Mai hui MHmarkets: July 5, 2023-MHM European Perspective

Sommario:During the Asian session on Wednesday (July 5), spot gold oscillated in a narrow range near its near one-week high and is currently trading near $1,924.30 per ounce.

Market Overview

During the Asian session on Wednesday (July 5), spot gold oscillated in a narrow range near its near one-week high and is currently trading near $1,924.30 per ounce. Investors generally await the release of the Federal Reserve's latest monetary policy meeting minutes and other economic data out, the market is trading more cautiously. Monday's poor U.S. economic data to gold prices to provide support, and international trade tensions, but also to provide confidence to the long side.

The Fed held rates steady at 5%-5.25% in June and said it may need to make at least two more rate hikes of 25 basis points each before the end of the year.

The number of rate hikes by the world's major central banks in June was the highest in a single month so far this year, with many of them surpassing market expectations for tightening, while forecasting more rate hikes in the future as central bank executives try to gain the upper hand in the battle against inflation. This still puts pressure on gold prices in the medium to long term.

According to CME's Fedwatch tool, investors see a nearly 86% chance of a 25 basis point rate hike in July. High interest rates are discouraging investment in gold without a rate hike.

This trading day, the U.S. monthly rate of factory orders for May and the final U.S. monthly rate of durable goods orders for May will be released, investors also need to pay attention to; In addition to the Fed minutes, investors also need to pay attention to the Fed's “number three”, New York Fed President Williams to participate in the Central Bank Research Association (CEBRA) 2023 annual meeting discussions.

U.S. crude oil is in a narrow range and is currently trading at $70.98 per barrel, holding most of Tuesday's gains for now. Expectations of tighter supply due to production cuts announced by Saudi Arabia and Russia in August continue to provide support to oil prices. However, China's Caixin services PMI data was weaker than market expectations, and expectations of a global economic slowdown are still causing caution for bulls.

Traders will look for demand clues from industry data on U.S. crude and oil inventories from the American Petroleum Institute (API) later Wednesday and government data on Thursday, both of which were released a day later due to the U.S. holiday.

Saudi Arabia said Monday it will extend its voluntary production cut of 1 million barrels per day into August. Russia and Algeria said they voluntarily reduced the size of their August production and exports by 500,000 bpd and 20,000 bpd, respectively.

This trading day will see the 8th OPEC International Symposium held on July 5-6, which investors need to pay attention to. In addition, investors need to pay attention to the minutes of the Federal Reserve meeting, the monthly rate of U.S. factory orders in May and the final monthly rate of U.S. durable goods orders in May.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on July 5, Beijing time.

Intraday Oscillation Range: 1873-1889-1903-1911-1929-1937-1951

Overall Oscillation Range: 1730-1756-1780-1801-1817-1833-1856-1873-1889-1903-1911-1929-1937-1951-1960-1978-1985-1998-2007-2016-2033-2046-2057-2066-2077-2089-2097-2100

In the subsequent period of spot gold, 1873-1889-1903-1911-1929-1937-1951 can be operated as the bull and bear range; High throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on July 5. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 21.5-22.3-23.1-23.9

Overall Oscillation Range: 19.7-20.1-20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1-26.6-27.3

In the subsequent period of spot silver, 21.5-22.3-23.1-23.9 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on July 5. This policy is a daytime policy. Please pay attention to the policy release time.

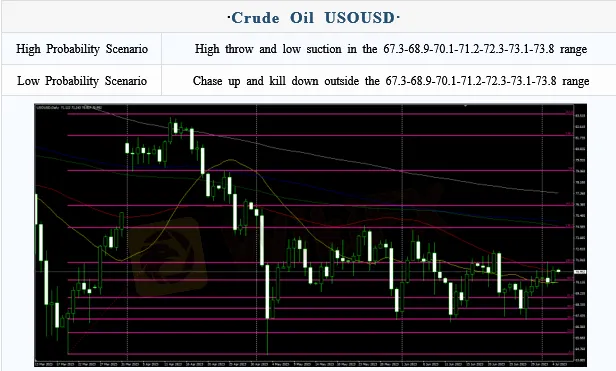

Intraday Oscillation Range: 67.3-68.9-70.1-71.2-72.3-73.1-73.8

Overall Oscillation Range: 62.1-63.7-64.5-65.8-66.9-67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3-89.1

In the subsequent period of crude oil, 67.3-68.9-70.1-71.2-72.3-73.1-73.8 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on July 5. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 1.0690-1.0755-1.0830-1.0950-1.1157

Overall Oscillation Range: 1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0830-1.0950-1.1157-1.1220-1.1303

In the subsequent period of EURUSD, 1.0690-1.0755-1.0830-1.0950-1.1157 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on July 5. This policy is a daytime policy. Please pay attention to the policy release time.

Overall Oscillation Range: 1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2375-1.2400-1.2470-1.25460-1.26505-1.27000-1.28200-1.29300-1.30000-1.30600

In the subsequent period of GBPUSD, 1.2470-1.25460-1.26505-1.27000-1.28200 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on July 5. This policy is a daytime policy. Please pay attention to the policy release time.

WikiFX Trader

FXTM

ATFX

XM

FXCM

Blueberry Markets

Exness

FXTM

ATFX

XM

FXCM

Blueberry Markets

Exness

WikiFX Trader

FXTM

ATFX

XM

FXCM

Blueberry Markets

Exness

FXTM

ATFX

XM

FXCM

Blueberry Markets

Exness

Rate Calc