05/11 Market report

Sommario:【Dow Jones】 【EUR】 【Gold】 【Crude Oil】

【Dow Jones】

U.S. President Joe Biden said in a statement in the intraday session on Tuesday that Qualcomm is hurting American families and that fighting inflation is a top priority in his presidency. The administration is weighing on whether to reduce U.S. tariffs on foreign imports to curb inflation. Loretta Mester, president of Cleveland United Bank, made hawkish remarks on Tuesday and supported a 50 basis point hike at the June and July meetings. Not ruling out a 75 basis point hike, it was argued that the unemployment rate may have to rise to reduce inflation.

At this stage, the Dow Jones daily line continues to fall below the previous wave low. The overall closing price was still below the previous wave low and this drove the death cross of Alligator and KD to a low. This indicates that the bears are currently dominant, and investments should be viewed in a more conservative manner.

USA30-D1

Resistance point 1: 32800 / Resistance point 2: 33500 / Resistance point 3: 34200

Support point 1: 31500 / support point 2: 30800 / support point 3: 30200

【EUR】

The dollar index continues to hover at 20-year highs on the eve of the release of its latest inflation data in the United States. The 10-year Treasury yield fell back below 3%. Investors will next look for Wednesday's U.S. Consumer Price Index (CPI) for April to look for any signs of cooling inflation and it is expected to grow at an annual rate of 8.1 percent in April, down from 8.5 percent in March.

The euro continues to consolidate near the recent lows, making the death cross opening of Alligator shrink. The KD has begun to flatten from a death cross to entanglement. This indicates that there is strength in the euro itself if not compared to the USD. The rise of the US dollar is indeed slightly stronger, making the euro undergo pressure.

EURUSD-D1

Resistance point 1: 1.05800 / Resistance point 2: 1.06200 / Resistance point 3: 1.06800

Support point 1: 1.05200 / support point 2: 1.04200 / support point 3: 1.03800

【Gold】

The World Gold Council reported that global gold-backed ETF (Exchange Traded Funds) positions increased by 42.8t in April 2022. This is the fourth consecutive month of increase and a cumulative increase of nearly 300 metric tons this year.

At the end of April, total global gold-backed ETF holdings were 3,868.6t and this is just slightly below the record high of 3,909t in October 2020. The report also said that in April, global gold-backed ETF holdings, although increasing for the fourth consecutive month, has slowed significantly from the previous month's six-year high. Gold prices came under significant pressure in April, mainly from the rise in the US dollar and US Treasury yields.

Alligator shows a death cross while the KD show a low-end figure. This indicates that in the face of the rising US dollar, gold prices has gradually decline in price. The price collapse of the stock markets in various countries has also allowed investors to gradually sell assets.

XAUUSD-D1

Resistance point 1: 1850.00 / Resistance point 2: 1870.00 / Resistance point 3: 1900.00

Support point 1: 1820.00 / support point 2: 1810.00 / support point 3: 1780.00

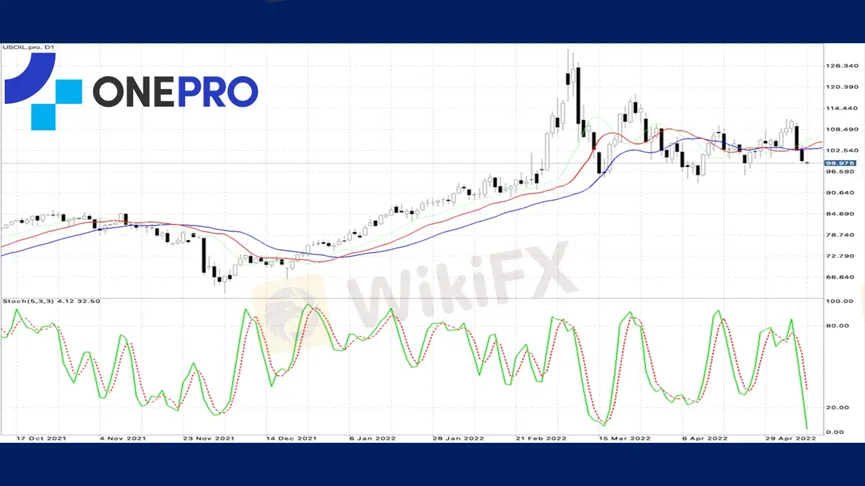

【Crude Oil】

Saudi Aramco announced on Sunday that it would cut prices in all categories of crude oil in Europe, Asia and the Mediterranean region for June. With the Mediterranean region seeing the biggest price cuts, US prices remained unchanged.

Crude oil is currently in a bullish trend but has not broken the previous days high.

At this stage, the technical line on the Alligator has begun to tangle and this indicates that the direction is unclear. There is a low-end blunt on the KD indicator which also shows that the short-term selling strength is relatively strong. Follow-up observation would be whether the swing low can be successfully defended. If it doesnt, the crude oil bullish grid will be officially broken.

USOIL-D1

Resistance point 1: 101.800 / Resistance point 2: 103.500 / Resistance point 3: 105.200

Support point 1: 97.500 / support point 2: 95.200 / support point 3: 93.800

OnePro Special Analyst

Buy or sell or copy trade crypto CFDs at www.oneproglobal.com

The foregoing is a personal opinion only and does not represent any opinion of OnePro Global, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

WikiFX Trader

STARTRADER

Neex

IC Markets Global

Pepperstone

OANDA

TMGM

STARTRADER

Neex

IC Markets Global

Pepperstone

OANDA

TMGM

WikiFX Trader

STARTRADER

Neex

IC Markets Global

Pepperstone

OANDA

TMGM

STARTRADER

Neex

IC Markets Global

Pepperstone

OANDA

TMGM

Rate Calc