TradeDog -Some important Details about This Broker

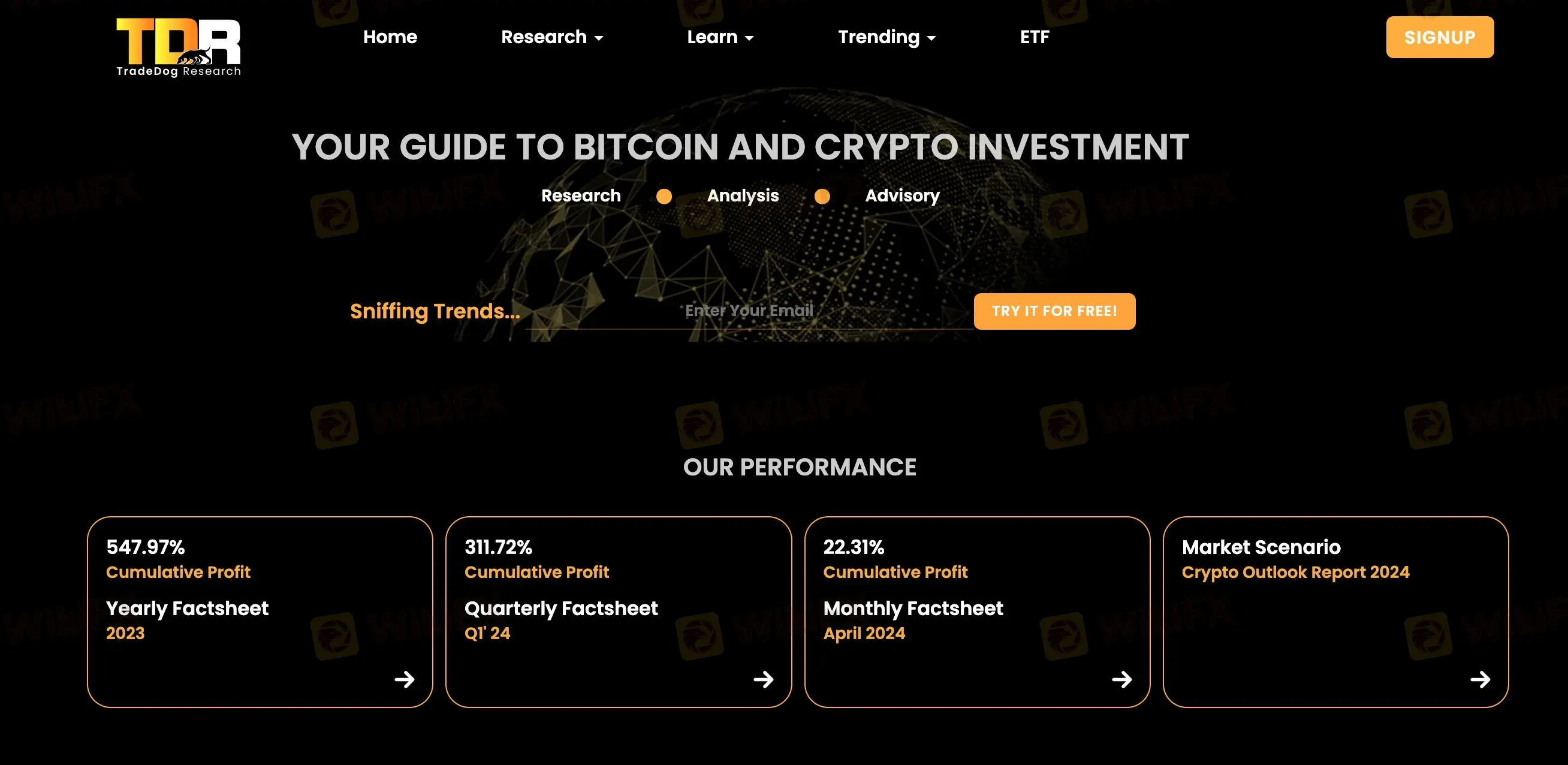

Sommario:TradeDog is an ‘Independent Financial Advisory’ Firm registered in the UK. The company caters to retail investors through their multi-day ‘Trade Advices’ and research ‘Lite Reports’ on various cryptocurrencies and blockchain projects. Its more comprehensive based service offerings also include a range of institutional grade focused products such as ‘In-Depth Reports’, ‘Portfolio Management’ ‘IFA’, etc.

| Aspect | Details |

| Company Name | TradeDog.io |

| Registered Country/Area | United Kingdom |

| Founded Year | 2-5 years ago |

| Regulation | Not regulated |

| Products | Research reports, trade advisory, army of Analysts |

| Account Types | N/A |

| Trading Platforms | None |

| Customer Support | E-mail: corporate@tradedog.io |

Overview of TRADEDOG.IO

Founded in the United Kingdom 2-5 years ago, TradeDog.io offers institutional-grade research reports and market intelligence for cryptocurrency investors.

Key services include detailed research, machine learning and AI-based trade alerts, and a community-driven “Research to Earn” model. TradeDog.io does not provide a trading platform, requiring users to execute trades elsewhere.

The platform operates without regulation from any financial authority, meaning users lack official protections.

Regulatory Status

TRADEDOG.IO is not regulated by any financial authority.

This lack of regulation means there are no official protections for users' funds, making them vulnerable to potential fraud or mismanagement.

Pros and Cons

| Pros | Cons |

| Detailed research reports | Unregulated |

| Machine learning and AI-based trade alerts | No trading platform provided |

| Community-driven “Research to Earn” model |

Pros

Detailed Research Reports

TradeDog.io provides comprehensive research reports that cover various aspects of the cryptocurrency market. These reports include in-depth technical and fundamental analysis, helping investors make informed decisions.

Machine Learning and AI-Based Trade Alerts

The platform employs advanced machine learning models and AI to generate trade alerts. These alerts are based on market sentiment analysis and predictive algorithms, aiming to enhance the accuracy of trading decisions.

Community-Driven “Research to Earn” Model

TradeDog.io fosters a community of analysts who contribute research on various token projects. This model allows participants to earn cryptocurrency as a reward for their research efforts.

Cons

Unregulated

TradeDog.io operates without regulation from any financial authority. This lack of oversight means there are no official protections for users' funds.

No Trading Platform Provided

Unlike some comprehensive cryptocurrency services, TradeDog.io does not offer a trading platform for buying and selling digital assets.

Products and Services

TradeDog.io offers a variety of products and services focused on providing institutional-grade research and market intelligence for cryptocurrency investors. The platform aims to help users understand and navigate market trends through continuous assessment and advanced analytical techniques.

Research

TradeDog.io produces detailed research reports that aim to offer authentic and reliable insights into the cryptocurrency markets. These reports utilize both technical and fundamental analysis to help retail investors make informed decisions, counteracting the hype-driven nature of the market.

Trade Advisory

TradeDog.io provides trade alerts generated by a team of professional traders. These alerts are based on proprietary machine learning models and AI-driven market sentiment analysis, designed to guide users in their trading activities.

Army of Analysts

TradeDog.io's Army of Analysts is a community-driven program that allows contributors to earn cryptocurrency by conducting research on various token projects. This democratized platform supports a “Research to Earn” model, encouraging participants to provide valuable insights on project reviews, industry trends, initial exchange offerings (IEOs), initial DEX offerings (IDOs), and price analyses.

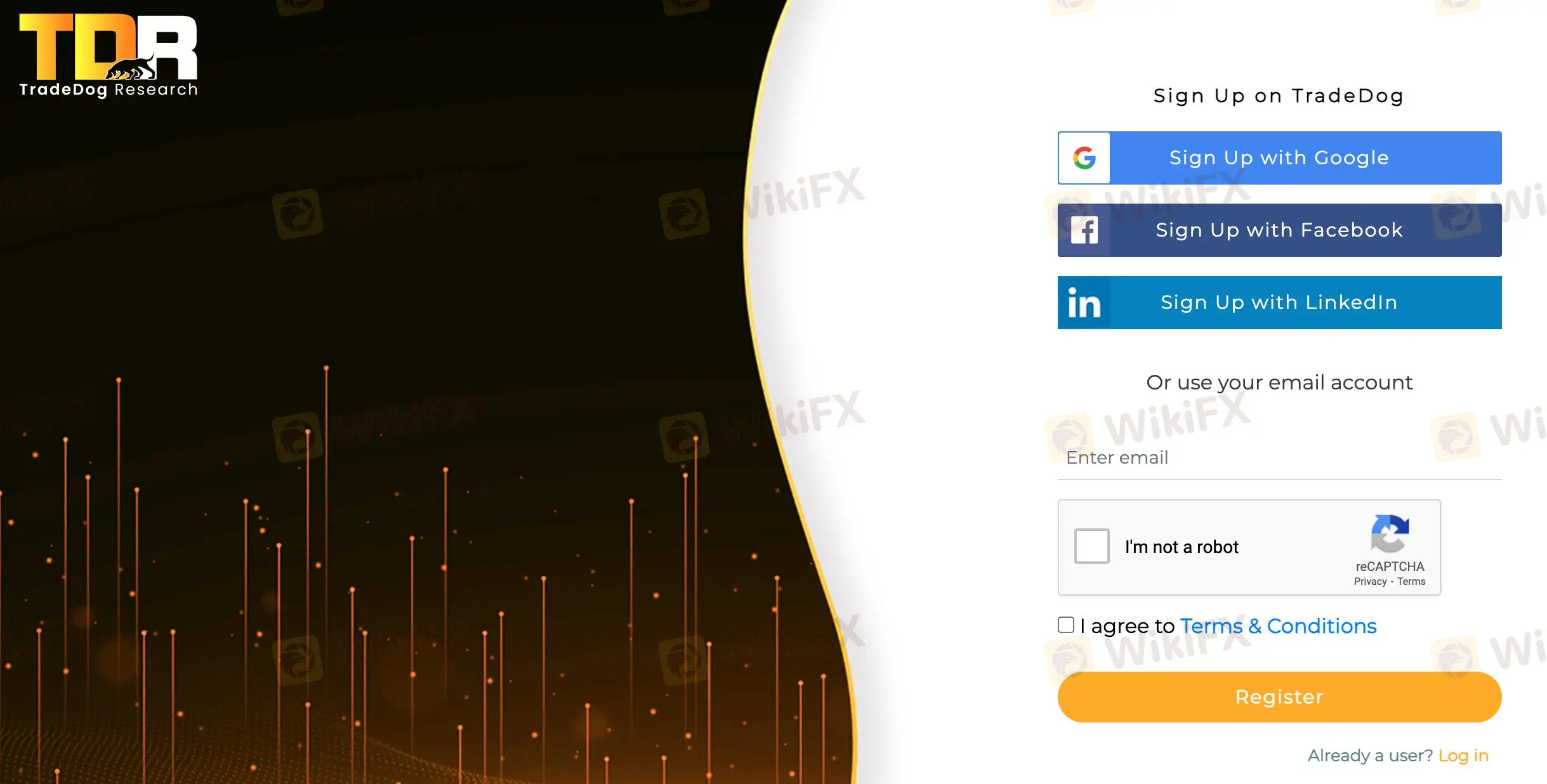

How to Open an Account?

Visit the TradeDog.io Website

Navigate to the official TradeDog.io website using your preferred web browser.

Click on the Sign-Up Button

Locate and click on the “Get Started” button, usually found at the top right corner of the homepage.

Fill Out the Registration Form

Complete the registration form by entering your personal information, such as your name, email address, and a secure password. Ensure that all required fields are filled in accurately.

Verify Your Email Address

After submitting the registration form, check your email for a verification message from TradeDog.io. Click the verification link in the email to activate your account.

Customer Support

Investors can contact TradeDog for inquiries through a variety of channels, including telegram, Youtube, Twitter, Instagram and other social media. Also, they can contact the trader via e-mail: corporate@tradedog.io. Address: 1 Foxglove Close, Weston-Super-Mare, Somerset, United Kingdom, BS22 9WG.

Conclusion

TradeDog.io offers valuable services like detailed research reports and AI-driven trade alerts, enhancing market insight and decision-making.

The “Research to Earn” model incentivizes high-quality contributions from the community. However, the platform is unregulated, exposing users to potential risks without official protections.

Additionally, the lack of a trading platform means users must execute trades elsewhere, adding inconvenience and potential costs.

Despite these drawbacks, TradeDog.io provides a robust suite of tools for informed trading.

FAQs

Question: What services does TradeDog.io offer?

Answer: TradeDog.io provides detailed research reports, AI-based trade alerts, and a community-driven “Research to Earn” model.

Question: Is TradeDog.io regulated?

Answer: No, TradeDog.io is not regulated by any financial authority.

Question: Does TradeDog.io have its own trading platform?

Answer: No, TradeDog.io does not offer a trading platform; users must trade on external platforms.

Leggi di più

Aggiornamenti broker dal 7-13 dicembre

La bolletta denominata Stablecoin Tethering and Bank Licensing Enforcement Act., proposto da Rashida Tlaib, un democratico del Michigan, insieme ai membri del Congresso, Jesus García e Stephen Lynch, mira a proteggere i consumatori dalle minacce emergenti associate al mercato delle criptovalute e richiederà a chiunque che offre stablecoin l'approvazione della Federal Deposit Insurance Corporation (FDIC) e di altre agenzie governative competenti.

Aggiornamenti broker dal 30 novembre-6 dicembre

Le autorità cinesi hanno confiscato criptovalute per un valore di oltre 4,2 miliardi di dollari in relazione alla famigerata truffa Plus Token, rivelano i file del tribunale locale.

Aggiornamenti broker dal 23-29 novembre

Matthew Piercey, l'uomo dietro due società di investimento - Zolla e Family Wealth Legacy, è stato arrestato dagli agenti dell'FBI a Sacramento con l'accusa di frode telematica, manomissione di testimoni, frode postale e riciclaggio di denaro, che si è appropriata indebitamente di circa 35 milioni di dollari di fondi degli investitori, come affermato dalla corte degli Stati Uniti.

Aggiornamenti dei broker dal 9-15 novembre

Salgono a 323 i domini dei servizi finanziari bloccati da Consob.

WikiFX Trader

OANDA

HFM

STARTRADER

FxPro

FOREX.com

Vantage

OANDA

HFM

STARTRADER

FxPro

FOREX.com

Vantage

WikiFX Trader

OANDA

HFM

STARTRADER

FxPro

FOREX.com

Vantage

OANDA

HFM

STARTRADER

FxPro

FOREX.com

Vantage

Rate Calc