SmartTop-Overview of Minimum Deposit, Leverage & Spreads

Sommario:Established in 2018, SmartTop is a fintech company based in Australia, offering clients access to a wide range of markets including Forex, Precious Metals, shares, indices, commodities, cryptocurrencies, commodities and more.

| Information | Details |

| Company Name | SmartTop |

| Registered Country/Region | Australia |

| Founded in | 2018 |

| Regulation | Not regulated |

| Market Instruments | CFDs on forex currency pairs, Precious Metals, Shares & Indices, Futures, Energy, Funds, Crypto Currencies |

| Trading Platforms | MetaTrader4 |

| Minimum Deposit | Not specified |

| Maximum Leverage | 1:500 |

| Commission | Not specified |

| Deposit Methods | Bank Wire transfers, Credit/Debit cards |

| Education Resources | Not specified |

| Customer Support | Phone, email |

| Additional Features | Demo account |

General Information

Established in 2018, SmartTop is a fintech company based in Australia, offering clients access to a wide range of market instruments, including Forex, Precious Metals, shares, indices, commodities, cryptocurrencies, commodities, and more. However, it is vital to note that SmartTop operates without regulation. The broker provides access to an industry-leading trading platform MetaTrader4 (MT4), renowned for its powerful features, customized interface, and robust analytical tools. Regarding customer support, it provides a variety of ways and channels, including phone, email, and address, while it's not 24/7.

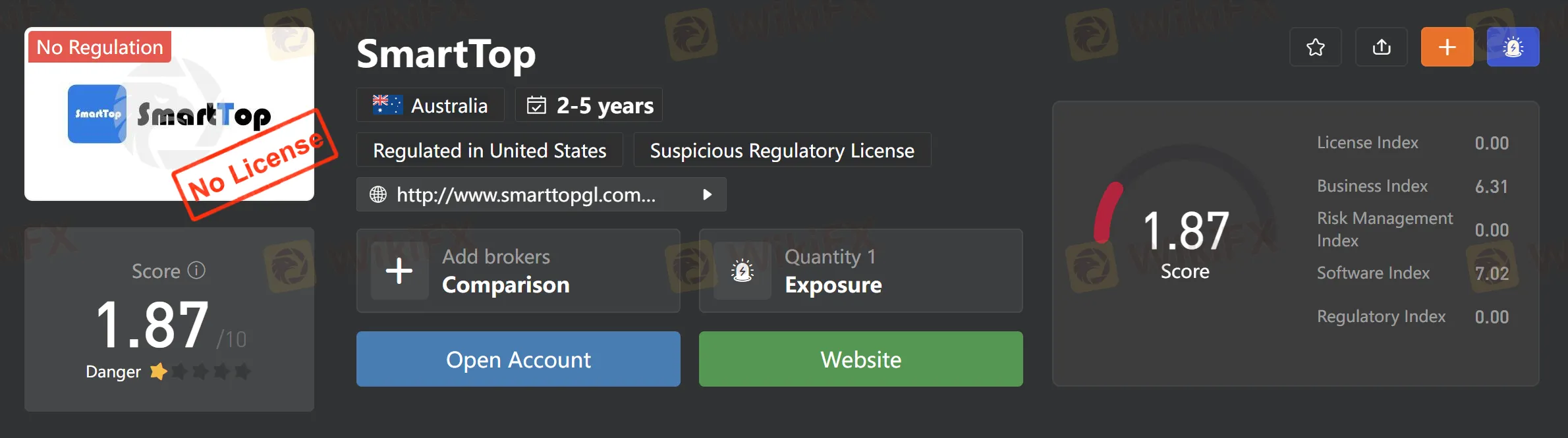

Is SmartTop legit or a scam?

SmartTop is not regulated by any financial regulatory authority, which means that the company is not subject to the rules and regulations that apply to regulated brokers. As a result, there may be potential risks associated with trading with an unregulated broker. Traders should take extra caution and thoroughly research the broker's background and reputation before depositing any funds.

Given the unique regulatory environment, it is crucial for investors to exercise caution and conduct thorough due diligence. It is recommended to assess the regulatory status and reputation of SmartTop, ensuring alignment with individual risk tolerance and investment goals. By taking these proactive measures, investors can make informed decisions and capitalize on the opportunities presented by this broker.

Pros and cons

SmartTop presents a combination of advantages and considerations for traders to evaluate. On a positive note, SmartTop provides a diverse range of market instruments, allowing traders to explore different investment opportunities. The broker offers high leverage, providing the potential for amplified gains. Additionally, the availability of the popular MT4 trading platform grants traders a familiar and reliable tool for executing their trades. SmartTop also offers a demo account, which serves as a valuable resource for both novice and experienced traders to practice and refine their strategies in a risk-free environment.

However, it is important to note that SmartTop operates without regulation, which may raise concerns regarding investor protection and oversight. It is worth noting that detailed information regarding trading costs, spreads, and commissions are not readily available, requiring traders to seek clarification from SmartTop directly. Furthermore, it is important to consider that customer support may be lacking in terms of responsiveness and effectiveness.

| Pros | Cons |

| High leverage up to 1:500 | Not regulated by prominent financial authorities |

| Demo account | Trading costs, spreads, commissions not specified |

| A wide range of market instruments | Not 24/7 customer support |

| Multiple customer support ways | Limited information available on the website |

| MT4 trading platform available | Limited trading platforms |

Market Instruments

Tradable financial instruments available on the SmartTop platform include CFDs on forex currency pairs, Precious Metals, Shares & Indices, Futures, Energy, Funds, Crypto Currencies.

Minimum Deposit

SmartTop does not mention its initial deposit requirement. In most cases, most broker would ask traders to fund around $100 to start real trading.

Leverage

martTop offers traders the opportunity to utilize leverage with a maximum ratio of 1:500, which is considered high. It is important to exercise caution when using leverage, as it has the potential to amplify both gains and losses. Inexperienced traders are advised to approach high leverage with care, ensuring it aligns with their risk tolerance and trading strategy.

Micro Trade Size

SmartTop welcomes traders of all levels by allowing a minimum trade volume of 0.01 lots, which is particularly beneficial for beginners. This provision enables novice traders to engage in the market with smaller trade sizes, promoting gradual learning and risk management.

Demo Account Available

Demo accounts are a valuable trading tool to help beginners learn how to trade and allow experienced traders to experiment and test new strategies in a risk-free environment. Traders can open demo accounts via Client Portal.

Spreads & Commissions

SmartTop only mentions that it offers low spreads, but does not specify detailed spreads on particular instruments.

Trading Platform Available

SmartTop offers clients the highly acclaimed MT4 trading platform. MT4 is a comprehensive and versatile platform, catering to traders of all levels. With a rich selection of tools and an intuitive design, it allows for efficient navigation and trade execution. Supporting 30 languages, it eliminates language barriers. Customized with 50+ technical indicators, 30 charting options, and 9 time frames, traders can tailor it to their preferences. This powerful platform empowers traders to make informed decisions with precision and accuracy, making it a top choice for reliable and user-friendly trading.

Deposit & Withdrawal

SmartTop provides a wide range of payment methods to cater to the diverse needs of its traders. Traders can fund their accounts and make deposits using various options, including Bank Wire transfers, Credit/Debit cards, and other methods that may be available based on their country of residence. This flexibility allows individuals to choose the payment method that best suits their preferences and ensures an efficient deposit process. When it comes to withdrawals, SmartTop follows a policy that ensures funds are returned via the same method used for the initial deposit.

Customer Support

SmartTop values customer support and provides multiple channels for users to reach out for assistance. To ensure prompt and reliable communication, SmartTop offers the following contact options:

Telephone: For immediate assistance, customers can contact SmartTop's dedicated support team by dialing +852 39013250.

Email: Users can also reach out to SmartTop's customer support via email at support@smarttopgl.com. This method allows customers to communicate their questions or issues in writing, ensuring clarity and the opportunity to provide detailed information.

Address: The physical address of SmartTop's headquarters is Level 19, Chifley Tower, 1 Chifley Square, Sydney. While most customer queries are typically resolved through telephone or email, the provided address serves as a point of reference for individuals who may require in-person assistance or need to correspond through traditional mail.

Conclusion

To summarize, in our conversation about SmartTop, we discussed the question of the broker's regulation information, market instruments, minimum deposit, and leverage, as well as its trading platform and customer support. We also talked about the risks associated with high leverage trading and the importance of choosing regulated brokers. SmartTop does not provide specific information about trading fees or educational resources, which could be disadvantageous for traders who are looking to concrete information. Overall, traders should exercise caution in choosing a broker which is not overseen by regulators.

FAQs

Q: Is SmartTop a regulated broker?

A: No, SmartTop operates without regulation. It is important to consider the potential implications of trading with an unregulated broker and carefully assess the associated risks.

Q: What is the minimum deposit required to open an account with SmartTop?

A: SmartTop does not explicitly state its minimum deposit requirement. However, it aims to accommodate traders with varying financial capacities, making it accessible to a wide range of individuals.

Q: Which trading platform does SmartTop offer?

A: SmartTop provides the MT4 trading platform, a popular and widely used platform known for its comprehensive features and user-friendly interface.

Q: Does SmartTop offer a demo account?

A: Yes, SmartTop offers a demo account. This valuable tool allows traders to practice and test their strategies in a risk-free environment before engaging in live trading.

Q: Are the trading costs, spreads, and commissions disclosed by SmartTop?

A: Detailed information regarding trading costs, spreads, and commissions are not readily available on the SmartTop website.

Q: What range of market instruments does SmartTop provide?

A: SmartTop offers a wide range of market instruments for trading, allowing clients to explore various opportunities. However, specific details regarding the available instruments are not explicitly mentioned. Traders can seek further information from SmartTop for a comprehensive understanding of the available markets.

Q: How is the customer support provided by SmartTop?

A: SmartTop values customer support and provides multiple channels for users to reach out for assistance: telephone: 852 39013250, e-mail: support@smarttopgl.com, and address: Level 19, Chifley Tower, 1 Chifley Square, Sydney.

Leggi di più

Aggiornamenti broker dal 7-13 dicembre

La bolletta denominata Stablecoin Tethering and Bank Licensing Enforcement Act., proposto da Rashida Tlaib, un democratico del Michigan, insieme ai membri del Congresso, Jesus García e Stephen Lynch, mira a proteggere i consumatori dalle minacce emergenti associate al mercato delle criptovalute e richiederà a chiunque che offre stablecoin l'approvazione della Federal Deposit Insurance Corporation (FDIC) e di altre agenzie governative competenti.

Aggiornamenti broker dal 30 novembre-6 dicembre

Le autorità cinesi hanno confiscato criptovalute per un valore di oltre 4,2 miliardi di dollari in relazione alla famigerata truffa Plus Token, rivelano i file del tribunale locale.

Aggiornamenti broker dal 23-29 novembre

Matthew Piercey, l'uomo dietro due società di investimento - Zolla e Family Wealth Legacy, è stato arrestato dagli agenti dell'FBI a Sacramento con l'accusa di frode telematica, manomissione di testimoni, frode postale e riciclaggio di denaro, che si è appropriata indebitamente di circa 35 milioni di dollari di fondi degli investitori, come affermato dalla corte degli Stati Uniti.

Aggiornamenti dei broker dal 9-15 novembre

Salgono a 323 i domini dei servizi finanziari bloccati da Consob.

WikiFX Trader

XM

FXCM

Exness

Pepperstone

FOREX.com

FBS

XM

FXCM

Exness

Pepperstone

FOREX.com

FBS

WikiFX Trader

XM

FXCM

Exness

Pepperstone

FOREX.com

FBS

XM

FXCM

Exness

Pepperstone

FOREX.com

FBS

Rate Calc