2025-01-30 18:31

SettoreUsing Bollinger Bands in Crypto Trading

#firstdealofthenewyearFateema

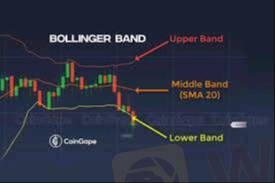

Bollinger Bands are a popular technical analysis tool used in crypto trading to identify potential price breakouts, overbought and oversold conditions, and market volatility. They consist of three lines:

1. Middle Band – A simple moving average (SMA), typically set to 20 periods.

2. Upper Band – Calculated as the SMA plus two standard deviations.

3. Lower Band – Calculated as the SMA minus two standard deviations.

How to Use Bollinger Bands in Crypto Trading

1. Identifying Overbought and Oversold Conditions

Price Near Upper Band → The asset may be overbought, signaling a potential pullback.

Price Near Lower Band → The asset may be oversold, indicating a possible bounce.

2. Bollinger Band Squeeze (Volatility Indicator)

Bands Contracting → Low volatility, possible upcoming breakout.

Bands Expanding → Increased volatility, confirming a trend continuation.

3. Breakout Trading Strategy

If the price breaks above the upper band with strong volume, it may signal a bullish breakout.

If the price breaks below the lower band with strong volume, it may indicate a bearish breakout.

4. Using Bollinger Bands with Other Indicators

RSI (Relative Strength Index): Confirms overbought/oversold conditions.

MACD (Moving Average Convergence Divergence): Helps validate breakout signals.

Support & Resistance Levels: Avoid false breakouts by checking key price levels.

Limitations

False signals can occur, so always combine Bollinger Bands with other indicators.

Does not predict trend direction, only volatility changes.

Would you like insights on applying Bollinger Bands in specific market conditions or assets?

Mi piace 0

FX2016752587

Trader

Discussione popolari

Settore

Offerta di lavoro Marketing

Settore

Marketing App

categoria forum

Piattaforma

Esibizione

IB

Reclutamento

EA

Settore

Mercato

indice

Using Bollinger Bands in Crypto Trading

Nigeria | 2025-01-30 18:31

Nigeria | 2025-01-30 18:31#firstdealofthenewyearFateema

Bollinger Bands are a popular technical analysis tool used in crypto trading to identify potential price breakouts, overbought and oversold conditions, and market volatility. They consist of three lines:

1. Middle Band – A simple moving average (SMA), typically set to 20 periods.

2. Upper Band – Calculated as the SMA plus two standard deviations.

3. Lower Band – Calculated as the SMA minus two standard deviations.

How to Use Bollinger Bands in Crypto Trading

1. Identifying Overbought and Oversold Conditions

Price Near Upper Band → The asset may be overbought, signaling a potential pullback.

Price Near Lower Band → The asset may be oversold, indicating a possible bounce.

2. Bollinger Band Squeeze (Volatility Indicator)

Bands Contracting → Low volatility, possible upcoming breakout.

Bands Expanding → Increased volatility, confirming a trend continuation.

3. Breakout Trading Strategy

If the price breaks above the upper band with strong volume, it may signal a bullish breakout.

If the price breaks below the lower band with strong volume, it may indicate a bearish breakout.

4. Using Bollinger Bands with Other Indicators

RSI (Relative Strength Index): Confirms overbought/oversold conditions.

MACD (Moving Average Convergence Divergence): Helps validate breakout signals.

Support & Resistance Levels: Avoid false breakouts by checking key price levels.

Limitations

False signals can occur, so always combine Bollinger Bands with other indicators.

Does not predict trend direction, only volatility changes.

Would you like insights on applying Bollinger Bands in specific market conditions or assets?

Mi piace 0

Voglio commentare

Fai una domanda

0Commenti

Non ci sono ancora commenti. Crea uno.

Fai una domanda

Non ci sono ancora commenti. Crea uno.