KVB Market Analysis | 8 Oct: Ethereum Surge Ahead as EIP-7781 Impacts ETH/USD

Sommario:Product: XAU/USDPrediction: IncreaseFundamental Analysis: Spot Golds consolidative phase continued throughout the first half of Monday after the noisy United States (US) Nonfarm Payrolls (NFP) report

Product: XAU/USD

Prediction: Increase

Fundamental Analysis:

Spot Gold's consolidative phase continued throughout the first half of Monday after the noisy United States (US) Nonfarm Payrolls (NFP) report released last Friday. XAU/USD found near-term demand at the beginning of the week as Middle East tensions undermined the markets mood. Nevertheless, the bright metal turned south early in the American session, as the US Dollar benefits from solid US data supporting the case for a slow pace of interest rate cuts.

Technical Analysis:

The daily chart for XAU/USD shows the pair is pressuring the base of a near-term wedge but holding within the figure. The pair is also developing above all its moving averages, with the 20 Simple Moving Average (SMA) heading firmly north at around $2,616. The 100 and 200 SMAs maintain their bullish slopes, yet roughly $200 below the shorter one. Finally, the Momentum indicator turned flat within positive levels, while the Relative Strength Index (RSI) indicator aims lower at around 63, correcting overbought conditions and far from supporting another leg south.

Product: AUD/USD

Prediction: Decrease

Fundamental Analysis:

With growing conflicts in the Middle East region, market sentiment remains uncertain. Risk-perceived currencies are under pressure as rising Oil prices due to the Israel-Iran war would result in a sharp increase in foreign outflows of those economies, which are highly dependent on imported Oil. The US Dollar Index (DXY), which tracks the Greenback‘s value against six major currencies, clings to gains near 102.00. The US NFP will be under the spotlight as it would force traders to adjust market expectations for Federal Reserve’s (Fed) monetary policy action in the remaining two meetings this year. Currently, financial markets are slightly confident about the Fed to reduce interest rates further by 75 basis points (bps).

Technical Analysis:

The AUD/USD pair remains offered near the key resistance of 0.6850 in Fridays European session. The Aussie asset would continue to face pressure as traders brace for the United States (US) Nonfarm Payrolls (NFP) data for September, which will be published at 12:30 GMT.

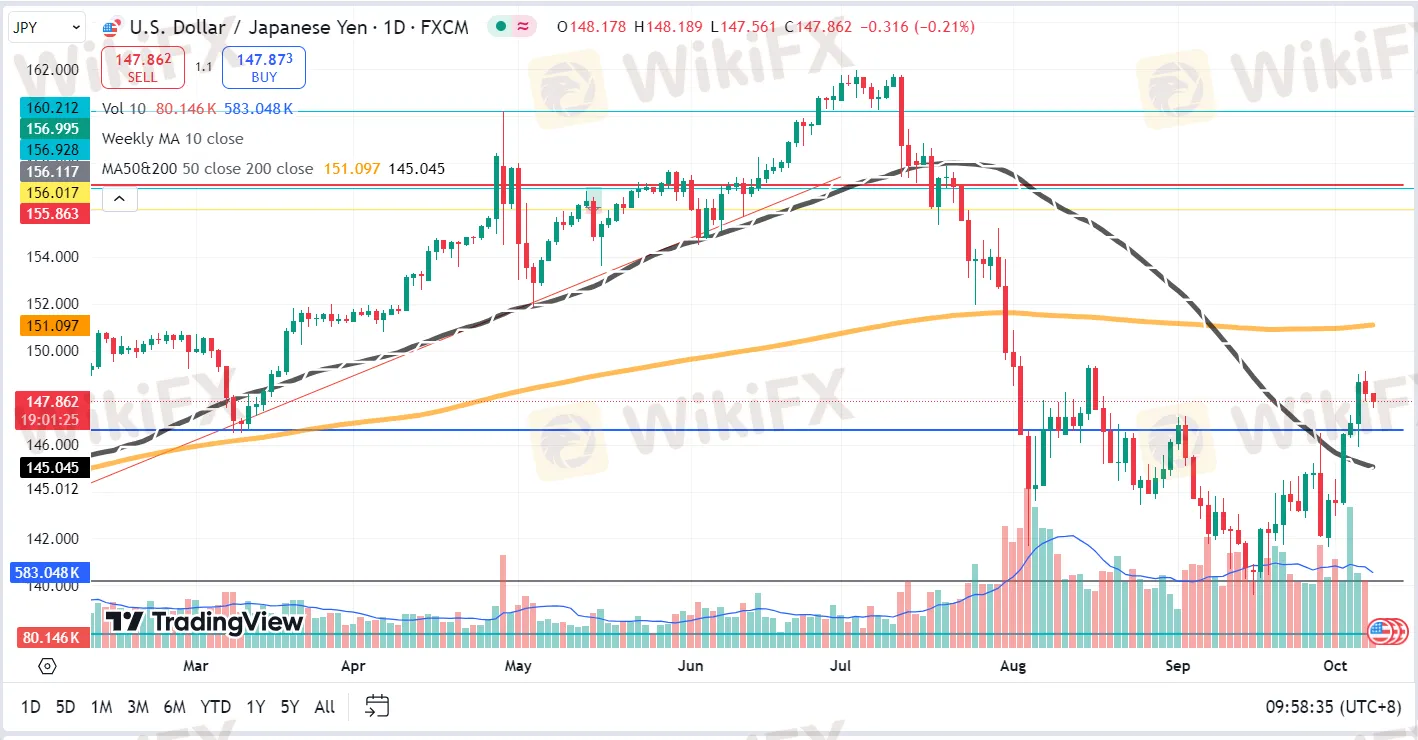

Product: USD/JPY

Prediction: Increase

Fundamental Analysis:

Japan economy minister Ryosei Akazawa said on Tuesday that a decline in real wages for the first time in three months is not good news. Akazawa further stated that the Japanese government will create an environment where real wages continue to rise. USD/JPY reverses an Asian session dip to the 147.55 area and stalls a modest pullback from its highest level since August 16 touched the previous day. The uncertainty about future BoJ rate hikes keeps the JPY bulls on the defensive ahead of Japan's snap election on October 27.

Technical Analysis:

The USD/JPY pair retreats after touching its highest level since August 16, around the 149.10-149.15 area and extends the steady intraday descent through the first half of the European session on Monday. Spot prices, for now, seem to have snapped a three-day winning streak and dropped to the 148.00 mark, or a fresh daily low in the last hour. albeit recover a few pips thereafter.

Product: ETH/USD

Prediction: Increase

Fundamental Analysis:

The new EIP-7781, initially proposed by Illyriad Games co-founder Ben Adams, aims to boost Ethereum's throughput by 33% through a process that will see slot time fall from 12 seconds to 8 seconds. Slot times are intervals during which validators propose new blocks to the Ethereum network. The decrease in slot time also implies a reduction in based rollup latency. Based rollups are a new type of rollup that leverages the main chain for transaction sequencing as opposed to optimistic and ZK rollups. The changes also imply an increase in blob — a data structure for storing L2 transactions introduced in the March Dencun — count from 6 to 8 or a hike in the gas limit from 30M to 40M.

Technical Analysis:

Ethereum is trading around $2,450 on Monday, slightly up on the day. The top altcoin has sustained liquidations worth nearly $57 million in the past 24 hours, with long and short liquidations accounting for $41.23 million and $15.75 million, respectively. ETH is consolidating within a key rectangle channel after it saw a rejection around the $2,500 psychological level, posting a Doji candle on the 4-hour chart.

WikiFX Trader

FXTM

Exness

DBG Markets

MultiBank Group

GMI

FOREX.com

FXTM

Exness

DBG Markets

MultiBank Group

GMI

FOREX.com

WikiFX Trader

FXTM

Exness

DBG Markets

MultiBank Group

GMI

FOREX.com

FXTM

Exness

DBG Markets

MultiBank Group

GMI

FOREX.com

Rate Calc