Mai hui MHmarkets: USD has entered a pressure-intensive zone and U.S. crude oil has fallen back big time!

Sommario:On Thursday (August 3), spot gold shook slightly lower during the Asian session, and is currently trading near $1934.38 per ounce. The U.S. private jobs growth in July that came out overnight exceeded expectations, fueling market bets on more monetary policy tightening and continuing to support the U.S.

Market Overview

On Thursday (August 3), spot gold shook slightly lower during the Asian session, and is currently trading near $1934.38 per ounce. The U.S. private jobs growth in July that came out overnight exceeded expectations, fueling market bets on more monetary policy tightening and continuing to support the U.S. dollar higher. U.S. bond yields were also very strong, approaching near nine-month highs, keeping gold prices under pressure. The loss of the Bollinger Bands mid-rail has strengthened the short-term bearish signal for gold prices, and investors need to beware of the possibility of a sharp decline in gold prices.

U.S. crude oil is narrowly oscillating, and is currently trading near $79.51 per barrel. Global equity markets are under pressure due to the previous Fitch downgrade of the US top credit rating, dampening demand expectations. Despite the record-high drop in EIA crude inventories, the bulls took the opportunity to take profits near the strong resistance level, and the US dollar also continued to strengthen, dragging down oil prices significantly. And reports that OPEC+ is unlikely to adjust its current oil production policy also demoralized the bulls. Technically, a top signal is seen near the strong resistance level, so we need to beware of further downside risks for oil prices.

This trading day will usher in a wave of economic data, including USD Initial Jobless Claims & USD Challenger Job Cuts (JUL) &USD ISM Non-Manufacturing PMI (JUL) & USD Factory Orders MoM (JUN). In addition, investors need to focus on the BOE Interest Rate Resolution and Fed official speeches.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on August 3, Beijing time.

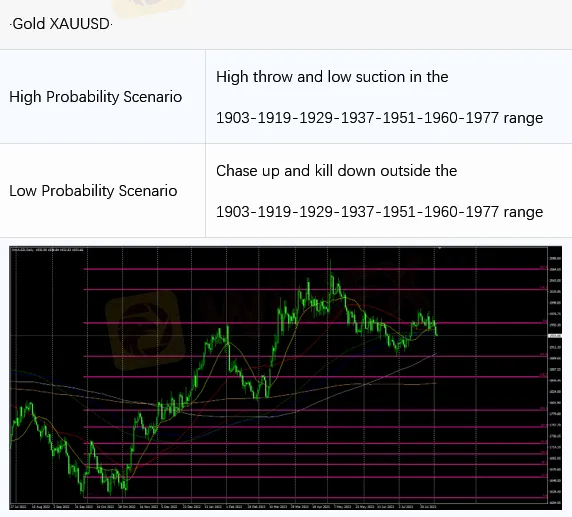

Intraday Oscillation Range: 1903-1919-1929-1937-1951-1960-1977

Overall Oscillation Range: 1730-1756-1780-1801-1817-1833-1856-1873-1889-1903-1919-1929-1937-1951-1960-1977-1985-1998-2007-2016-2033-2046-2057-2066-2077-2089-2097-2100

In the subsequent period of spot gold, 1903-1919-1929-1937-1951-1960-1977

can be operated as the bull and bear range; High throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 3. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 22.3-23.1-23.9-24.5-25.3

Overall Oscillation Range: 19.7-20.1-20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1-26.6-27.3

In the subsequent period of spot silver, 22.3-23.1-23.9-24.5-25.3 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 3. This policy is a daytime policy. Please pay attention to the policy release time.

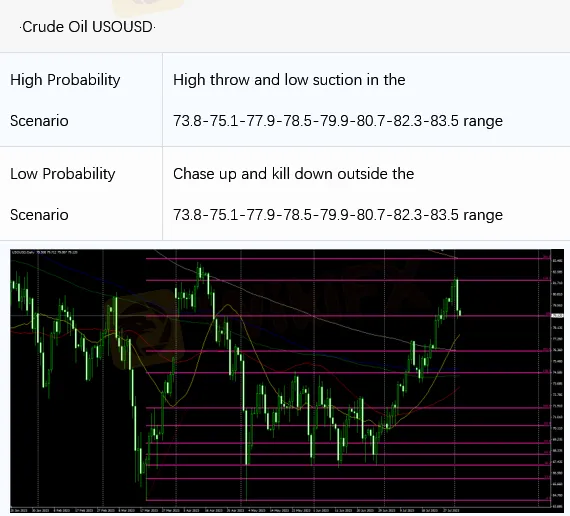

Intraday Oscillation Range: 73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5

Overall Oscillation Range:62.1-63.7-64.5-65.8-66.9-67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3-89.1

In the subsequent period of crude oil,73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 3. This policy is a daytime policy. Please pay attention to the policy release time.

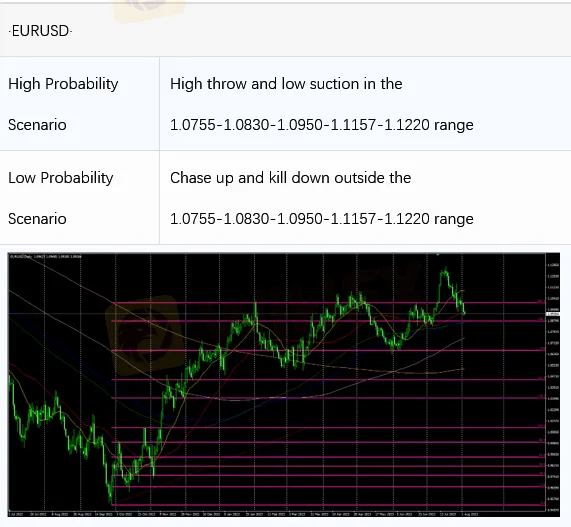

Intraday Oscillation Range:1.0755-1.0830-1.0950-1.1157-1.1220

Overall Oscillation Range: 1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0830-1.0950-1.1157-1.1220-1.1303-1.13340

In the subsequent period of EURUSD, 1.0755-1.0830-1.0950-1.1157-1.1220can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 3. This policy is a daytime policy. Please pay attention to the policy release time.

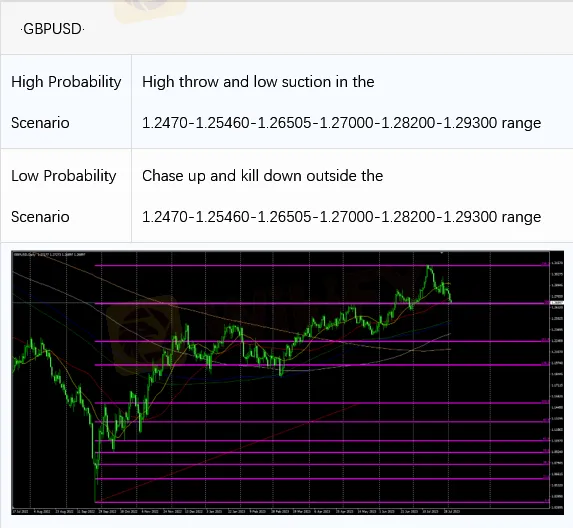

Intraday Oscillation Range:1.2470-1.25460-1.26505-1.27000-1.28200-1.29300

Overall Oscillation Range: 1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2375-1.2400-1.2470-1.25460-1.26505-1.27000-1.28200-1.29300-1.30000-1.30600-1.31000-1.31660-132000

In the subsequent period of GBPUSD, 1.2470-1.25460-1.26505-1.27000-1.28200-1.29300 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 3. This policy is a daytime policy. Please pay attention to the policy release time.

WikiFX Trader

Rate Calc