KDFX-Some important Details about This Broker

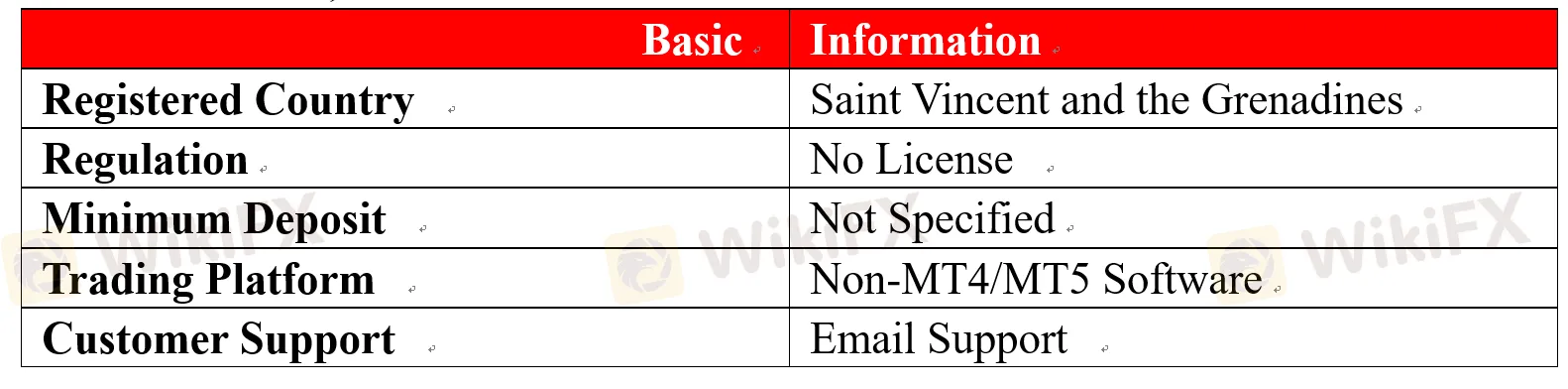

Sommario:KDFX is an offshore forex broker registered in Saint Vincent and the Grenadines owned by a company called KDFX Company Limited. Since this brokerage's website cannot be accessed, we were unable to obtain further details on trading assets, leverage, trading platform, minimum deposit amount, spread and commissions, etc.

As KDFXs official website (https://www.kdfx.live/) is unavailable at this time, we could only gather relevant information from other websites to present a rough picture of this brokerage.

General Information

KDFX is an offshore forex broker registered in Saint Vincent and the Grenadines owned by a company called KDFX Company Limited.

Since this brokerage's website cannot be accessed, we were unable to obtain further details on trading assets, leverage, trading platform, minimum deposit amount, spread and commissions, etc.

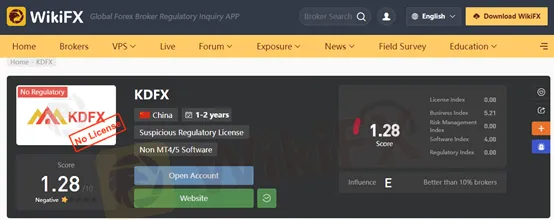

When it comes to regulation, it has been verified that KDFX does not fall under any valid regulations. That is why its regulatory status on WikiFX is listed as “No License” and it receives a relatively low score of 1.28/10.

Please note that trading with an unregulated forex broker is a risky process, take extra vigilance before investing with a broker.

Negative Reviews

We get some negative reviews on this broker, saying it extracts their available money and rejected their withdrawal request (see the following screenshot).

Trading Platform

What KDFX offers is not the advanced MT4 or MT5 trading platform, may be some simply-designed proprietary trading platform. Please be aware of the risk.

Customer Support

Unfortunately, KDFX can be available only through an email: admin@secure.kdfx.org, which means once something goes wrong with your trading process, you cannot directly talk to this broker to make things get back on the right track.

Risk Warning

Online trading in leveraged Forex and CFD instruments contains a high level of risk and may not be suitable for all investors.

Please note that the information contained in this article is for general information purposes only.

Leggi di più

Aggiornamenti broker dal 7-13 dicembre

La bolletta denominata Stablecoin Tethering and Bank Licensing Enforcement Act., proposto da Rashida Tlaib, un democratico del Michigan, insieme ai membri del Congresso, Jesus García e Stephen Lynch, mira a proteggere i consumatori dalle minacce emergenti associate al mercato delle criptovalute e richiederà a chiunque che offre stablecoin l'approvazione della Federal Deposit Insurance Corporation (FDIC) e di altre agenzie governative competenti.

Aggiornamenti broker dal 30 novembre-6 dicembre

Le autorità cinesi hanno confiscato criptovalute per un valore di oltre 4,2 miliardi di dollari in relazione alla famigerata truffa Plus Token, rivelano i file del tribunale locale.

Aggiornamenti broker dal 23-29 novembre

Matthew Piercey, l'uomo dietro due società di investimento - Zolla e Family Wealth Legacy, è stato arrestato dagli agenti dell'FBI a Sacramento con l'accusa di frode telematica, manomissione di testimoni, frode postale e riciclaggio di denaro, che si è appropriata indebitamente di circa 35 milioni di dollari di fondi degli investitori, come affermato dalla corte degli Stati Uniti.

Aggiornamenti dei broker dal 9-15 novembre

Salgono a 323 i domini dei servizi finanziari bloccati da Consob.

WikiFX Trader

FXTM

Exness

DBG Markets

ZFX

IC Markets Global

GTCFX

FXTM

Exness

DBG Markets

ZFX

IC Markets Global

GTCFX

WikiFX Trader

FXTM

Exness

DBG Markets

ZFX

IC Markets Global

GTCFX

FXTM

Exness

DBG Markets

ZFX

IC Markets Global

GTCFX

Rate Calc