AUSFIT

Sommario:AUSFIT is an unregulated financial brokerage that offers various financial instruments across multiple asset classes, including Forex, Indices, Energies, Metals, Cryptocurrencies, and Stocks through the Ausfit App and Ausfit Web. It claims to offer tight spreads from 0 pips and no commission charges. Additionally, AUSFIT states that it provides 24/7 customer service through live chat, online messaging, and email.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| AUSFIT Review Summary in 10 Points | |

| Founded | Within 1 year |

| Registered Country/Region | Saint Vincent and the Grenadines |

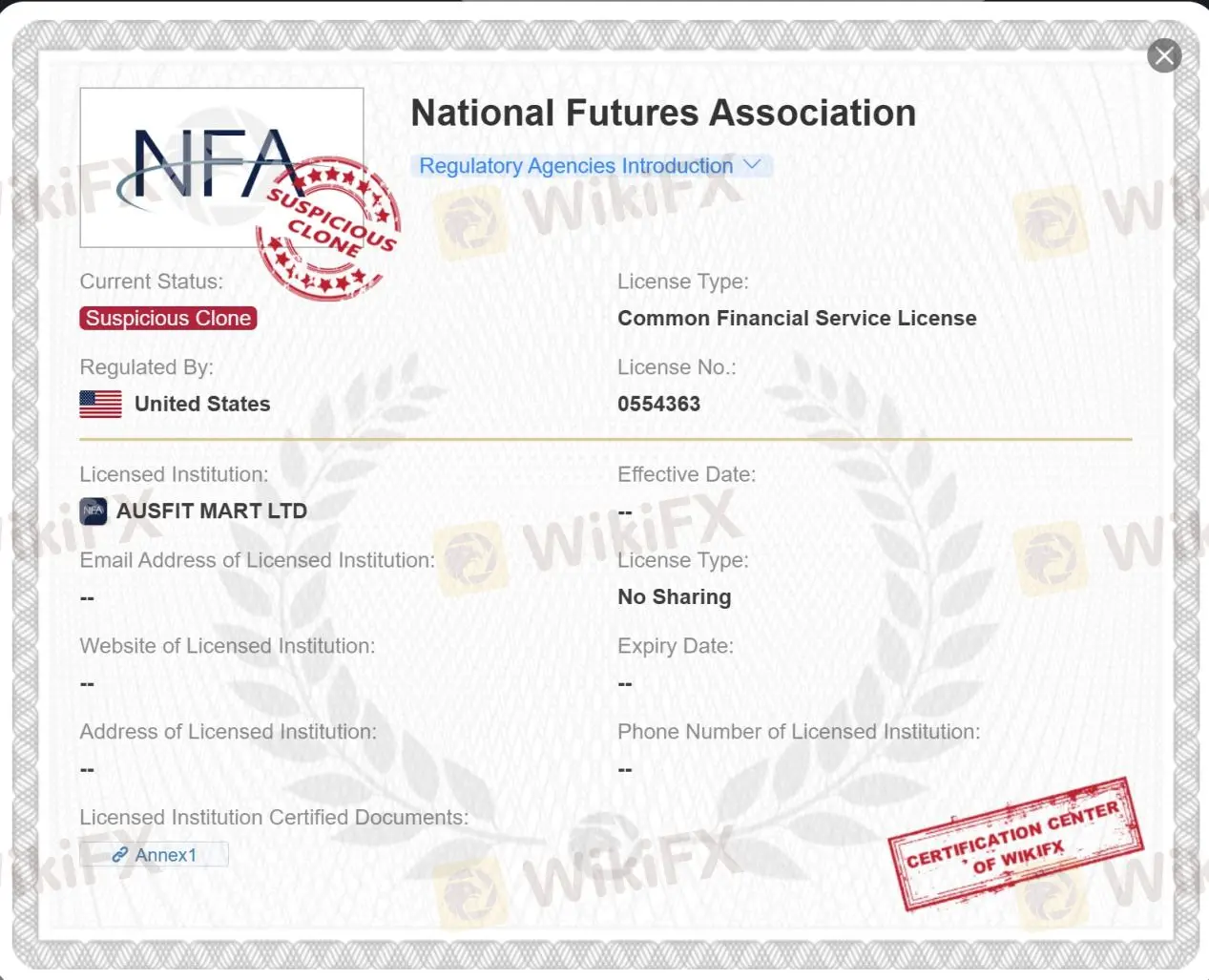

| Regulation | NFA - suspicious clone |

| Market Instruments | Forex, Indices, Energies, Metals, Cryptocurrencies and Stocks |

| Demo Account | Available |

| Leverage | 1:400 |

| EUR/USD Spread | From 0 pips |

| Trading Platforms | Ausfit App, Ausfit Web |

| Minimum Deposit | N/A |

| Customer Support | 24/7 live chat, online messaging, email |

What is AUSFIT?

AUSFIT is an unregulated financial brokerage that offers various financial instruments across multiple asset classes, including Forex, Indices, Energies, Metals, Cryptocurrencies, and Stocks through the Ausfit App and Ausfit Web. It claims to offer tight spreads from 0 pips and no commission charges. Additionally, AUSFIT states that it provides 24/7 customer service through live chat, online messaging, and email.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

| Pros | Cons |

| • Diverse range of financial instruments | • Suspicious clone NFA license |

| • Tight spreads and no commission charges | • Regional restrictions |

| • 24/7 customer service | • Lack of specific account details |

| • Unstable trading platform | |

| • Limited information on deposits and withdrawals |

AUSFIT Alternative Brokers

There are many alternative brokers to AUSFIT depending on the specific needs and preferences of the trader. Some popular options include:

Tickmill - a reputable broker with competitive trading conditions and a wide range of financial instruments, making it a good choice for traders looking for a reliable and diverse trading experience.

FxPrimus - a well-regulated broker offering a variety of trading platforms, educational resources, and excellent customer support, making it a recommended choice for traders of all levels.

Grand Capital - provides a range of trading services and account types.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is AUSFIT Safe or Scam?

AUSFIT claims to offer Segregated Funds Protection, and Client funds are segregated separately in global investment banks. However, the broker currently has no valid regulation. Their United States National Futures Association (NFA, No. 0554363) license is a suspicious clone. The lack of valid regulation is a red flag that suggest caution should be exercised when dealing with this broker. It's important to thoroughly research and verify the legitimacy and regulatory status of AUSFIT through reliable sources or financial authorities before making any decisions.

Market Instruments

AUSFIT offers over 90 instruments across 6 asset classes including Forex, Indices, Energies, Metals, Cryptocurrencies and Stocks.

Forex refers to the foreign exchange market, where traders can buy and sell different currencies. Indices are a measurement of the performance of a group of stocks from a specific market, representing the overall market sentiment. Energies typically refer to commodities such as oil and gas, which can be traded as futures contracts. Metals include precious metals like gold, silver, and platinum, which are often considered safe-haven assets. Cryptocurrencies are digital or virtual currencies that utilize cryptography for secure transactions, with popular examples being Bitcoin and Ethereum. Finally, stocks represent ownership shares in publicly traded companies, allowing traders to invest in various companies and potentially benefit from their performance.

Accounts

AUSFIT claims to offer demo and live accounts, but not specified.

A demo account is typically a practice account that allows traders to simulate trading activities using virtual funds. It is a useful tool for beginners or those who want to test their trading strategies without risking real money. Demo accounts often have the same features and functionality as live accounts, providing traders with a realistic trading environment.

On the other hand, a live account is a real trading account that involves the use of real money. It allows traders to participate in the actual financial markets and execute real trades. Live accounts may offer various features and trading conditions, such as different leverage options, access to specific financial instruments, and trading platforms.

Leverage

Leverage refers to the use of borrowed funds to amplify potential returns while trading financial instruments. AUSFIT claims to offer a maximum leverage of up to 1:400, which means that for every dollar of the trader's capital, they can open a position worth up to 400 dollars.

High leverage ratios like 1:400 provide traders with the opportunity to control larger positions with a smaller amount of capital. This can potentially lead to increased profits if the trade goes in the trader's favor. However, it's important to note that high leverage also increases the risk of substantial losses, as even a small adverse price movement can result in significant losses.

Traders should be aware of the risks associated with high leverage and ensure they have a solid understanding of risk management techniques before utilizing maximum leverage. It's crucial to consider one's risk tolerance, trading strategy, and financial goals before deciding on the appropriate leverage level.

Spreads & Commissions

AUSFIT claims to offer spreads from 0 pips and no commission charges.

Spreads refer to the difference between the bid and ask prices of a financial instrument. A tight or low spread is generally favorable for traders as it reduces the cost of entering and exiting trades. A spread of 0 pips means there is no difference between the bid and ask prices, which can potentially result in lower transaction costs for traders.

Commission charges are fees that brokers may charge for executing trades on behalf of their clients. The absence of commission charges can be advantageous for traders as it eliminates additional costs when entering or exiting positions.

Trading Platforms

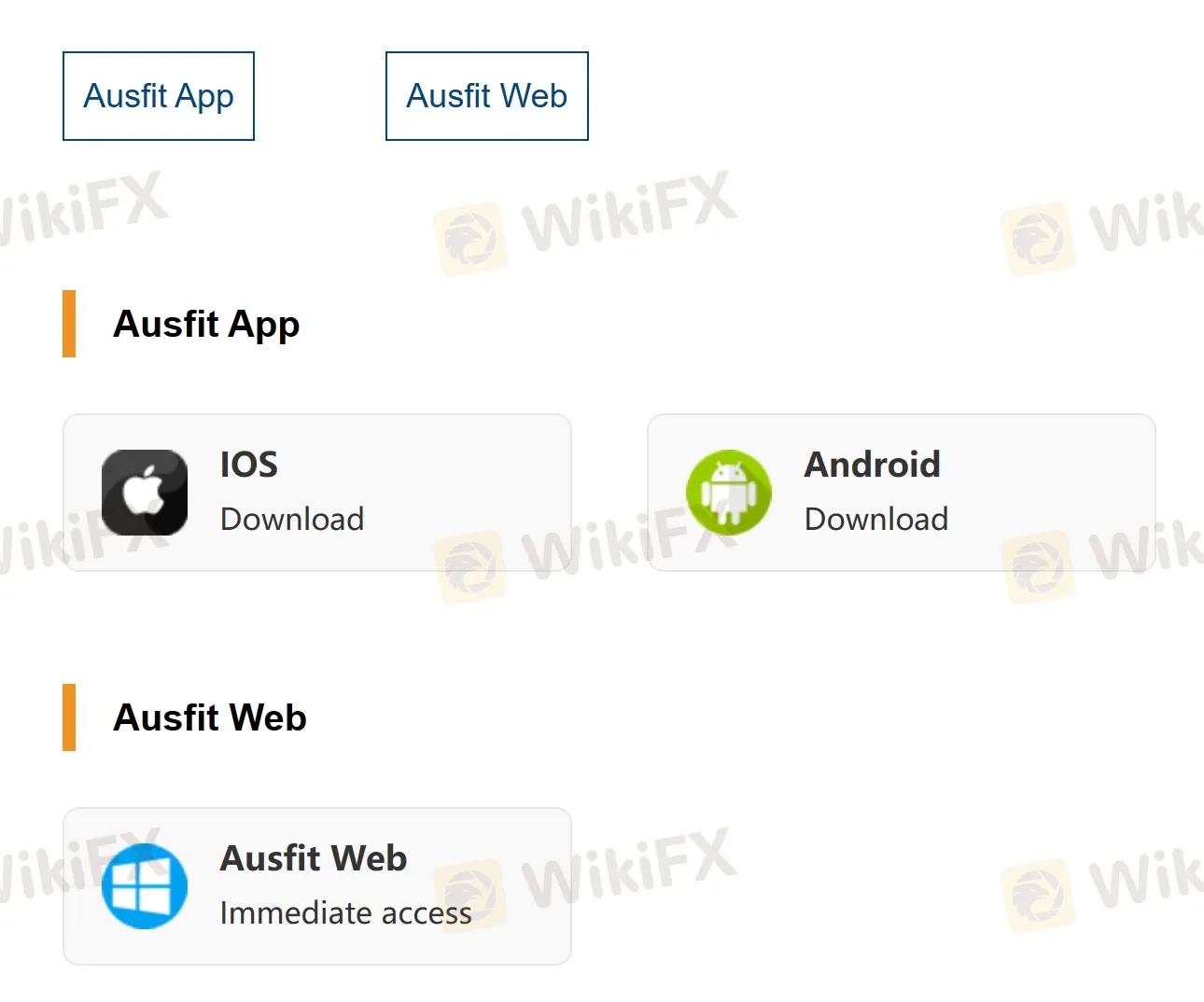

AUSFIT offers multiple trading platforms, including the Ausfit App for iOS and Android, as well as Ausfit Web.

The Ausfit App is designed for mobile trading, allowing traders to access the financial markets and manage their trades from anywhere using their smartphones or tablets. The app offers a user-friendly interface, advanced charting tools, real-time quotes, and the ability to execute trades directly from the app. It allows traders to stay connected to the markets and take advantage of trading opportunities on the go.

Ausfit Web, on the other hand, is a web-based trading platform that can be accessed through any web browser without the need for downloading or installing any software. It provides traders with a comprehensive set of trading features, such as advanced order types, customizable charts, technical analysis tools, and real-time market data. It offers a seamless trading experience and allows traders to monitor their positions and make informed trading decisions from any device with an internet connection.

See the trading platform comparison table below:

| Broker | Trading Platform |

| AUSFIT | Ausfit App (iOS and Android), Ausfit Web |

| Tickmill | MetaTrader 4, MetaTrader 5, Tickmill Web Trader |

| FxPrimus | MetaTrader 4, MetaTrader 5 |

| Grand Capital | MetaTrader 4, MetaTrader 5, WebTrader |

Deposits & Withdrawals

The information provided states that withdrawals can arrive on the same working day, suggesting that AUSFIT aims to process withdrawal requests promptly. However, specific details about the available deposit and withdrawal methods, associated fees, processing times, and minimum/maximum transaction limits are not mentioned.

AUSFIT minimum deposit vs other brokers

| AUSFIT | Most other | |

| Minimum Deposit | N/A | $100 |

Customer Service

AUSFIT offers customer service through various channels, including 24/7 live chat, online messaging, and email. This implies that traders can reach out to their customer support team at any time for assistance with their queries or concerns.

The availability of 24/7 live chat suggests that traders can engage in real-time communication with the AUSFIT support team, enabling them to receive immediate responses to their inquiries. Online messaging may also provide a convenient method for contacting customer support and seeking assistance with account-related matters or technical issues.

Additionally, AUSFIT provides an email address (info@ausfitm.com) for individuals who prefer to communicate via email. This allows traders to send detailed inquiries or requests and receive responses at their convenience.

Moreover, the presence of an FAQ section indicates that AUSFIT provides a resource where traders can find answers to commonly asked questions. This can be beneficial for those seeking quick solutions or information without directly contacting customer support.

| Pros | Cons |

| • 24/7 availability | • Lack of phone support |

| • Multiple communication option | • No social media presence |

Note: These pros and cons are subjective and may vary depending on the individual's experience with AUSFIT's customer service.

Conclusion

Based on the limited information available, AUSFIT offers a diverse range of financial instruments and multiple trading platforms for convenient access to the markets. They also provide customer service options through 24/7 live chat, online messaging, and email.

However, there is a lack of regulatory information and specific details on deposit/withdrawal methods and account types. Traders should conduct thorough research and due diligence before engaging with AUSFIT or any brokerage to ensure it meets their specific trading needs and preferences.

Frequently Asked Questions (FAQs)

| Q 1: | Is AUSFIT regulated? |

| A 1: | No. Their United States National Futures Association (NFA, No. 0554363) license is a suspicious clone. |

| Q 2: | At AUSFIT, are there any regional restrictions for traders? |

| A 2: | Yes. AUSFIT does not provide services to residents of the Haiti, Iran, Suriname, the Democratic Republic of Korea, Puerto Rico, Brazil, the Occupied Area of Cyprus, Syria, North Korea and Cuba. |

| Q 3: | Does AUSFIT offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does AUSFIT offer the industry leading MT4 & MT5? |

| A 4: | No. Instead, it offers Ausfit App and Ausfit Web. |

| Q 5: | Is AUSFIT a good broker for beginners? |

| A 5: | No. It is not a good choice for beginners. Not only because of its unregulated condition, but also because of its lack of transparency. |

WikiFX Trader

FXTM

FOREX.com

Exness

DBG Markets

XM

GTCFX

FXTM

FOREX.com

Exness

DBG Markets

XM

GTCFX

WikiFX Trader

FXTM

FOREX.com

Exness

DBG Markets

XM

GTCFX

FXTM

FOREX.com

Exness

DBG Markets

XM

GTCFX

Rate Calc