Pound was deceived. Forecast as of 10.08.2023

Sommario:Anticipations were initially high that the Bank of England (BoE) would increase the rate to 6.5%. Nevertheless, the projections for the bank rate have been lowered to a range of 5.5-5.75%. The GBP/USD depreciation in August is considered typical, yet optimism remains amongst the pound bulls. It's high time we delve into the Forex perspective and conceptualize a GBP/USD trading strategy.

Anticipations were initially high that the Bank of England (BoE) would increase the rate to 6.5%. Nevertheless, the projections for the bank rate have been lowered to a range of 5.5-5.75%. The GBP/USD depreciation in August is considered typical, yet optimism remains amongst the pound bulls. It's high time we delve into the Forex perspective and conceptualize a GBP/USD trading strategy.

Pound fundamental forecast as of 10th August

Although speculators used to buy the pound betting on the BoE interest rate potential growth to 6.5%, the GBPUSD failed to continue the rally. The UK weak economy cant afford a strong currency, and the GBPUSD trend could turn down soon unless there is a lucky chance.

As expected, the hawkish position of the Bank of England, which raised the interest rate for the 14th time to the current 5.25%, and a weak US jobs report allowed the GBPUSD to rebound from the zone of 1.2615-1.263. However, the unfavorable environment and low forecasts for the UK GDP discouraged the GBPUSD bulls.

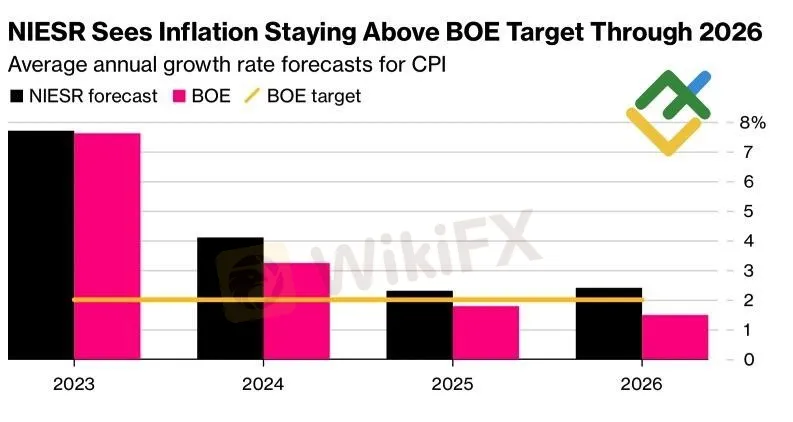

The estimates of the National Institute of Economic and Social Research for the coming years are worse than those of the Bank of England. NIESR refers to the negative impact of Brexit, the war in Ukraine, the aggressive monetary tightening of the BoE; it expects the UK GDP to expand by 0.3% in 2023 and 0.4% in 2024. Inflation this year will be 7.7%; next year, it slow down to 4.1% but wont return to the target either in 2025 or 2026.

Forecasts for UK GDP

According to the BRC, retail sales experienced the weakest growth in 11 months, resulting in a reduction in the pound's popularity. The derivatives market forecasts a potential increase of 25 basis points in the BoE rate to 5.5% in the regulator's September meeting, with a likelihood of 60%. There is a 40% possibility that the Bank rate may remain the same. In contrast, Barclays, BNP Paribas, and UBS predict just one rate hike before the culmination of the monetary tightening phase. They believe the cap for the BoE rate is 5.5%, distinct from the derivatives market's expectation of 5.75%.

However, too high expectations eventually weakened the pound. Just a month ago, the gap between the expected peak rates in the UK and the US seemed huge. However, the slowdown in UK inflation has changed the optimistic views on the sterling. Hedge funds have been cutting net longs for the second week in a row, and asset managers have halved their pound longs from record levels. However, the positioning remains bullish. Together with the UK economic weakness and the growing risks of an early end of the BoE monetary restriction cycle, this will press the sterling down.

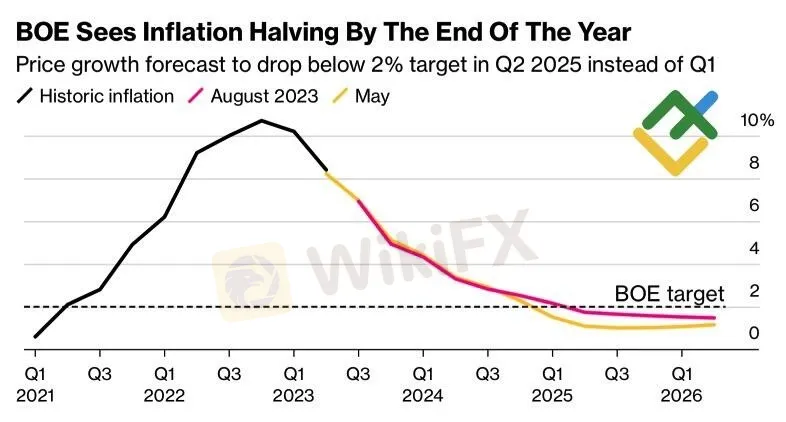

According to the BoE chief economist Huw Pill, monetary tightening is already having an impact on the economy. At the same time, inflation will fall to 5% by the end of the year, which is lower than the forecast by the Bank of England.

Dynamics and forecasts for UK inflation

GBPUSD trading plan today

July report on consumer prices will surely influence the GBPUSD. However, the US inflation report comes first. If the CPI meets the Bloomberg forecast, one could add up to the longs entered at 1.2615-1.263 betting on the rally towards 1.285 and 1.29. Otherwise, it will be relevant to sell.

WikiFX Trader

FXTM

Exness

DBG Markets

FOREX.com

GMI

Pepperstone

FXTM

Exness

DBG Markets

FOREX.com

GMI

Pepperstone

WikiFX Trader

FXTM

Exness

DBG Markets

FOREX.com

GMI

Pepperstone

FXTM

Exness

DBG Markets

FOREX.com

GMI

Pepperstone

Rate Calc