FX Analysis – Yields and USD rise again, AUD clobbered, JPY intervention?

Sommario:The first week of the new quarter has so far been an interesting one, rampant US treasury yields breaking out to 16-year highs, a USD that just keeps going up and now it seems the Japanese Ministry of Finance is directly intervening in currency markets.

The first week of the new quarter has so far been an interesting one, rampant US treasury yields breaking out to 16-year highs, a USD that just keeps going up and now it seems the Japanese Ministry of Finance is directly intervening in currency markets.

USD rose to a high of 107.35 on the back of a surge in yields and a hawkish US JOLTS report which showed the US labor markets resilience. Fed member Mester also spoke noting the Fed will likely need to hike rates one more time this year adding to the higher for longer narrative. The USD did dip later in the session on what seemed to be a Japanese FX intervention, DXY still holding the key 107 level though.

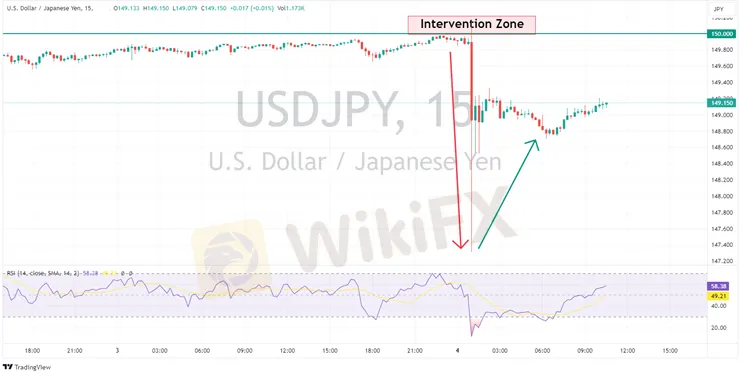

JPY was again weak early in the session with USDJPY hitting a high of 150.16 , above the “line in the sand” at 150. The weakness dramatically reversed on what could only be a BoJ intervention in the FX market seeing USDJPY sharply move lower 3 big figures in a heartbeat, hitting a low of 147.31. There has been no official confirmation this was an intervention but with recent jaw boning from Japanese officials threatening just that, it seems obvious it was. USDJPY recovered after the dust settled to reclaim the 149 level, but from my experience this wont be the last intervention so USDJPY longs should tread with caution from here.

AUD underperformed with the Aussie struggling against a strong USD, sour risk sentiment and post RBA where the Aussie Central Bank kept rates on hold and gave nothing extra for the hawks in their statement. AUDUSD dipped below 0.63 before finding some support around the Nov 22 lows and retaking the 0.63 support level for now.

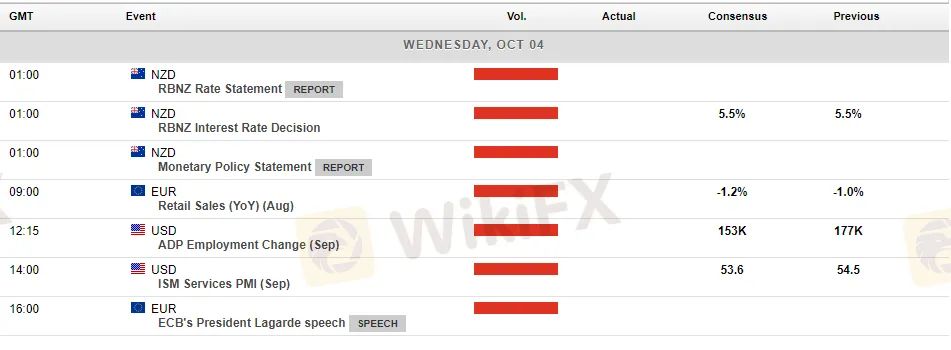

Todays economic announcements:

WikiFX Trader

FXTM

Exness

DBG Markets

XM

AvaTrade

FXCM

FXTM

Exness

DBG Markets

XM

AvaTrade

FXCM

WikiFX Trader

FXTM

Exness

DBG Markets

XM

AvaTrade

FXCM

FXTM

Exness

DBG Markets

XM

AvaTrade

FXCM

Rate Calc