Mohicans markets:November 22-European Perspective

Sommario:On Tuesday, November 22, Beijing time, during the Asian and European session, spot gold rebounded slightly, and is currently trading near at $ 1742.45 per ounce. Two Fed officials this week's speech is less hawkish than last week, and some analysts even interpreted it as dovish. The dollar index retracted some of the overnight gains, which gave gold prices the opportunity to rally.

Market Overview

On Tuesday, November 22, Beijing time, during the Asian and European session, spot gold rebounded slightly, and is currently trading near at $ 1742.45 per ounce. Two Fed officials this week's speech is less hawkish than last week, and some analysts even interpreted it as dovish. The dollar index retracted some of the overnight gains, which gave gold prices the opportunity to rally.

This trading day need to continue to pay attention to the Fed officials' speeches, Kansas Fed President George and St. Louis Fed President Bullard in the New York session will speak respectively; in addition, investors need to watch for changes in market expectations for the release of the Fed minutes early Thursday morning Beijing time.

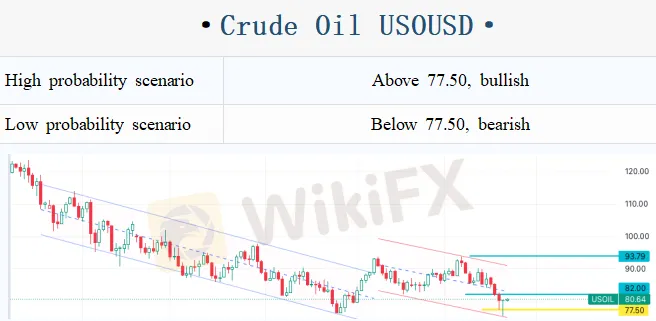

U.S. crude oil is shaking and slightly down, which is currently trading around $80.10 per barrel. Overnight a report that OPEC+ is considering increasing production once caused oil prices to plunge more than 5% to a new low of $75.27 per barrel since the beginning of the year; although after Saudi Arabia publicly denied it, oil prices recovered all the losses; however, oil prices are still weak amid concerns that the Asian epidemic may drag down the demand outlook; the dollar rally to a one-week high also weakened oil prices, and there are still further downside risks for oil prices in the short term.

The API crude oil inventory data needs to be watched this session; the market is currently expecting a decline in crude oil inventories, which may limit the downside of oil prices before the data is released. It is also important to keep an eye on the speeches of Fed officials and the performance of global stock markets.

Mohicans Markets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on November 22, 2022 Beijing time.

Technical Analysis

CME Group options layout changes (December Futures Price):

1820-1830 Bullish unchanged, bearish increased sharply, long target weakened

1775 Bullish increased sharply, bearish unchanged, long target

1750-1760 Bullish decreased sharply, bearish decreased sharply, long-short game interval and resistance

1725-1735 Bullish increased, bearish decreased sharply, support level

1695-1710 Bullish increased, bearish decreased sharply, support

1675 Bullish unchanged, bearish increased, short target

Order flow key point marking (Spot Price):

1773-1775 Second resistance

1766 Long-short boundary, key resistance

1755 Neckline of Head & Shoulders Top in 4-hour K line

1747 Short-term resistance

1736 15 min swing support

1730 Neckline support of W-bottom

Note: The above strategy was updated at 15:00 on November 22. This policy is a daytime policy. Please pay attention to the policy release time.

CME Group options layout changes (December Futures Price):

22 Bullish increased slightly and the stock was large, bearish unchanged, long target

21.5 Bullish decreased but the stock was large, bearish decreased slightly, long target and resistance

21.2-21.25 Bullish increased slightly, bearish decreased slightly, rebound target

21 Bullish decreased but the stock was large, bearish decreased slightly=, support weakened

20.75-20.80 Bullish increased, bearish decreased sharply, next support

20.50 Bullish increased, bearish increased, short target and support

Order flow key point marking (Spot Price):

21.4 was likely to be a weekly resistance

20.9 Resistance becomes support (possibly Asian and European)

20.7-20.6 Support during the day

20.4 Support during the day

20.1 Intermediate support

Note: The above strategy was updated at 15:00 on November 22. This policy is a daytime policy. Please pay attention to the policy release time.

CME Group options layout changes (Futures Price in Jan.):

85 Bullish decreased but stocks were large, bearish slightly increased and stocks were large, resistance level

82 Bullish and bearish increased significantly, with long target and resistance

79.5-80 Bullish increased significantly, bearish decreased, but stock was large, short-term support level

76 Bullish increased, bearish increased, support level

75 Bullish increased significantly, bearish decreased significantly, but the stock was large, the key support

74 Bullish increased, bearish decreased significantly, support level

Order flow key point marking (Futures Price in Jan.):

84.5 Second resistance of this week

82 First resistance of this week

80.4 The intraday resistance level, and the starting point and falling point on Friday

79.2 Band support position (may only be applicable to Eurasian market)

78.7 The starting point of Monday's massive downward trend may be weak support

77.3 It is low on Friday, which may be the first support of this week (4-hour pinbar)

75.3 Yesterday, it rose to a low point, the daily line was double bottomed, and the mid-line was supported

Note: The above strategy was updated at 15:00 on November 22. This policy is a daytime policy. Please pay attention to the policy release time.

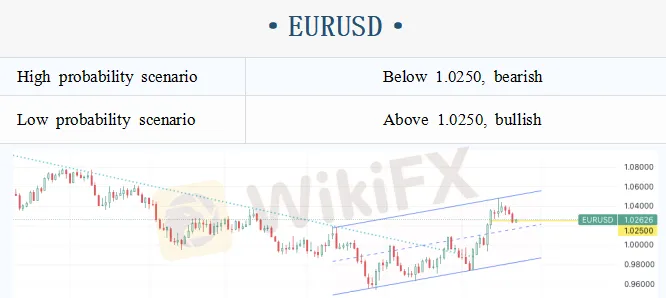

Todays CME Group data:

1.04 Bullish slightly reduced, but the stock was large, bearish slightly reduced, and long target and resistance

1.035 Bullish increased, bearish slightly decreased, long target

1.03 Bullish increased significantly and stocks were large, while bearish increased slightly, with rebound target

1.025-1.0275 Bullish increased significantly, while bearish decreased slightly, supporting

1.02 Bullish decreased, bearish increased significantly and stocks were large, falling back on target

1.015 Bullish increased, bearish decreased, support

1.01 Bullish slightly reduced but large stock, bearish increased and large stock, short target and support

Note: The above strategy was updated at 15:00 on November 22. This policy is a daytime policy. Please pay attention to the policy release time.

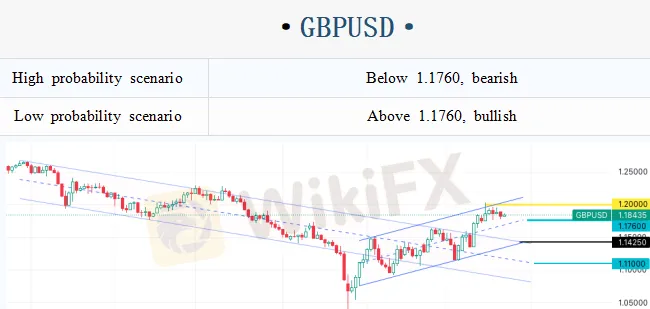

Todays CME Group data:

1.20 Bullish slightly reduced but large stock, bearish unchanged, long target and resistance

1.195 Bullish increased and large stock, bearish unchanged, long target

1.19 Bullish unchanged but large stock, keep bullish but rebound target

1.18-1.182 Bullish increased, bearish increased, long and short competition

1.17-1.172 Bullish slightly reduced, bearish unchanged, falling target

1.165 Bullish decreased but stock was large, bearish unchanged, and short target was also supportive

Note: The above strategy was updated at 15:00 on November 22. This policy is a daytime policy. Please pay attention to the policy release time.

Statement|Disclaimer

Disclaimer: The information contained in this material is for general advice only. It does not take into account your investment goals, financial situation or special needs. We have made every effort to ensure the accuracy of the information as of the date of publication. MHMarkets makes no warranties or representations about this material. The examples in this material are for illustration only. To the extent permitted by law, MHMarkets and its employees shall not be liable for any loss or damage arising in any way, including negligence, from any information provided or omitted from this material. The features of MHMarkets products, including applicable fees and charges, are outlined in the product disclosure statements available on the MHMarkets website. Derivatives can be risky and losses can exceed your initial payment. MHMarkets recommends that you seek independent advice.

Mohicans Markets, (Abbreviation: MHMarkets or MHM, Chinese name: Maihui), Australian Financial Services License No. 001296777.

WikiFX Trader

FXTM

ATFX

IC Markets Global

FXCM

CPT Markets

Blueberry Markets

FXTM

ATFX

IC Markets Global

FXCM

CPT Markets

Blueberry Markets

WikiFX Trader

FXTM

ATFX

IC Markets Global

FXCM

CPT Markets

Blueberry Markets

FXTM

ATFX

IC Markets Global

FXCM

CPT Markets

Blueberry Markets

Rate Calc