FPG AUDUSD Market Report December 31, 2025

Sommario:On the AUDUSD H4 chart, after moving in a bearish channel from 10 to 19 December, the pair finally experienced a clear trend reversal in the form of a strong bullish move from 0.6602 to 0.6717. This b

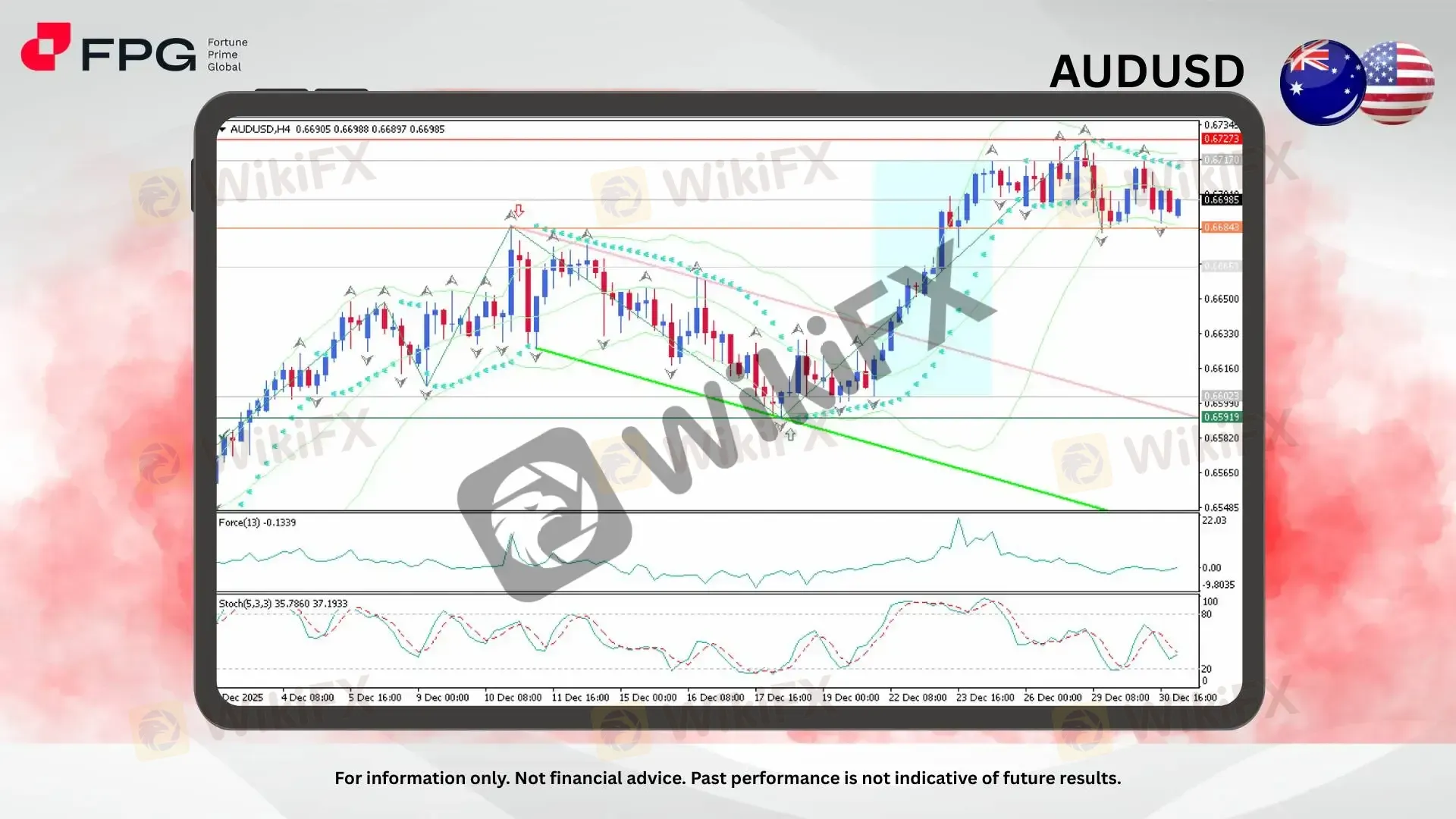

On the AUDUSD H4 chart, after moving in a bearish channel from 10 to 19 December, the pair finally experienced a clear trend reversal in the form of a strong bullish move from 0.6602 to 0.6717. This bullish impulse was supported by a decisive break above the descending trendline and followed by a period of sideways consolidation. Price is currently ranging within a defined structure, with the upper boundary near 0.6727 and the lower boundary around 0.6684. At present, AUDUSD is hovering around 0.6698, indicating a pause as the market digests the prior gains.

From an indicator perspective, the Bollinger Bands expanded significantly during the bullish breakout phase, reflecting a surge in volatility and strong momentum, before starting to narrow again during the current consolidation. The Force Index has retreated from its recent peak but remains near neutral territory, indicating reduced buying pressure rather than aggressive selling. Meanwhile, the Stochastic Oscillator is oscillating in the mid-range, moving away from overbought conditions, which signals consolidation and a potential setup for the next directional move rather than an immediate reversal.

Overall, AUDUSD has shown notable price strengthening over the past few months, largely driven by broad-based USD weakness. Ongoing uncertainty surrounding the Federal Reserves future policy direction, combined with factors such as Trump-related policy expectations, geopolitical tensions, and renewed tariff war concerns, has weighed on the US Dollar. These macroeconomic pressures continue to support commodity-linked currencies like the Australian Dollar, reinforcing the medium-term bullish outlook for AUDUSD despite short-term consolidation.

Market Observation & Strategy Advice

1. Current Position: AUDUSD is trading around 0.6698, consolidating after a strong bullish reversal from the 0.6602 low. Price remains above the former bearish trendline, keeping the short-term bullish bias intact.

2. Resistance Zone: Key resistance is located around 0.6717–0.6727, marking the recent high and the upper boundary of the consolidation range. A break above this area may open room toward 0.6750.

3. Support Zone: Immediate support sits near 0.6684, while a stronger support zone is found around 0.6600–0.6605, which aligns with the previous breakout base.

4. Indicators: Bollinger Bands are contracting, indicating consolidation after high volatility. Force Index is near neutral, and the Stochastic Oscillator is in the mid-range, suggesting balanced momentum.

5. Trading Strategy Suggestions:

Pullback buy: Consider buying near 0.6684 if bullish confirmation appears.

Breakout trade: Look for follow-through buying on a clear break above 0.6727.

Range play: Apply short-term range strategies while price remains between support and resistance.

Market Performance:

Forex Last Price % Change

EUR/USD 1.1745 −0.02%

USD/JPY 156.45 +0.08%

Today's Key Economic Calendar:

US: FOMC Minutes

US: API Crude Oil Stock Change

CN: NBS Manufacturing & Non Manufacturing PMI

CN: RD Manufacturing PMI

US: MBA 30-Year Mortgage Rate

US: Initial Jobless Claim

US: EIA Crude Oil & Gasoline Stocks Change

Risk Disclaimer: This report is for informational purposes only and does not constitute financial advice. Investments involve risks, and past performance does not guarantee future results. Consult your financial advisor for personalized investment strategies.

WikiFX Trader

FXTM

ATFX

XM

FXCM

Blueberry Markets

AVATRADE

FXTM

ATFX

XM

FXCM

Blueberry Markets

AVATRADE

WikiFX Trader

FXTM

ATFX

XM

FXCM

Blueberry Markets

AVATRADE

FXTM

ATFX

XM

FXCM

Blueberry Markets

AVATRADE

Rate Calc