May 24, 2023-MHM European Perspective

Sommario:During the Asian session on Wednesday (May 24), spot gold oscillated slightly higher and is currently trading around $1978.15 per ounce.

Market Overview

During the Asian session on Wednesday (May 24), spot gold oscillated slightly higher and is currently trading around $1978.15 per ounce. Market concerns about U.S. debt default have picked up, providing support to gold prices; gold prices held the 1950 line of support on Tuesday, short term bearish signal has weakened. However, the U.S. economic data is still relatively strong, the dollar is relatively strong, still on the gold price to form a suppression.

This trading day will usher the Federal Reserve meeting minutes, investors need to focus on. Given that the Fed only raised interest rates by 25 basis points at the time, and hinted at the possibility of a pause in rate hikes, the meeting minutes dovish school is more likely, which is expected to provide gold prices with further rally opportunities before the minutes come out. However, according to experience, the meeting minutes dovish is less likely than expected, which means that gold prices are still facing the risk of shocks back after the market.

In addition, investors need to pay attention to the U.S. debt ceiling negotiations of further news.

U.S. crude oil is in a narrow range, and is currently trading near $73.72 per barrel. The Saudi energy minister's warning to speculators on Tuesday raised the prospect of further OPEC+ production cuts, which helped oil prices rise to near three-week highs near resistance, with an unexpectedly sharp drop in API crude inventories also lending support to prices. However, concerns over the risk of a U.S. debt default picked up and global stocks generally retreated, making bulls wary.

This trading day will usher the US EIA crude oil inventory series data, which investors need to focus on. Considering the upcoming summer travel peak in the US, supporting demand expectations, oil prices are expected to topple upwards through the recent oscillation range.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on May 24, Beijing time.

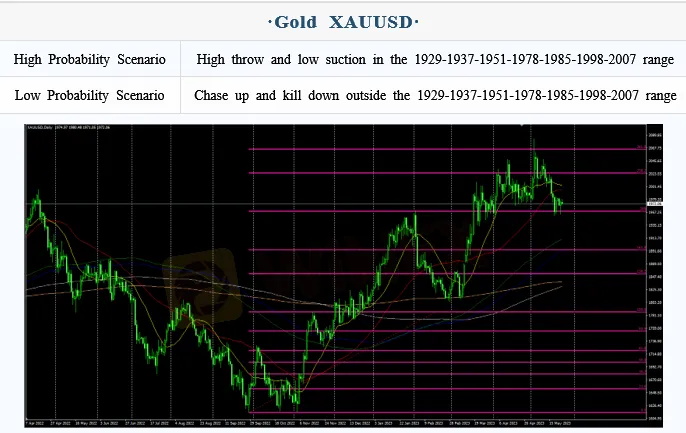

Intraday Oscillation Range: 1929-1937-1951-1978-1985-1998-2007

Overall Oscillation Range: 1730-1756-1780-1801-1817-1833-1856-1873-1889-1903-1911-1929-1937-1951-1978-1985-1998-2007-2016-2033-2046-2057-2066-2077-2089-2097-2100

In the subsequent period of spot gold, 1929-1937-1951-1978-1985-1998-2007 can be operated as the bull and bear range; High throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on May 24. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 21.5-22.3-23.1-23.9-24.5

Overall Oscillation Range: 19.7-20.1-20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1-26.6-27.3

In the subsequent period of spot silver, 21.5-22.3-23.1-23.9-24.5 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on May 24. This policy is a daytime policy. Please pay attention to the policy release time.

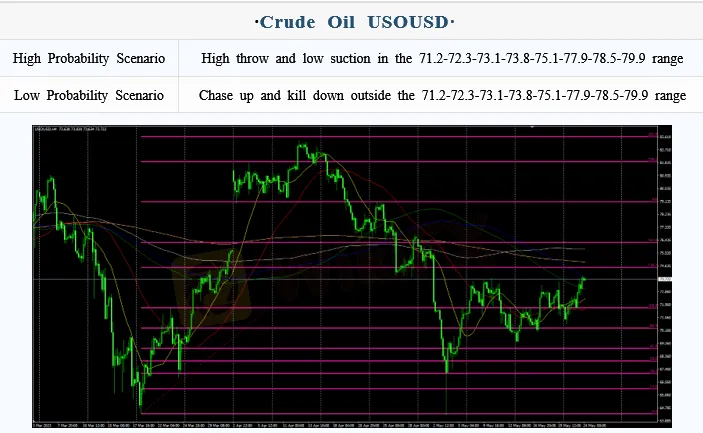

Intraday Oscillation Range: 71.2-72.3-73.1-73.8-75.1-77.9-78.5-79.9

Overall Oscillation Range: 62.1-63.7-64.5-65.8-66.9-67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3-89.1

In the subsequent period of Crude Oil, 71.2-72.3-73.1-73.8-75.1-77.9-78.5-79.9 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on May 24. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 1.0570-1.0690-1.0755-1.0830-1.0950

Overall Oscillation Range: 1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0830-1.0950-1.1157-1.1220-1.1303

In the subsequent period of EURUSD, 1.0570-1.0690-1.0755-1.0830-1.0950 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on May 24. This policy is a daytime policy. Please pay attention to the policy release time.

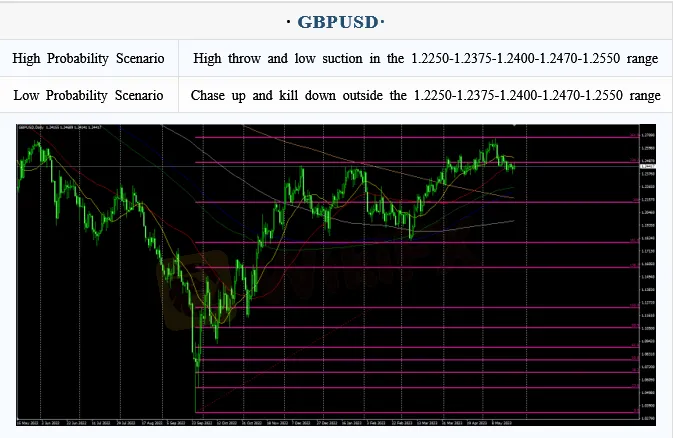

Intraday Oscillation Range: 1.2250-1.2375-1.2400-1.2470-1.2550

Overall Oscillation Range: 1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2375-1.2400-1.2470-1.2550-1.27000

In the subsequent period of GBPUSD, 1.2250-1.2375-1.2400-1.2470-1.2550 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on May 24. This policy is a daytime policy. Please pay attention to the policy release time.

WikiFX Trader

WikiFX Trader

Rate Calc