2025-01-29 17:05

SettoreSwing Trading Strategies

#firstdealofthenewyearFateema

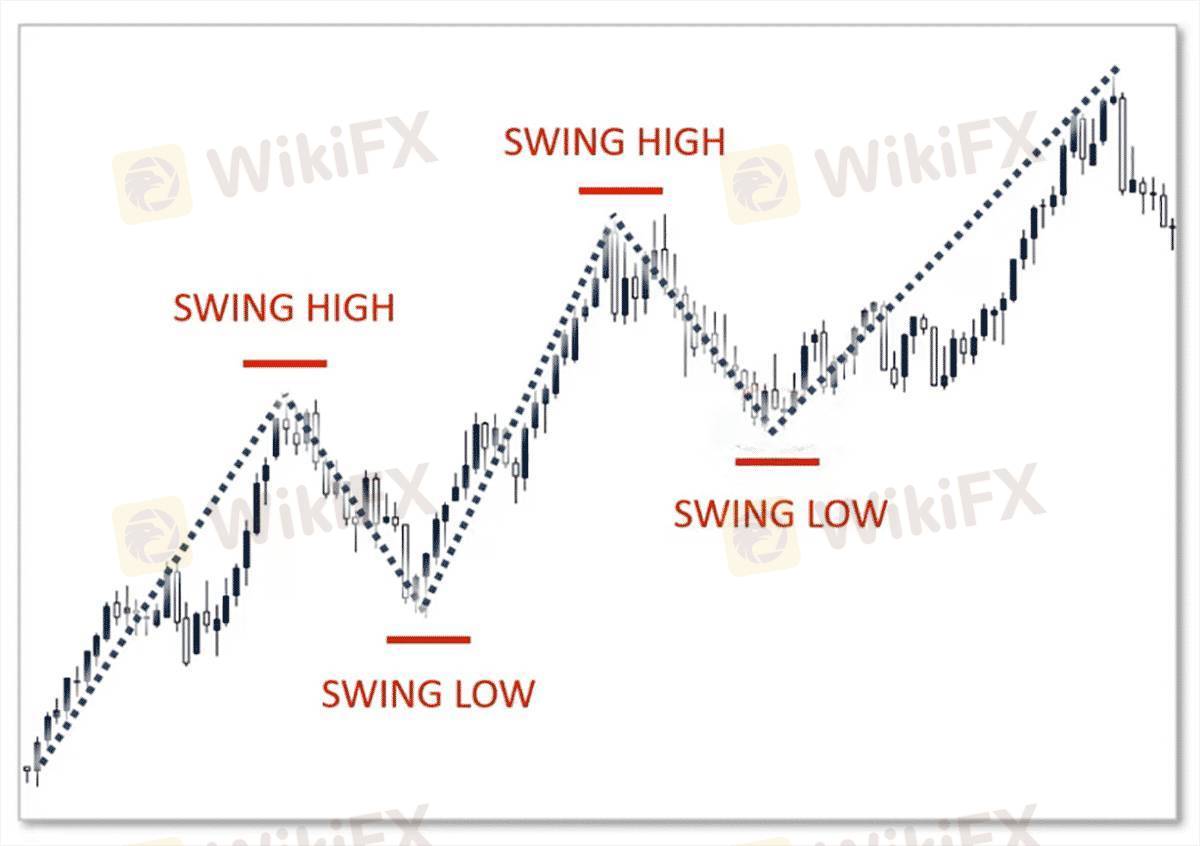

Swing trading strategies aim to capture short- to medium-term price movements within a larger trend. Traders typically hold positions for several days or weeks, taking advantage of price “swings” between support and resistance levels. Key strategies include:

1. Trend-following: This involves identifying the prevailing trend (up or down) and entering trades in the direction of the trend. Traders use technical indicators like moving averages or trendlines to confirm trends.

2. Breakout Trading: Traders enter positions when price breaks key support or resistance levels, expecting strong price movement in the direction of the breakout.

3. Retracement/Correction Trading: This strategy targets price pullbacks within a trend. Traders look for opportunities to buy during an uptrend or sell during a downtrend when the price retraces to a key Fibonacci level or moving average.

4. Divergence Strategy: Traders look for divergences between price and indicators (like RSI or MACD), which can signal potential reversals.

Swing traders use a combination of technical analysis, risk management, and patience to profit from market swings.

Mi piace 0

Veinticinco25

Trader

Discussione popolari

Settore

Offerta di lavoro Marketing

Settore

Marketing App

categoria forum

Piattaforma

Esibizione

IB

Reclutamento

EA

Settore

Mercato

indice

Swing Trading Strategies

Nigeria | 2025-01-29 17:05

Nigeria | 2025-01-29 17:05#firstdealofthenewyearFateema

Swing trading strategies aim to capture short- to medium-term price movements within a larger trend. Traders typically hold positions for several days or weeks, taking advantage of price “swings” between support and resistance levels. Key strategies include:

1. Trend-following: This involves identifying the prevailing trend (up or down) and entering trades in the direction of the trend. Traders use technical indicators like moving averages or trendlines to confirm trends.

2. Breakout Trading: Traders enter positions when price breaks key support or resistance levels, expecting strong price movement in the direction of the breakout.

3. Retracement/Correction Trading: This strategy targets price pullbacks within a trend. Traders look for opportunities to buy during an uptrend or sell during a downtrend when the price retraces to a key Fibonacci level or moving average.

4. Divergence Strategy: Traders look for divergences between price and indicators (like RSI or MACD), which can signal potential reversals.

Swing traders use a combination of technical analysis, risk management, and patience to profit from market swings.

Mi piace 0

Voglio commentare

Fai una domanda

0Commenti

Non ci sono ancora commenti. Crea uno.

Fai una domanda

Non ci sono ancora commenti. Crea uno.