WIKIFX REPORT: Murrey Math Lines 07.06.2022 (AUDUSD, NZDUSD)

Sommario:Murrey Math Lines are support and resistance lines based on geometric mathematical formulas developed by T. H. Murrey. MM lines are a derivation of the observations of W.D. Gann. Murrey's geometry facilitate the use of Gann's theories in a somewhat easier application. Below are for some pairs:

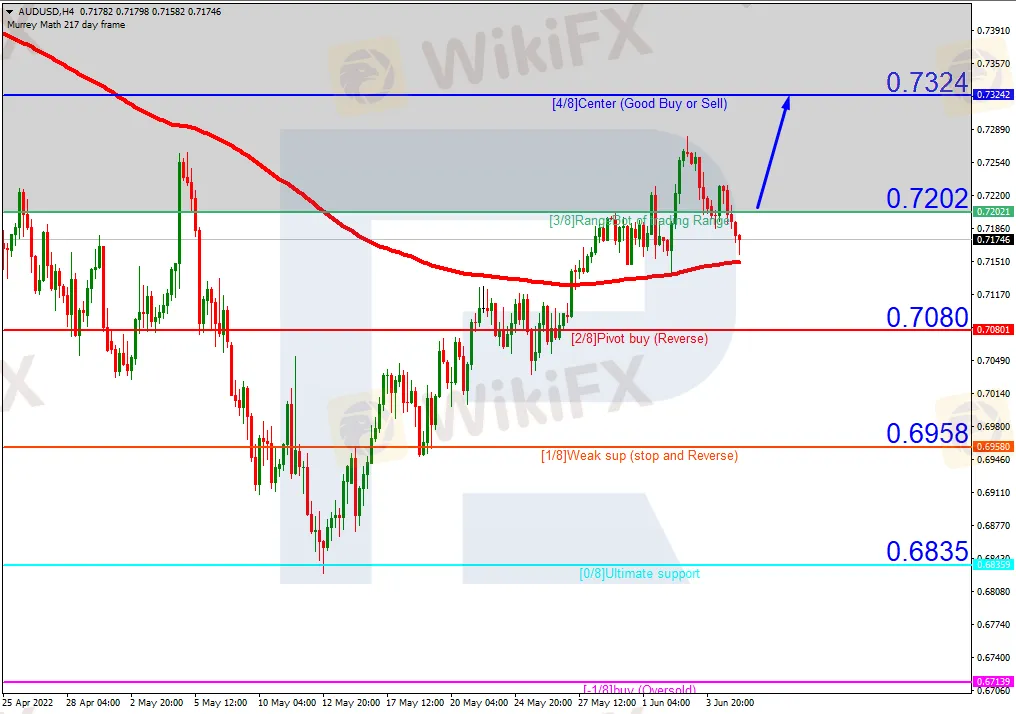

AUDUSD, “Australian Dollar vs US Dollar”

We can easily observe in the H4 chart, AUDUSD is trading above the 200-day Moving Average to indicate an ascending tendency. In this case, the price is expected to break 3/8 and then continue growing to reach the resistance at 4/8. However, this scenario may no longer be valid if the price breaks the support at 2/8 to the downside. After that, the instrument may reverse and resume falling towards 1/8.

In the M15 chart, the pair may break the upside line of the VoltyChannel indicator and, as a result, continue moving upwards.

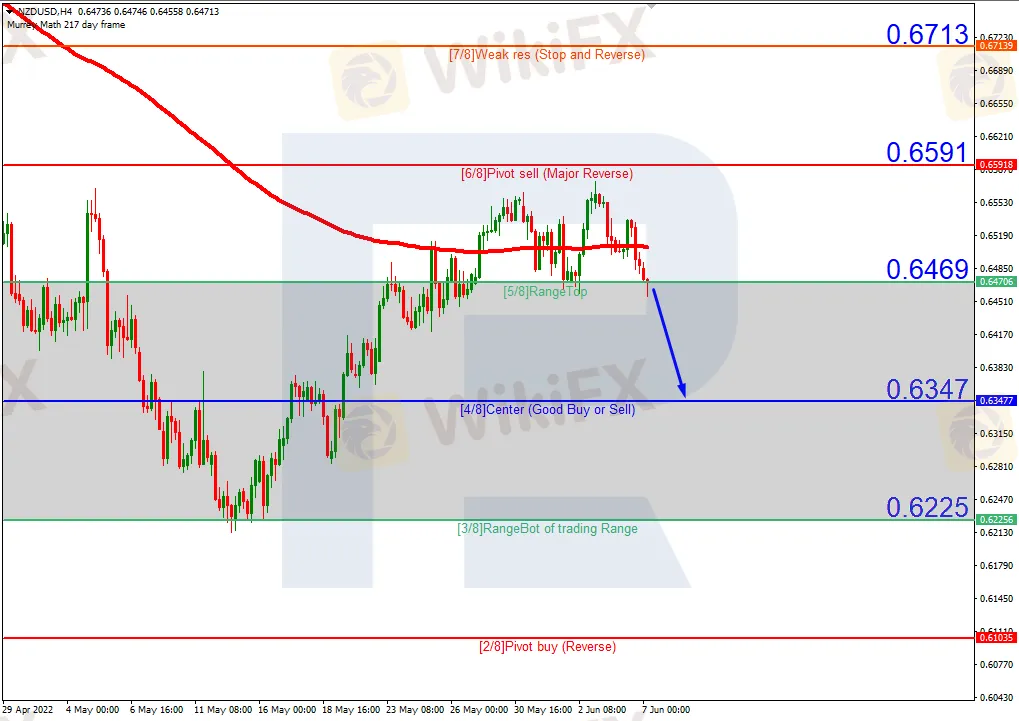

NZDUSD, “New Zealand Dollar vs US Dollar”

In the H4 chart, after breaking the 200-day Moving Average, NZDUSD is trading below it, thus indicating a possible descending tendency. In this case, the price is expected to continue moving downwards to reach the closest support at 4/8. However, this scenario may no longer be valid if the price breaks the resistance at 6/8 to the upside. After that, the instrument may reverse and grow towards 7/8.

As we can observe in the M15 chart, the pair has broken the downside line of the VoltyChannel indicator and, as a result, may continue its decline to reach 4/8 from the H4 chart.

WikiFX Trader

IB

IC Markets Global

EC Markets

FXCM

XM

FOREX.com

IB

IC Markets Global

EC Markets

FXCM

XM

FOREX.com

WikiFX Trader

IB

IC Markets Global

EC Markets

FXCM

XM

FOREX.com

IB

IC Markets Global

EC Markets

FXCM

XM

FOREX.com

Rate Calc