CP Markets

Sommario:CP Markets is a Forex and CFD broker registered in 2021 with its headquarters in London. It offers trading services for Forex, Commodities, Shares, Futures and Indices. CP Markets claims to provide access to over 500 assets on the MetaTrader5 platform, along with four account types. However, this broker does not hold a legal regulatory license.

Note: CP Markets's official website - https://cp-markets.com/ is currently inaccessible normally.

| CP Markets Review Summary | |

| Founded | 2021 |

| Registered Country/Region | United Kingdom |

| Regulation | Unregulated |

| Market Instruments | 500+, Forex, Commodities, Shares, Futures and Indices |

| Demo Account | ❌ |

| Leverage | 1:100 |

| EUR/USD Spread | 0.6 pips (Standard account) |

| Trading Platform | MT5 |

| Min Deposit | $50 |

| Customer Support | Contact form |

| Email: cs@cp-markets.com | |

| Physical address: Unit 1804 South Bank Tower, 55 Upper Ground, London, England, SE1 9EY | |

CP Markets is a Forex and CFD broker registered in 2021 with its headquarters in London. It offers trading services for Forex, Commodities, Shares, Futures and Indices. CP Markets claims to provide access to over 500 assets on the MetaTrader5 platform, along with four account types. However, this broker does not hold a legal regulatory license.

Pros and Cons

| Pros | Cons |

| Diverse tradable assets | Unavailable website |

| Multiple account types | No regulation |

| Commission-free accounts offered | No demo accounts |

| Micro account | Unknown payment methods |

| MT5 trading platform | Only email support |

| Low minimum deposit |

Is CP Markets Legit?

No, CP Markets is not a legitimate broker as it holds no license from any legal authorities. Furthermore, our investigation has revealed that the company's physical address is fake, and no office was found at that location.

What Can I Trade on CP Markets?

CP Markets claims to offer more than 500 trading instruments across three classes, including 70+ Forex, Commodities (Spot metals), Shares, Futures and Indices.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Shares | ✔ |

| Futures | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

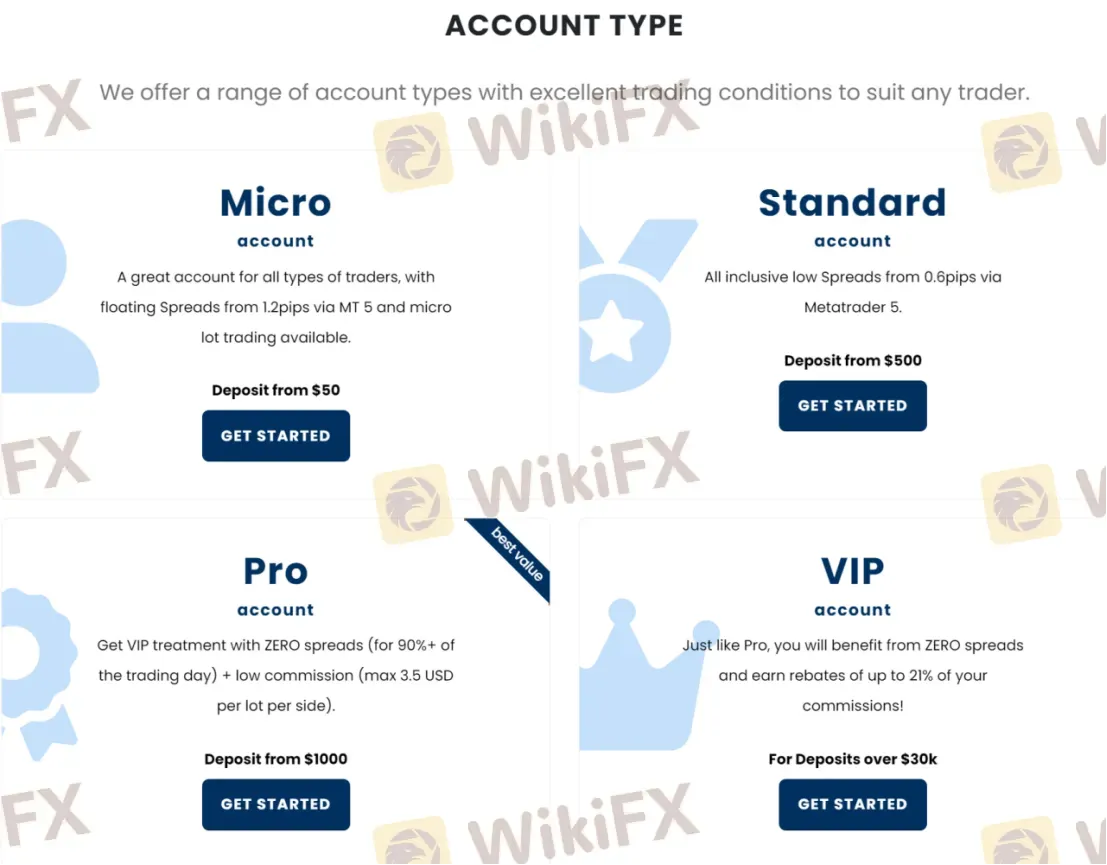

Account Type

| Account Type | Min Deposit |

| Micro | $50 |

| Standard | $500 |

| PRO | $1,000 |

| VIP | $30,000 |

Leverage

CP Markets offers leverage up to 1:100. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spread and Commission

| Account Type | Spread | Commission |

| Micro | 1.2 pips | ❌ |

| Standard | 0.6 pips | ❌ |

| PRO | 0 pips | $3.5 per lot per side |

| VIP | 0 pips | Earn rebates of up to 21% of commissions |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Web and Mobile | Experienced traders |

| MT4 | ❌ | / | Beginners |

Leggi di più

Aggiornamenti broker dal 7-13 dicembre

La bolletta denominata Stablecoin Tethering and Bank Licensing Enforcement Act., proposto da Rashida Tlaib, un democratico del Michigan, insieme ai membri del Congresso, Jesus García e Stephen Lynch, mira a proteggere i consumatori dalle minacce emergenti associate al mercato delle criptovalute e richiederà a chiunque che offre stablecoin l'approvazione della Federal Deposit Insurance Corporation (FDIC) e di altre agenzie governative competenti.

Aggiornamenti broker dal 30 novembre-6 dicembre

Le autorità cinesi hanno confiscato criptovalute per un valore di oltre 4,2 miliardi di dollari in relazione alla famigerata truffa Plus Token, rivelano i file del tribunale locale.

Aggiornamenti broker dal 23-29 novembre

Matthew Piercey, l'uomo dietro due società di investimento - Zolla e Family Wealth Legacy, è stato arrestato dagli agenti dell'FBI a Sacramento con l'accusa di frode telematica, manomissione di testimoni, frode postale e riciclaggio di denaro, che si è appropriata indebitamente di circa 35 milioni di dollari di fondi degli investitori, come affermato dalla corte degli Stati Uniti.

Aggiornamenti dei broker dal 9-15 novembre

Salgono a 323 i domini dei servizi finanziari bloccati da Consob.

WikiFX Trader

FXTM

Exness

DBG Markets

EC Markets

GTCFX

Eightcap

FXTM

Exness

DBG Markets

EC Markets

GTCFX

Eightcap

WikiFX Trader

FXTM

Exness

DBG Markets

EC Markets

GTCFX

Eightcap

FXTM

Exness

DBG Markets

EC Markets

GTCFX

Eightcap

Rate Calc