Can the Euro Replace the U.S. Dollar as the Dominant Global Currency?

Sommario:As mentioned in our previous report, net short positions on the U.S. dollar surged to $16.5 billion by mid-May—the highest level since September of last year. Capital has been flowing out of the dolla

As mentioned in our previous report, net short positions on the U.S. dollar surged to $16.5 billion by mid-May—the highest level since September of last year. Capital has been flowing out of the dollar and into other major currencies such as the euro, New Zealand dollar, Australian dollar, and Japanese yen, as well as into gold. The dollars weakness is becoming increasingly evident.

1. Speculative Capital Exits the Dollar, Renewed Focus on the Euro

According to the COT (Commitments of Traders) report released on May 20, net short positions on the dollar briefly contracted by $4.5 billion, but overall bullish sentiment remains weak. Following former President Trumps announcement to delay the implementation of a 50% tariff on EU goods, the dollar index ended its four-week winning streak, prompting traders to significantly reduce long dollar positions. Some analysts argue that if the White House continues its aggressive tariff policies, bearish bets against the dollar could deepen further.

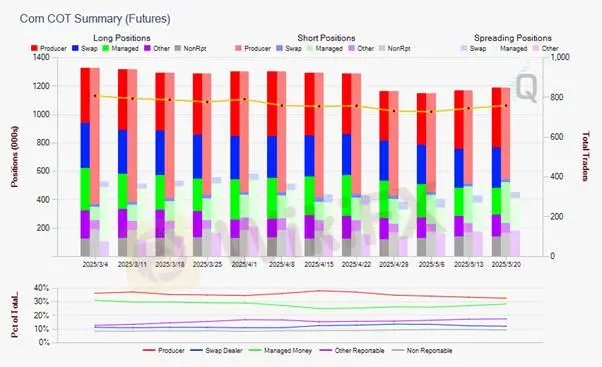

Source: CME Group

Despite a brief pullback in dollar shorts last week, asset managers still hold over 4,000 net short contracts on the U.S. Dollar Index, reflecting cautious sentiment among institutional players. Meanwhile, ECB President Christine Lagarde publicly stated that if EU member states further integrate their fiscal, financial, and security policies, the euro has the potential to become a viable alternative to the dollar. While this view may reinforce bearish pressure on the dollar, we offer a more cautious perspective.

2. Structural Challenges of the Euro: Unified Currency, Divided Fiscal System

What gives the U.S. dollar its staying power isn‘t short-term policy—it’s institutional strength. U.S. Treasury bonds are backed by the federal government, offering high liquidity and low risk. Theyve long been regarded as a safe haven for global capital.

In contrast, the eurozone features a unified currency but fragmented fiscal policies. Each member state issues its own sovereign debt, with wide disparities in credit ratings. The fiscal outlook and debt burdens of Germany, France, and Italy are vastly different, and investors aren‘t evaluating “euro credit”—they’re evaluating “whose euro-denominated debt” theyre holding. This undermines confidence in the euro as a global reserve asset.

The EU has long debated the issuance of Eurobonds, but political disagreements over fiscal burden-sharing have prevented consensus. This structural division remains a major barrier to the euro achieving reserve currency status.

3. The Dollar Still Dominates Global Monetary Functions

From a monetary perspective, the dollar maintains overwhelming dominance. Whether as a medium of exchange, store of value, or unit of account, the dollars global usage far exceeds that of any other currency. Over 80% of global forex transactions involve the U.S. dollar, and nearly 60% of central bank reserves are dollar-denominated. In contrast, the euro remains largely confined to regional circulation.

Source: Bloomberg

More critically, the dollar‘s role as a crisis hedge is unmatched. In both the 2008 financial crisis and the 2020 pandemic, global investors turned to the dollar—not the euro—for safety. The Federal Reserve’s crisis management capabilities and intervention mechanisms are superior to those of the eurozone. Political factors also play a role: in terms of diplomacy, military power, and geopolitical reach, the EU lags significantly behind the U.S. Even if the euro meets monetary criteria, it lacks the political foundation to support a globally trusted financial system.

Conclusion: The Euro Has Potential, But Isnt Ready to Replace the Dollar

The euro may play a greater “supplemental role” as the dollar faces mounting challenges, especially in areas like energy trade, bilateral trade settlements, and selective bond allocations. However, replacing the dollar is still a distant prospect. Without deeper fiscal integration, a unified bond issuance framework, and stronger geopolitical influence, the euro is more likely to remain a strong regional currency than a global hegemon.

Gold Market Outlook

Given the ongoing divergence between the dollar and the euro, gold has established a solid support base around $3,320–$3,325, with each dip attracting strong buying interest. The $3,340–$3,350 range has become a critical battleground. A clear breakout could signal the start of another leg higher. Although U.S. markets are closed, the rebound in European equities has not dampened golds appeal, underscoring the persistent demand for safe-haven assets.

Resistance: $3,365/oz

Support: $3,248, $3,300, $3,325/oz

Risk Disclaimer: The views, analysis, research, and price levels mentioned above are provided solely for general market commentary and do not reflect the official stance of this platform. Readers should exercise their own judgment and trade at their own risk.

WikiFX Trader

FXTM

ATFX

AVATRADE

EBC

Blueberry Markets

EC markets

FXTM

ATFX

AVATRADE

EBC

Blueberry Markets

EC markets

WikiFX Trader

FXTM

ATFX

AVATRADE

EBC

Blueberry Markets

EC markets

FXTM

ATFX

AVATRADE

EBC

Blueberry Markets

EC markets

Rate Calc