MetFX-Overview of Minimum Deposit, Spreads & Leverage

Sommario:MetFX, the trading name of Met Tech Global Ltd, is a brokerage company with its domain registered in 2003 and currently does not maintain functional website, that's why we can only gather all the information in this article from Internet.

Note: MetFX's official website - https://metfx.com/ is currently inaccessible normally.

| MetFX Review Summary | |

| Founded | 2003 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | No regulation |

| Market Instruments | Forex, commodities, cryptocurrencies, shares and indices |

| Demo Account | ✅ |

| Spread | From 0 pips |

| Leverage | Up to 1:100 |

| Trading Platform | MT5 |

| Min Deposit | $50 |

| Customer Support | Tel: +44 20 3289 5271 |

| Email: support@metfx.com | |

| Social media: Facebook, LinkedIn, Instagram | |

| Address: Griffith Corporate Centre, Beachmont, 1510, Kingstown, St. Vincent and the Grenadines | |

| Restricted Areas | Cuba, North Korea, United States, Syria, Iran |

MetFX Information

MetFX, the trading name of Met Tech Global Ltd, is a brokerage company with its domain registered in 2003 and currently does not maintain functional website, that's why we can only gather all the information in this article from Internet.

The company offers trading services in forex, commodities, cryptocurrencies, shares and indices. Minimum dpeosit is affordable at $50, with a tight spread from 0 pips. And the broker claims to offer the world-renowned MetaTrader 5 platform to enhance customer experience.

However, it cannot be negleceted that the broker currently operates without any valid regulation, which indicates possible less compliance to industry and customer protection.

Pros and Cons

| Pros | Cons |

| Diverse tradable assets | Regional restrictions |

| Demo accounts available | No regulation |

| MT5 platform | Inactivity fees charged |

| Acceptable minimum deposit | Chargeback fees for credit card payments |

| Popular payment otions | Long withdrawal process |

Is MetFX Legit?

Regulation is a crucial aspect of evaluating the legitimacy and reliability of a brokerage firm, and in the case of MetFX, the broker operates without any valid regulatory oversight. The absence of a regulatory framework raises huge concerns regarding the broker's adherence to industry standards, financial transparency, and the protection of client interests.

What Can I Trade on MetFX?

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Cryptocurrencies | ✔ |

| Shares | ✔ |

| Indices | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type/Fees

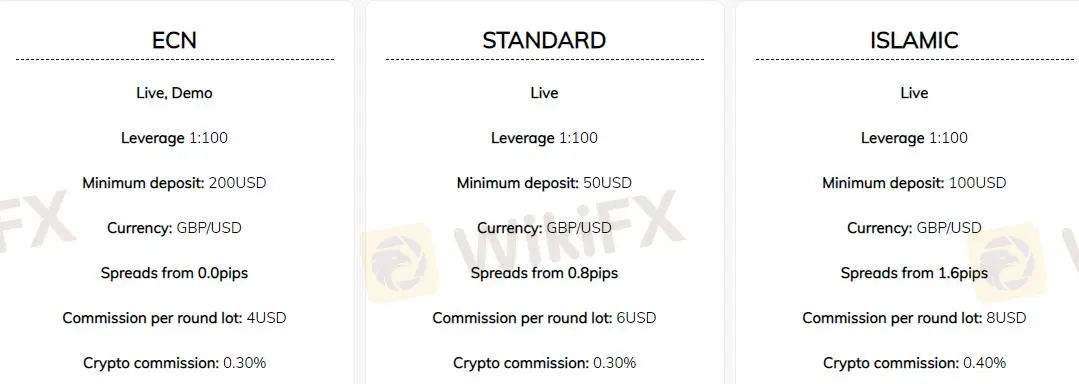

There are three trading accounts offered by MetFX, namely Standard, Islamic and ECN. You can open a demo account for ECN account.

| Account Type | Min Deposit | Spread | Commission (per round lot) | Crypto Commission |

| ECN (live, demo) | USD 100 | From 0 pips | USD 4 | 0.3% |

| STANDARD (live) | USD 50 | From 0.8 pips | USD 6 | |

| ISLAMIC (live) | USD 200 | From 1.6 pips | USD 8 | 0.4% |

Leverage

MetFX offers varying leverage levels of up to 1:100, allowing you to maximize your position with limited initial deposit.

But it's always advised to use leverage prudently due to significantly amplified losses at the same time as gains.

Trading Platform

When it comes to trading platforms available, MetFX gives traders the world's most widely-used MetaTrader5 platform. MT5 is known as one of the most successful, efficient, and competent forex trading software, featuring an array of technical analysis indicators, trading signals, financial calendar and more.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Web, desktop, mobile | Experienced traders |

| MT4 | ❌ | / | Beginners |

Deposit and Withdrawal

MetFX accepts deposits and withdrawals via Bank Wire, Credit/Debit Cards, Sticpay, cryptocurrencies of Bitcoin, Ethereum, and others.

As for the processing time of withdrawal requests, it usually takes up to 5 business days to process.

Fees

MetFX charges a monthly inactivity fee of $30 for accounts being inactive for over 3 months.

Unreasonabley, there's another charge of $250 if client of this company issue chargeback for credit card payments. We suggest you not to agree such unfair clause when trading with this broker.

Leggi di più

Aggiornamenti broker dal 7-13 dicembre

La bolletta denominata Stablecoin Tethering and Bank Licensing Enforcement Act., proposto da Rashida Tlaib, un democratico del Michigan, insieme ai membri del Congresso, Jesus García e Stephen Lynch, mira a proteggere i consumatori dalle minacce emergenti associate al mercato delle criptovalute e richiederà a chiunque che offre stablecoin l'approvazione della Federal Deposit Insurance Corporation (FDIC) e di altre agenzie governative competenti.

Aggiornamenti broker dal 30 novembre-6 dicembre

Le autorità cinesi hanno confiscato criptovalute per un valore di oltre 4,2 miliardi di dollari in relazione alla famigerata truffa Plus Token, rivelano i file del tribunale locale.

Aggiornamenti broker dal 23-29 novembre

Matthew Piercey, l'uomo dietro due società di investimento - Zolla e Family Wealth Legacy, è stato arrestato dagli agenti dell'FBI a Sacramento con l'accusa di frode telematica, manomissione di testimoni, frode postale e riciclaggio di denaro, che si è appropriata indebitamente di circa 35 milioni di dollari di fondi degli investitori, come affermato dalla corte degli Stati Uniti.

Aggiornamenti dei broker dal 9-15 novembre

Salgono a 323 i domini dei servizi finanziari bloccati da Consob.

WikiFX Trader

WikiFX Trader

Rate Calc