Two reasons to hold dollar longs and retain bearish view on stocks

Sommario:A bear market is when investment prices drop 20% from their most recent high. Volatility across asset classes is hitting new highs this year, credit spreads are rising, and the market is trying to calm down after the threat of a financial crisis that has been brewing in the UK pension fund industry has tipped.

A bear market is when investment prices drop 20% from their most recent high. Volatility across asset classes is hitting new highs this year, credit spreads are rising, and the market is trying to calm down after the threat of a financial crisis that has been brewing in the UK pension fund industry has tipped.

The most important thing to keep in mind during an economic slowdown is that it's normal for the stock market to have negative years—it's part of the business cycle. If you are a long-term investor (meaning a time horizon of 10+ years), one option is to take advantage of dollar-cost averaging (DCA). As a result, demand for defensive assets in FX remains high and is unlikely to turn into a steady decline soon. Among such assets, the key is cash dollar, as well as Japanese yen in cross pairs. The market is waiting for data on inflation, as well as for Putin's address to the nation.

Volatility in the foreign exchange market has reached its highest level this year and may rise even higher. There are two factors that contribute to this. The first is the policy of central banks, which are trying to prevent high inflation bygaining a foothold in the minds of economic agents and therefore urgently raise interest rates. The Fed is leading this race.

Whether the Fed will be able to maintain its leadership will depend on incoming data, and the August Core PCE which is due today will help to gauge the likelihood of even more aggressive policy tightening. The Fed prefers to measure inflation using this index, so it is of great importance. Core PCE is expected to increase from 4.6% to 4.7% in August, with a monthly change of 0.5%.

The Fed predicts a slowdown in inflation to 4.5% at the end of the year and at the same time intends to bring the range of interest rate to 4.25-4.5%. It is clear that in the event of a positive surprise, there will be a higher risk that year-end inflation wont meet expectations of the Fed, and therefore the regulator may be forced to signal that there will be two 75 bp increases in November and December. In short, a surprise on the upside in the report could trigger a dollar rally today.

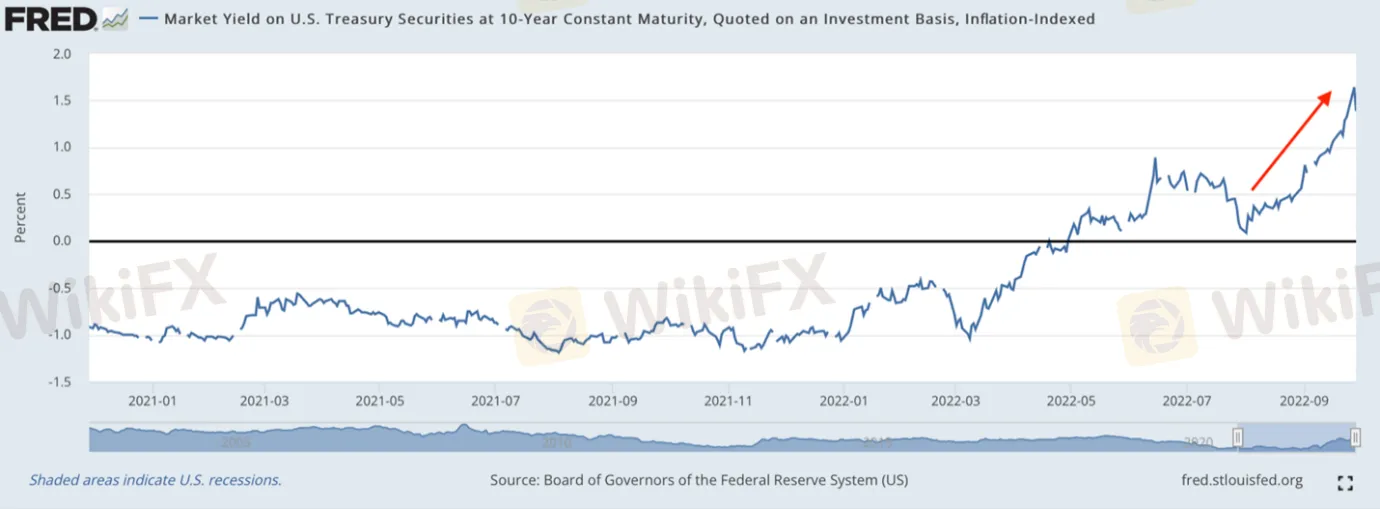

A strong dollar is also due to higher real interest rates in the US. If at the beginning of August, the real interest rate (yield on 10-year inflation-protected bonds) was 0%, now it has risen to 1.4%:

The real interest rate is calculated as the nominal rate minus inflation expectations, and for its increase it is necessary that inflation expectations decrease, and nominal rate rises, and this is precisely what is happening now.

Typically, such a process is accompanied by a bearish trend in risky assets (as an alternative to bonds) and strong dollar (due to investment demand from abroad). One should not expect a reversal of this trend soon, surely not until the Fed gives the appropriate signal.

The second volatility factor are geopolitical tensions. President Putin will make an address to the nation today, in which he will probably announce that four regions of Ukraine have become part of the Russian Federation and will also comment on the sabotage on two Nord Stream pipelines. The market will most likely interpret the speech as a signal of escalation in the confrontation with the West and will price in retaliatory measures.

Inflation in Germany rose to double digits (10%), while core inflation in the Eurozone accelerated to 4.8% against the forecast of 4.7%. Accelerating inflation in the EU above the forecast hurts the Euro, as the ECB is constrained in manoeuvring as any rate hike will hurt the EU economy. After release of the report, EURUSD resistance formed at 0.99 (the upper limit of the bearish channel), downward movement is likely to resume after the speech of the President of the Russian Federation, as market participants will tend to factor in further escalation, which will have negative consequences for inflation.

WikiFX Trader

FXTM

ATFX

XM

Blueberry Markets

EBC

Upway

FXTM

ATFX

XM

Blueberry Markets

EBC

Upway

WikiFX Trader

FXTM

ATFX

XM

Blueberry Markets

EBC

Upway

FXTM

ATFX

XM

Blueberry Markets

EBC

Upway

Rate Calc