +442038070716Email: support@4x-capital.co |

General Information

4X Capital is an online forex broker based in the United Kingdom. However, it should be noted that the company lacks regulation from any valid regulatory authority. This absence of regulation raises concerns about the transparency and security of client funds. Traders should exercise caution and thoroughly assess the potential risks associated with engaging with an unregulated broker.

The broker offers a range of trading accounts, including Classic, Gold, Platinum, and VIP, catering to different trading needs and goals. Each account type has a different minimum deposit requirement, providing options for traders with varying capital availability. However, specific details regarding leverage, spreads, and trading platforms are not disclosed, limiting the ability to evaluate the trading conditions and features offered by 4X Capital.

Customer support is available through telephone and email, allowing traders to seek assistance or clarification regarding any concerns they may have. However, with the temporary unavailability of the official website, obtaining comprehensive information about the broker's offerings and services becomes challenging. Traders should carefully consider the limited information available and the lack of regulation before making any investment decisions with 4X Capital.

Pros and Cons

4X Capital, an online forex broker based in the United Kingdom, offers a range of trading accounts to cater to different traders' needs and goals. The availability of multiple account types, including Classic, Gold, Platinum, and VIP, provides flexibility for traders with varying capital availability. Furthermore, the lower minimum deposit requirement for the Classic account allows traders to start with a relatively smaller investment. However, it is crucial to note that 4X Capital lacks regulation from any valid regulatory authority, which raises concerns about the transparency and security of client funds. The absence of regulatory oversight introduces significant risks for traders, as there is no guarantee of fair practices or adherence to industry standards. Additionally, limited information about important aspects such as leverage, spreads, and trading platforms hinders a comprehensive evaluation of the broker's offerings.

| Pros | Cons |

| Offers multiple account types catering to different traders | Lacks regulation from any valid regulatory authority |

| Lower minimum deposit requirement for the Classic account | Limited information about important trading aspects |

| Potential risks associated with engaging with an unregulated broker |

Is 4X Capital Legit?

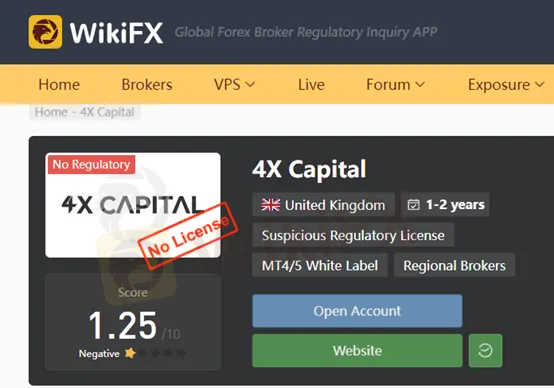

The information provided indicates that 4X Capital is not regulated by any valid regulatory authority. The warning explicitly states that there is no valid regulatory information available for the broker. This lack of regulation suggests that the activities and operations of 4X Capital are not monitored or overseen by any financial regulatory body.

The absence of regulation in the financial industry poses significant risks for investors and traders. Regulatory bodies are established to ensure that financial institutions adhere to specific standards and guidelines, protecting the interests of clients and maintaining the integrity of the market. When a broker is unregulated, there is no guarantee of fair practices, transparency, or the security of client funds.

Additionally, the low score mentioned in the warning further emphasizes the potential risks associated with 4X Capital. This could indicate negative reviews, complaints, or a track record of suspicious activities, such as involvement in a pyramid scheme.

Account Types

4X Capital offers four trading accounts to cater to the diverse trading needs and goals of traders. These account types are Classic, Gold, Platinum, and VIP accounts. Each account requires a different minimum deposit, providing options for traders with varying capital availability and investment preferences.

CLASSIC ACCOUNT

The Classic account is the entry-level option, requiring a minimum deposit of 250 EUR. It serves as a starting point for traders who want to explore the forex market with a relatively smaller investment.

GOLD ACCOUNT

The Gold account, on the other hand, has a higher minimum deposit requirement of at least 5,000 EUR. This account type may offer additional features and benefits compared to the Classic account, though the specific details are not available.

PLATINUM ACCOUNT

For traders seeking a more comprehensive trading experience, the Platinum account is offered. Opening a Platinum account requires a minimum deposit of 25,000 EUR. This account type may provide enhanced features, services, and potentially lower trading costs, but specific information regarding these aspects is not provided.

VIP ACCOUNT

Lastly, 4X Capital offers a VIP account for traders who prefer a premium trading experience. The VIP account demands the highest initial capital, with a minimum deposit requirement of at least 50,000 EUR. This account type is likely designed to provide exclusive perks, personalized services, and potentially even tighter spreads or better trading conditions, though precise details are not disclosed.

Unfortunately, the available information does not provide insights into other crucial aspects of these account types, such as leverage, spreads, commissions, or customer support hours. Traders interested in opening an account with 4X Capital would need to seek further information or clarification directly from the broker's customer support.

| Pros | Cons |

| Provides multiple account types catering to diverse trading needs and goals | Lack of detailed information about leverage, spreads, and other crucial account features |

| Offers options for traders with varying capital availability and investment preferences | Limited transparency regarding additional benefits and services |

| Allows entry-level trading with a relatively smaller investment in the Classic account | Absence of specific information on potential lower trading costs |

| Provides potential benefits and services for higher-tier accounts | Lack of disclosure on account-specific advantages or features |

| Offers a VIP account for traders seeking a premium trading experience | Insufficient information on customer support hours and availability |

Customer Support

4X Capital provides customer support services to address inquiries and assist traders. There are two primary channels through which traders can get in touch with their customer support:

1. Telephone: Traders can contact 4X Capital's customer support team by dialing the phone number +442038070716. By using this contact number, traders can directly communicate with the support staff to seek assistance or clarification regarding any concerns they may have.

2. Email: Another method to reach out to 4X Capital's customer support is through email. Traders can send their inquiries or requests to the email address support@4x-capital.co. By using this email address, traders can articulate their questions or concerns in writing and expect a response from the customer support team.

For any inquiries, traders can get in touch with 4X Capital through the following channels:

Telephone: +442038070716

Email:support@4x-capital.co

Conclusion

In conclusion, 4X Capital is an online forex broker registered in the United Kingdom, but it lacks valid regulation from any financial authority. The absence of regulation raises concerns about the broker's adherence to industry standards and the security of client funds. The low score and the warning suggest potential risks associated with 4X Capital, including negative reviews and possible involvement in suspicious activities. On the positive side, 4X Capital offers four account types to cater to different trading needs, with varying minimum deposit requirements. However, crucial information such as leverage, spreads, and trading platforms is not provided. Customer support is available through telephone and email channels. Traders should exercise caution and carefully consider the risks associated with engaging with 4X Capital due to the lack of regulatory oversight and limited available information.

FAQs

Q: Is 4X Capital a regulated forex broker?

A: No, 4X Capital is not regulated by any valid regulatory authority. The broker operates without oversight from financial regulatory bodies.

Q: What is the minimum deposit required to open an account with 4X Capital?

A: 4X Capital offers different account types with varying minimum deposit requirements. The Classic account requires a minimum deposit of 250 EUR, while the Gold account requires at least 5,000 EUR. The Platinum account has a minimum deposit of 25,000 EUR, and the VIP account requires a minimum deposit of 50,000 EUR.

Q: What trading platforms does 4X Capital offer?

A: Unfortunately, information about the trading platforms offered by 4X Capital is not available. The broker does not provide specific details regarding the trading platforms it supports.

Q: How can I contact customer support at 4X Capital?

A: 4X Capital provides customer support through telephone and email. You can reach their customer support team by calling +442038070716 or sending an email to support@4x-capital.co. Feel free to contact them for any inquiries or assistance you may require.

Leggi di più

Aggiornamenti broker dal 7-13 dicembre

La bolletta denominata Stablecoin Tethering and Bank Licensing Enforcement Act., proposto da Rashida Tlaib, un democratico del Michigan, insieme ai membri del Congresso, Jesus García e Stephen Lynch, mira a proteggere i consumatori dalle minacce emergenti associate al mercato delle criptovalute e richiederà a chiunque che offre stablecoin l'approvazione della Federal Deposit Insurance Corporation (FDIC) e di altre agenzie governative competenti.

Aggiornamenti broker dal 30 novembre-6 dicembre

Le autorità cinesi hanno confiscato criptovalute per un valore di oltre 4,2 miliardi di dollari in relazione alla famigerata truffa Plus Token, rivelano i file del tribunale locale.

Aggiornamenti broker dal 23-29 novembre

Matthew Piercey, l'uomo dietro due società di investimento - Zolla e Family Wealth Legacy, è stato arrestato dagli agenti dell'FBI a Sacramento con l'accusa di frode telematica, manomissione di testimoni, frode postale e riciclaggio di denaro, che si è appropriata indebitamente di circa 35 milioni di dollari di fondi degli investitori, come affermato dalla corte degli Stati Uniti.

Aggiornamenti dei broker dal 9-15 novembre

Salgono a 323 i domini dei servizi finanziari bloccati da Consob.

WikiFX Trader

FXTM

Exness

DBG Markets

FXCM

CPT Markets

EC Markets

FXTM

Exness

DBG Markets

FXCM

CPT Markets

EC Markets

WikiFX Trader

FXTM

Exness

DBG Markets

FXCM

CPT Markets

EC Markets

FXTM

Exness

DBG Markets

FXCM

CPT Markets

EC Markets

Rate Calc