Jefferies -Some important Details about This Broker

Sommario:Jefferies, recognized as a leading full-service investment banking and capital markets firm, holds three regulatory licenses and delivers an array of services, including Investment Banking, Global Research & Strategy, Equities, Fixed Income, Alternative Asset Management and Wealth Management.

| JefferiesReview Summary | |

| Founded | 1996 |

| Registered Country/Region | United States |

| Regulation | FCA, CIRO |

| Products & Services | Investment Banking, Global Research & Strategy, Equities, Fixed Income, Alternative Asset Management, Wealth Management |

| Trading Platform | / |

| Customer Support | Phone: +12122842300 |

| Email: mediacontact@jefferies.com | |

| Address: 520 Madison Avenue, New York, NY 10022 (Principal Executive Office) | |

Jefferies, recognized as a leading full-service investment banking and capital markets firm, holds three regulatory licenses and delivers an array of services, including Investment Banking, Global Research & Strategy, Equities, Fixed Income, Alternative Asset Management and Wealth Management.

Pros and Cons

| Pros | Cons |

| Regulated by FCA and CIRO | No details of trading platform |

| A range of financial services | |

| Multi-channel support |

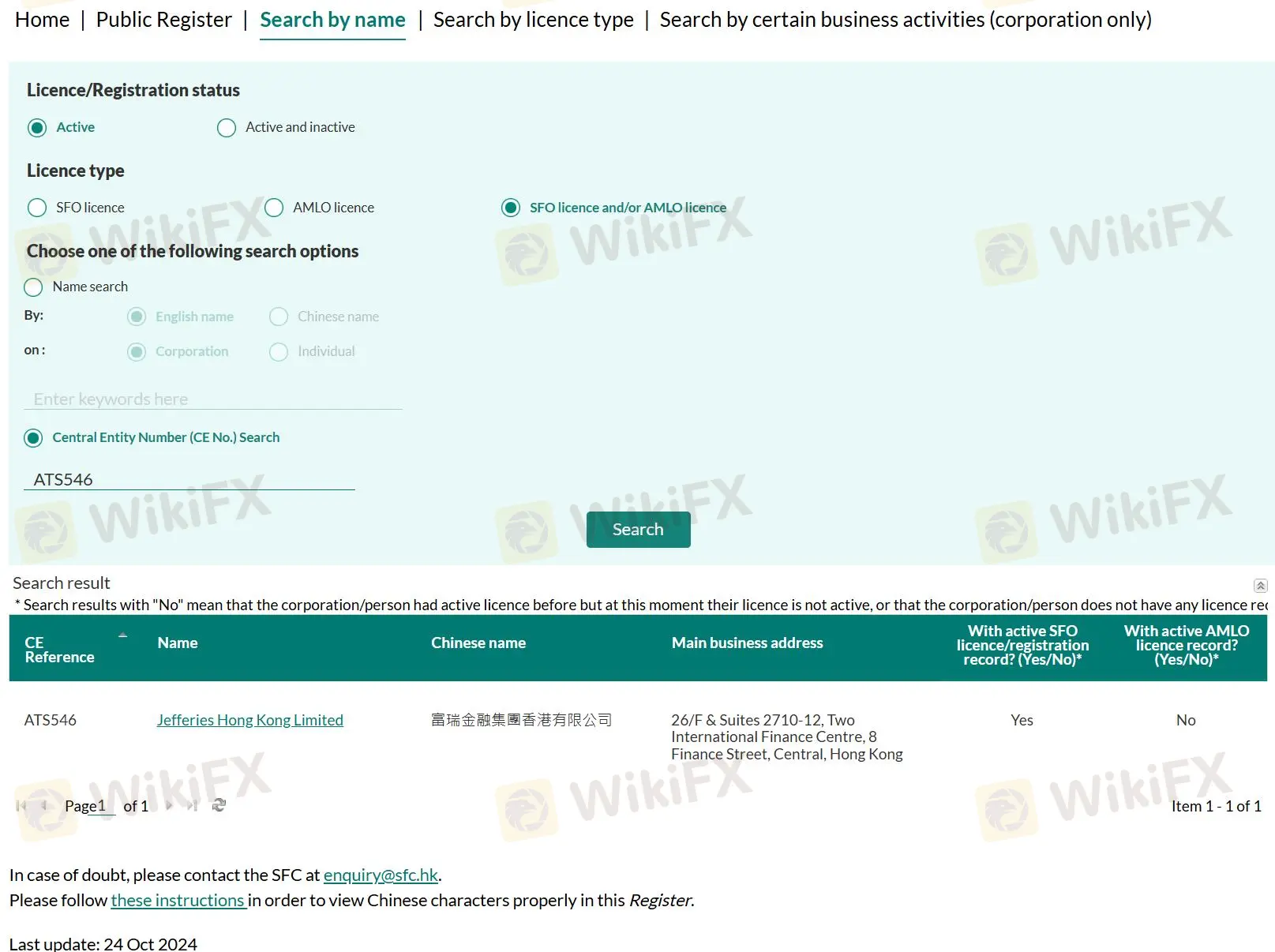

Is Jefferies Legit?

Jefferies has three regulation licenses.

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Current Status |

| United Kingdom | Financial Conduct Authority (FCA) | Jefferies International Ltd | Marketing Making (MM) | 139253 | Regulated |

| Canada | Canadian Investment Regulatory Organization (CIRO) | Jefferies Securities, Inc | Marketing Making (MM) | Unreleased | Regulated |

Products & Services

In Jefferies, you can trade on Equities and Fixed Income. Besides, it also offers other financial services including Investment Banking, Global Research&Strategy, Alternative Asset Management and Wealth Management.

Equities: Cash Equities, Electronic Trading, Equity Derivatives, Convertibles, Prime Services, Corporate Access.

Fixed Income: Leveraged Credit, Emerging markets, Investment Grade Corporates, Municipal and Not-for-Profits, Macro Credit, Securitized markets, Global structured solutions, Government & Agency.

Leggi di più

Aggiornamenti broker dal 7-13 dicembre

La bolletta denominata Stablecoin Tethering and Bank Licensing Enforcement Act., proposto da Rashida Tlaib, un democratico del Michigan, insieme ai membri del Congresso, Jesus García e Stephen Lynch, mira a proteggere i consumatori dalle minacce emergenti associate al mercato delle criptovalute e richiederà a chiunque che offre stablecoin l'approvazione della Federal Deposit Insurance Corporation (FDIC) e di altre agenzie governative competenti.

Aggiornamenti broker dal 30 novembre-6 dicembre

Le autorità cinesi hanno confiscato criptovalute per un valore di oltre 4,2 miliardi di dollari in relazione alla famigerata truffa Plus Token, rivelano i file del tribunale locale.

Aggiornamenti broker dal 23-29 novembre

Matthew Piercey, l'uomo dietro due società di investimento - Zolla e Family Wealth Legacy, è stato arrestato dagli agenti dell'FBI a Sacramento con l'accusa di frode telematica, manomissione di testimoni, frode postale e riciclaggio di denaro, che si è appropriata indebitamente di circa 35 milioni di dollari di fondi degli investitori, come affermato dalla corte degli Stati Uniti.

Aggiornamenti dei broker dal 9-15 novembre

Salgono a 323 i domini dei servizi finanziari bloccati da Consob.

WikiFX Trader

IB

FXCM

XM

IC Markets Global

OANDA

EC Markets

IB

FXCM

XM

IC Markets Global

OANDA

EC Markets

WikiFX Trader

IB

FXCM

XM

IC Markets Global

OANDA

EC Markets

IB

FXCM

XM

IC Markets Global

OANDA

EC Markets

Rate Calc