Dukascopy Bank Launches MetaTrader 5 Platform

Sommario:Dukascopy Bank integrates MetaTrader 5, boosting trading tools and client options. The firm sees profit growth and has launched a new crypto lending program.

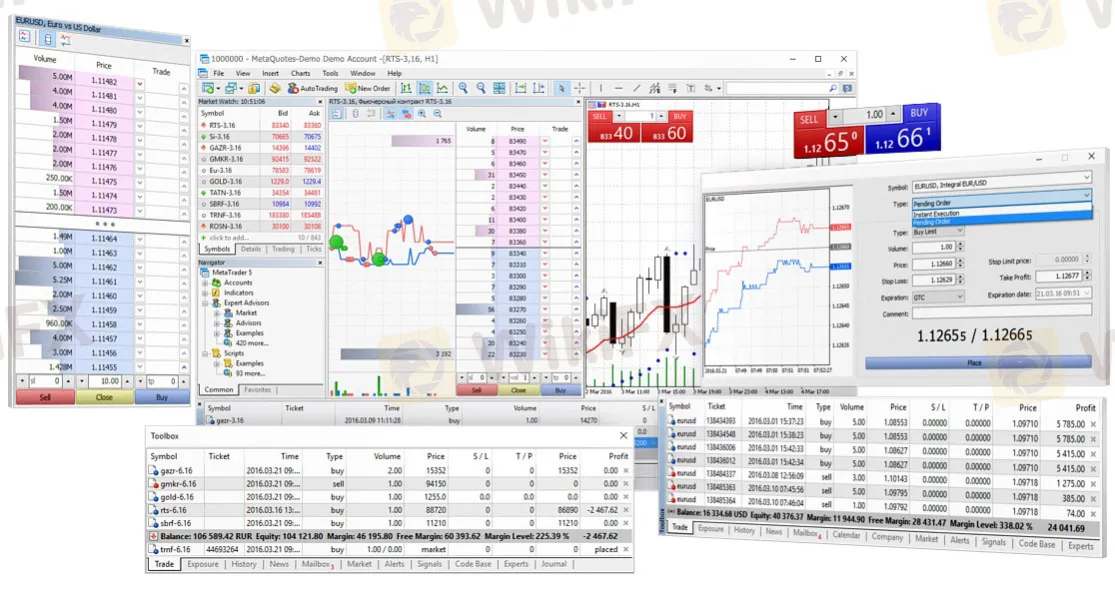

The Swiss city of Geneva - A new trading platform, MetaTrader 5 (MT5), is now available to customers of Dukascopy Bank SA. With the addition of the proprietary JForex 4 and the widely-used MT4, the bank's services for traders in a variety of asset classes have been expanded in this version.

Launching after a successful beta-testing period, Dukascopy is a big step forward for its cryptocurrency, commodities, precious metals, stock, bond, and index trading clients. With its extensive set of analytical tools and technical indicators, MT5's superior features make it a flexible platform for a wide variety of trading techniques.

New and improved technical indicators and time intervals for in-depth research are among the most notable improvements.

Traders may stay updated about financial developments with the inclusion of an economic calendar.

View the market from a Depth of Market (DOM) perspective to learn more about its dynamics.

The release of MetaTrader 5 (MT5) demonstrates Dukascopy's commitment to offering traders cutting-edge trading tools and services. The business made the bold claim that MT5 would provide customers with “unparalleled trading flexibility and analytical capabilities” in addition to enhancing their current platform offerings.

Financial Results

A rise in profitability is highlighted in Dukascopy's most recent financial report. Profit for the bank increased by 39% to CHF 8.5 million, from CHF 6.1 million the year before. An increase in trade volumes and a growing customer base are the reasons for this remarkable rise. From CHF 33.2 million in the same time last year, revenue grew to CHF 39.4 million, an 18% increase.

Annual operating expenditures were CHF 28.9 million, up slightly from CHF 26.6 million the previous year. The main drivers of these expenditures were investments in technology and endeavors to expand internationally. A major source of revenue for the bank, net fee and commission income, increased by 10% despite these higher expenditures.

Crypto Loan Scheme

Dukascopy has introduced a new crypto loan program with platform updates and financial development. Customers may borrow up to half the value of their digital assets in fiat money with this unique solution, letting them leverage their cryptocurrency holdings without giving up control of the original investments.

The program's crypto lending component is housed in Dukascopy's multi-currency bank accounts (MCAs), which users are required to obtain. In the “Investments” area, users may access their digital assets, and then use the “Crypto lending/borrowing” option to send their cryptocurrency to the MCA.

This automated lending platform combines the conventional banking system with the cutting-edge digital asset industry by giving customers the option to borrow US dollars secured by their Bitcoin holdings.

What Lies Ahead

Dukascopy Bank is well-prepared to meet the changing demands of contemporary traders with its full portfolio of products and services, including the integration of MetaTrader 5 and the debut of its crypto financing program. The bank's commitment to technological advancement and global expansion highlights its desire to stay ahead of the competition in the financial services market.

Clients may anticipate more sophisticated trading capabilities and financial solutions aimed at improving their trading experience and financial flexibility as Dukascopy keeps innovating and expanding its services.

WikiFX Trader

FXTM

FOREX.com

Exness

DBG Markets

AvaTrade

GTCFX

FXTM

FOREX.com

Exness

DBG Markets

AvaTrade

GTCFX

WikiFX Trader

FXTM

FOREX.com

Exness

DBG Markets

AvaTrade

GTCFX

FXTM

FOREX.com

Exness

DBG Markets

AvaTrade

GTCFX

Rate Calc