06/08 Market report

Sommario:【Dow Jones】 【Crude Oil】 【Bitcoin】 【Japanese Yen】

【Dow Jones】

World Bank on Tuesday (7th June) once again lowered global economic growth forecasts and warned of the risk of stagnant inflation, while performance concerns rose again. U.S. stocks opened lower, 10-year U.S. Treasury yield plummeted below 3.00%. Crude oil prices rise higher as energy stocks led the surge. The major sectors almost rebounded towards the end of the session and the four major indexes rose in unison. The Dow Jones closed more than 260 points.

After a few days of consolidation, Alligator presents a golden cross while the KD also shows a golden cross. This indicates that the bull forces are beginning to accumulate again. Yesterday's lower shadow line indicates that the price is still attractive and investors will be observing whether this range will be broken.

USA30-D1

Resistance point 1: 33500 / Resistance point 2: 33800 / Resistance point 3: 34200

Support point 1: 32800 / support point 2: 32000 / support point 3: 31500

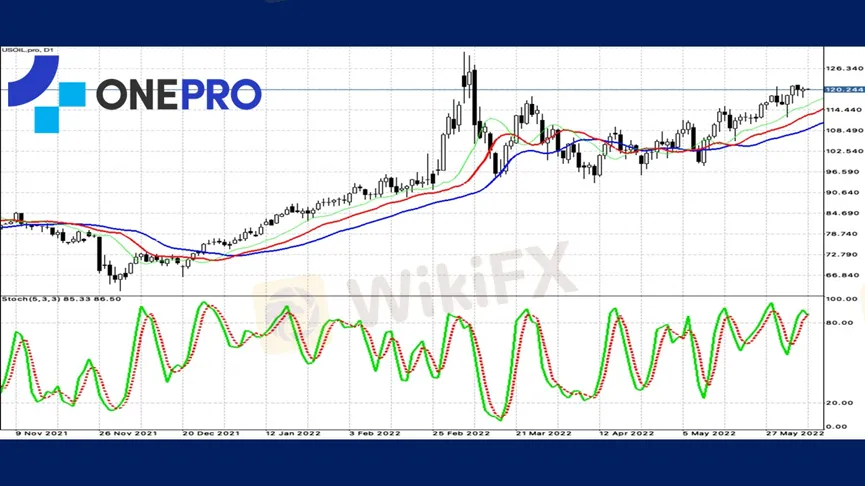

【Crude Oil】

International crude oil prices have recently soared from the beginning of May to the present. The rise of more than 10%, transactions from near $100 per barrel, made crude oil rise to $120 per barrel. As oil prices approached the historical ceiling, a large number of speculators shorted crude oil.

The price of crude oil continues to be high but still has not broken the previous high. Alligator shows a golden cross, while the KD shows a high-end blunting. This indicates that the buying strength is strong in the short-term. Until the next resistance is determined, pull backs may occur against the trend.

USOIL-D1

Resistance point 1: 121.800 / Resistance point 2: 123.500 / Resistance point 3: 125.200

Support point 1: 118.500 / Support point 2: 116.200 / Support point 3: 114.800

【Bitcoin】

At a time when the market risk aversion is rising, Bitcoin has once again lost momentum. Falling below the $30,000 mark to a 1-week low earlier, some experts have bluntly said that the market is in a state of malaise.

Adam Farthing and Collin Howe of crypto liquidity provider B2C2 said: “The market is languishing without an upside catalyst and the current sentiment could keep prices range-bound and there is some clear risk of an immediate breakout.”

In the technical indicators of long-term Bitcoin, Alligator shows a death cross. This indicates that Bitcoin had experienced a long decline. The downward force is still very strong. After a few days of oscillating, the KD indicator began to cross gold and indicates that many people think that the price of thirty thousand is an attractive price. There may be an opportunity of rebound on the short line but as Bitcoin fluctuates a lot, trade sizes should be reduced for risk management.

BTCUSD-D1

Resistance point 1: 32000 / Resistance point 2: 32500 / Resistance point 3: 32800

Support point 1: 30500 / support point 2: 30000 / support point 3: 29500

【Japanese Yen】

Under the divergence of policy paths between the United States and Japan, the yen continued to weaken against the US dollar and depreciated by 0.54% to 132.6 yen against the US dollar.

BoJ President Toshihiko Kuroda reiterated that a weak yen would help the Japanese economy if the yen did not decline too sharply.

USDJPY has recently continued to reach new highs and the Alligator presents a golden cross. KD is also at a high-end figure which shows that all resistances has been broken. Investors are recommended not to trade against the market.

USDJPY-D1

Resistance point 1: 134.200 / Resistance point 2: 136.500 / Resistance point 3: 138.800

Support 1: 130.800 / Support 2: 128.500 / Support 3: 126.800

Buy or sell or copy trade crypto CFDs at www.oneproglobal.com

The foregoing is a personal opinion only and does not represent any opinion of OnePro Global, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

WikiFX Trader

WikiFX Trader

Rate Calc