GOLD PRICE FORECAST: XAU/USD REMAINS ‘BUY-THE-DIP’ WHILE ABOVE $1,815 – CONFLUENCE DETECTOR

Sommario:Gold price licks its wounds, in the aftermath of hotter US inflation. US yields stabilize at higher levels, as DXY rockets on more Fed rate hike bets. Gold price suffers from US inflation-led blow, downside appears limited

Gold price licks its wounds, in the aftermath of hotter US inflation.

US yields stabilize at higher levels, as DXY rockets on more Fed rate hike bets.

Gold price suffers from US inflation-led blow, downside appears limited.

The US Federal Reserve (Fed) is now expected to hike rates by 50-basis points (bps) in March while delivering over four rate increases this year, as the inflation rate hit fresh 40-year highs at 7.5% YoY. Heightening expectations of hefty and faster Fed lift-offs could keep gold price undermined. However, a pause in the US Treasury yields rally may offer support to gold bulls. Further, a bunch of healthy support levels on golds technical graphs could also help cushion the downside.

Read: US yields jump after inflation soars to its biggest rise in forty years

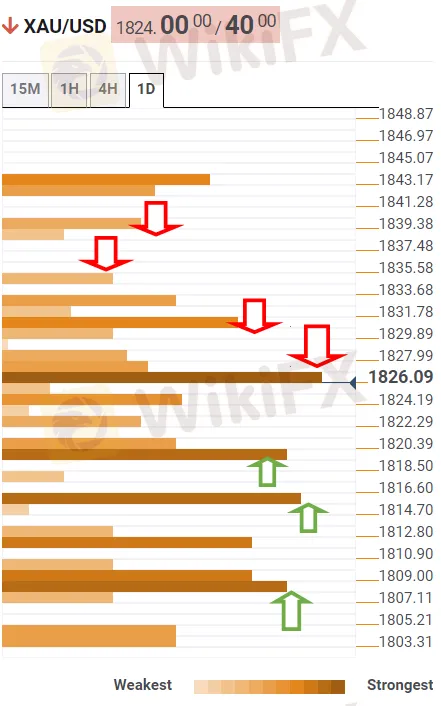

GOLD PRICE: KEY LEVELS TO WATCH

The Technical Confluences Detector shows that the gold price is holding above the previous days low of $1,822.

The next critical support is envisioned at $1,819, which is the convergence of the SMA100 four-hour, pivot point one-week R1 and pivot point one-day S1.

A breach of the latter will expose the downside towards $1,815, where the previous weeks low, SMA200 four-hour and SMA50 four-hour meet.

The last line of defense for gold bulls is aligned at $1,809, the confluence of the SMA50 one-day, Fibonacci 38.2% one-month and Fibonacci 23.6% one-week.

On the upside, acceptance above the Fibonacci 61.8% one-month at $1,826 is critical to initiating a meaningful recovery towards $1,831 – the SMA5 four-hour.

Further up, the Fibonacci 61.8% one-day at $1,835 will challenge the bearish commitments. The next stop for bulls is seen at the pivot point one-day R1 at $1,839.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

WikiFX Trader

FXTM

HFM

Vantage

AVATRADE

OANDA

octa

FXTM

HFM

Vantage

AVATRADE

OANDA

octa

WikiFX Trader

FXTM

HFM

Vantage

AVATRADE

OANDA

octa

FXTM

HFM

Vantage

AVATRADE

OANDA

octa

Rate Calc