2025-02-06 15:17

SettoreSmart contract trading strategies

#firstdealofthenewyearFateema

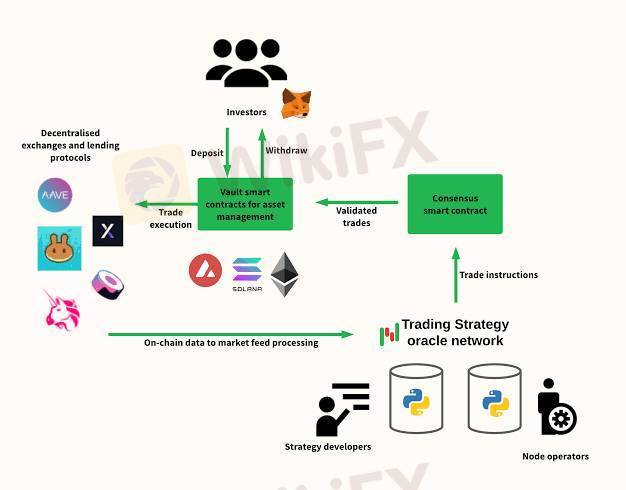

Smart contract trading strategies involve using automated, self-executing contracts to execute trades based on predefined conditions. These strategies are widely used in decentralized finance (DeFi) for market-making, arbitrage, liquidation, and automated portfolio management. Here are some key strategies:

1. Arbitrage Trading

Cross-DEX Arbitrage: Identifying price discrepancies between decentralized exchanges (DEXs) like Uniswap, Sushiswap, or STON.fi to buy low and sell high.

Triangular Arbitrage: Exploiting price differences within a single DEX by trading through three different assets in a loop.

Flash Loan Arbitrage: Borrowing funds without collateral using flash loans to perform arbitrage trades and repaying in the same transaction.

2. Market-Making & Liquidity Provision

Automated Market Maker (AMM) Strategies: Providing liquidity on platforms like Uniswap v3, Balancer, or Curve while using concentrated liquidity strategies for optimal returns.

Rebalancing Liquidity Positions: Adjusting liquidity positions dynamically based on market conditions to minimize impermanent loss.

3. Trend-Following Strategies

Moving Average Crossovers: Using smart contracts to track exponential moving averages (EMA) and execute buy/sell orders when trends shift.

Momentum Trading: Executing trades when an asset’s price or volume exceeds predefined thresholds.

4. Mean Reversion Trading

Bollinger Bands Strategy: Buying when an asset’s price is below the lower band and selling when it is above the upper band.

RSI-Based Trading: Buying when the RSI is oversold (<30) and selling when it is overbought (>70).

5. Automated Yield Farming & Staking

Yield Optimization: Using smart contracts to move assets between DeFi protocols like Aave, Compound, or Yearn to maximize APY.

Auto-Compounding: Automating reinvestment of rewards to maximize returns over time.

6. Liquidation Bots

Lending Protocol Liquidation: Monitoring platforms like Aave or MakerDAO to liquidate undercollateralized positions and earn a liquidation bonus.

7. Sandwich Attacks & MEV Strategies

Front-Running Arbitrage: Placing a buy order before a large trade and selling immediately after to profit from slippage.

Back-Running: Detecting profitable transactions in the mempool and submitting orders right after to benefit.

Would you like to explore a specific strategy or discuss implementing a trading bot using smart contracts?

Mi piace 0

mmaette100

Trader

Discussione popolari

Settore

Offerta di lavoro Marketing

Settore

Marketing App

categoria forum

Piattaforma

Esibizione

IB

Reclutamento

EA

Settore

Mercato

indice

Smart contract trading strategies

Nigeria | 2025-02-06 15:17

Nigeria | 2025-02-06 15:17#firstdealofthenewyearFateema

Smart contract trading strategies involve using automated, self-executing contracts to execute trades based on predefined conditions. These strategies are widely used in decentralized finance (DeFi) for market-making, arbitrage, liquidation, and automated portfolio management. Here are some key strategies:

1. Arbitrage Trading

Cross-DEX Arbitrage: Identifying price discrepancies between decentralized exchanges (DEXs) like Uniswap, Sushiswap, or STON.fi to buy low and sell high.

Triangular Arbitrage: Exploiting price differences within a single DEX by trading through three different assets in a loop.

Flash Loan Arbitrage: Borrowing funds without collateral using flash loans to perform arbitrage trades and repaying in the same transaction.

2. Market-Making & Liquidity Provision

Automated Market Maker (AMM) Strategies: Providing liquidity on platforms like Uniswap v3, Balancer, or Curve while using concentrated liquidity strategies for optimal returns.

Rebalancing Liquidity Positions: Adjusting liquidity positions dynamically based on market conditions to minimize impermanent loss.

3. Trend-Following Strategies

Moving Average Crossovers: Using smart contracts to track exponential moving averages (EMA) and execute buy/sell orders when trends shift.

Momentum Trading: Executing trades when an asset’s price or volume exceeds predefined thresholds.

4. Mean Reversion Trading

Bollinger Bands Strategy: Buying when an asset’s price is below the lower band and selling when it is above the upper band.

RSI-Based Trading: Buying when the RSI is oversold (<30) and selling when it is overbought (>70).

5. Automated Yield Farming & Staking

Yield Optimization: Using smart contracts to move assets between DeFi protocols like Aave, Compound, or Yearn to maximize APY.

Auto-Compounding: Automating reinvestment of rewards to maximize returns over time.

6. Liquidation Bots

Lending Protocol Liquidation: Monitoring platforms like Aave or MakerDAO to liquidate undercollateralized positions and earn a liquidation bonus.

7. Sandwich Attacks & MEV Strategies

Front-Running Arbitrage: Placing a buy order before a large trade and selling immediately after to profit from slippage.

Back-Running: Detecting profitable transactions in the mempool and submitting orders right after to benefit.

Would you like to explore a specific strategy or discuss implementing a trading bot using smart contracts?

Mi piace 0

Voglio commentare

Fai una domanda

0Commenti

Non ci sono ancora commenti. Crea uno.

Fai una domanda

Non ci sono ancora commenti. Crea uno.