MHMarkets:Fed's Balkin: Inflation more stubborn than widely expected.

Sommario:At the end of the Asian market on Thursday (December 21), the Fed Barkin announced that if the recent progress of inflation continues, the Fed will cut interest rates.

At the end of the Asian market on Thursday (December 21), the Fed Barkin announced that if the recent progress of inflation continues, the Fed will cut interest rates. But he said he is still looking for the belief that inflation will return to the Fed's 2% target. If the Fed believes that inflation will steadily decline, it will certainly make appropriate responses. He looks forward to the consistency and breadth of inflation data in the coming months, and adds that he believes labor demand and inflation are normalizing. Barkin said he would not assume that the data would bring any results. His viewpoint is that inflation is more stubborn than commonly expected, but he hopes his viewpoint is wrong. The US dollar index adjusted intraday yesterday with relatively small fluctuations and closed near the intraday high. At the opening of the Asian market today, the US dollar index slightly adjusted downwards, with a current price around 102.32. Yesterday, gold experienced a intraday correction and consolidation. After encountering resistance above, the market price briefly moved downwards and ultimately closed near the intraday low. At the opening of the Asian market today, the price of gold continued to rise, with the current price around 2035.13. Affected by the Red Sea situation, US crude oil has continued to rise recently. Yesterday, US crude oil prices surged and fell, ultimately closing near the intraday low. At the opening of the Asian market today, US crude oil slightly rose and rebounded, with the current price around 74.14.In a recent interview, ECB Managing Director Norte stated that it is “quite unlikely” for the ECB to cut interest rates in the first half of 2024, and policymakers need to observe the development of wages in order to conclude that inflation has been persistently improving. EURUSD continued to decline yesterday, receiving support from below during the US market period, but has not yet achieved a good rise, and ultimately closed near the intraday low yesterday. At the opening of the Asian market today, EURUSD experienced a slight fluctuation and adjustment, with the current price around 1.0944. The Japanese Cabinet Office released a report on December 21 stating that the Japanese government has raised its overall inflation expectations for the next fiscal year starting in April from 1.9% a few months ago to 2.5%. USDJPY fell sharply at the opening of the Asian market today, with a current price around 143.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on December 21, Beijing time.

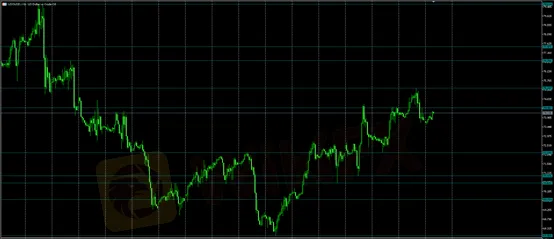

Gold XAUUSD· | |

Resistance | 2038.76 – 2043.45 – 2048.16 |

Support | 2021.50 – 2015.48 – 2007.95 |

The above figure shows the 30 minute chart of gold. The chart shows that the recent upward resistance of gold has been around 2038.76-2043.45-2048.16, and the downward support has been around 2021.50-2015.48-2007.95. The market will be judged by whether to break through the upper and lower support and resistance. Note: The above strategy was updated at 15:00 on December 21. This policy is a daytime policy. Please pay attention to the policy release time. | |

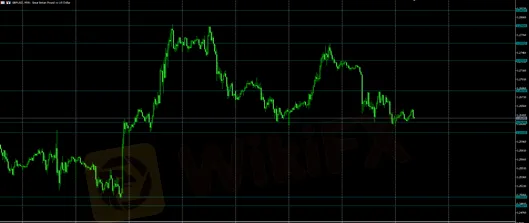

Crude Oil USOUSD· | |

Resistance | 74.40 – 75.38 – 76.76 |

Support | 72.14 – 70.97 – 70.61 |

The above chart shows the 30 minute chart of US crude oil. The chart shows that the recent upward resistance of US crude oil is around 74.40-75.38-76.76, and the downward support is around 72.14-70.97-70.61. The market will be judged by whether to break through the upper and lower support and resistance. Note: The above strategy was updated at 15:00 on December 21. This policy is a daytime policy. Please pay attention to the policy release time. | |

EURUSD· | |

Resistance | 1.0964 - 1.0987 - 1.1009 |

Support | 1.0929 - 1.0880- 1.0847 |

The above figure shows the 30 minute chart of EURUSD. The chart shows that the recent upward resistance of EURUSD is around 1.0964-1.0987-1.1009, and the downward support is around 1.0929-1.0880-1.0847. The market will be judged by whether to break through the upper and lower support and resistance. Note: The above strategy was updated at 15:00 on December 21. This policy is a daytime policy. Please pay attention to the policy release time. | |

GBPUSD· | |

Resistance | 1.2681 – 1.2732 – 1.2762 |

Support | 1.2628 - 1.2611 – 1.2502 |

The above figure shows the 30 minute chart of GBPUSD. The chart shows that the recent upward resistance of GBPUSD is around 1.2681-1.2732-1.2762, and the downward support is around 1.2628-1.2611-1.2502. The market will be judged by whether to break through the upper and lower support and resistance. Note: The above strategy was updated at 15:00 on December 21. This policy is a daytime policy. Please pay attention to the policy release time. | |

WikiFX Trader

FXTM

Exness

DBG Markets

FOREX.com

AvaTrade

CXM Trading

FXTM

Exness

DBG Markets

FOREX.com

AvaTrade

CXM Trading

WikiFX Trader

FXTM

Exness

DBG Markets

FOREX.com

AvaTrade

CXM Trading

FXTM

Exness

DBG Markets

FOREX.com

AvaTrade

CXM Trading

Rate Calc