GMG-Some important Details about This Broker

Sommario:GMG is an unregulated brokerage, offering traders the opportunity to utilize the MetaTrader 4 (MT4) trading platform with a maximum leverage of 1:100. The company provides three types of trading accounts to cater to different trading preferences, but specific details about these accounts have not been disclosed. Additionally, GMG does not provide the educational resources traders might require. While it may bring certain advantages such as high leverage and account options, the absence of regulatory supervision and educational support could raise concerns among traders seeking a regulated and comprehensive trading environment.

| GMG | Basic Information |

| Registered Country/Area | Hong Kong |

| Regulation | Not under valid regulation |

| Maximum Leverage | Up to 1:100 |

| Trading Platforms | MetaTrader 4 (MT4) |

| Tradable Assets | Forex, Equities, Metals |

| Account Types | Standard, VIP and Premium |

| Customer Support | Phone: +1-888-3415-740Email: support@gmgintl.net |

| Payment Methods | Bank wire transfers, Credit/Debit cards, and online payment processors |

| Educational Tools | No educational resources |

Overview of GMG

GMG operates as a brokerage, offering trading services in the financial markets. Established without valid regulatory oversight, the company provides traders with the MetaTrader 4 (MT4) trading platform, known for its technical analysis tools and order execution capabilities. With a maximum leverage of up to 1:100, traders can control larger market positions with a smaller capital investment.

GMG's range of account types accommodates varying trading preferences and experience levels, though specific details about these accounts are not provided. Notably, GMG does not offer educational resources, which may impact traders seeking additional knowledge and insights into trading techniques.

Traders seeking customer support can contact GMG via phone at +1-888-3415-740 or through email at support@gmgintl.net. It's essential for traders to consider GMG's lack of regulatory oversight and the absence of educational resources when evaluating the suitability of this brokerage for their trading needs.

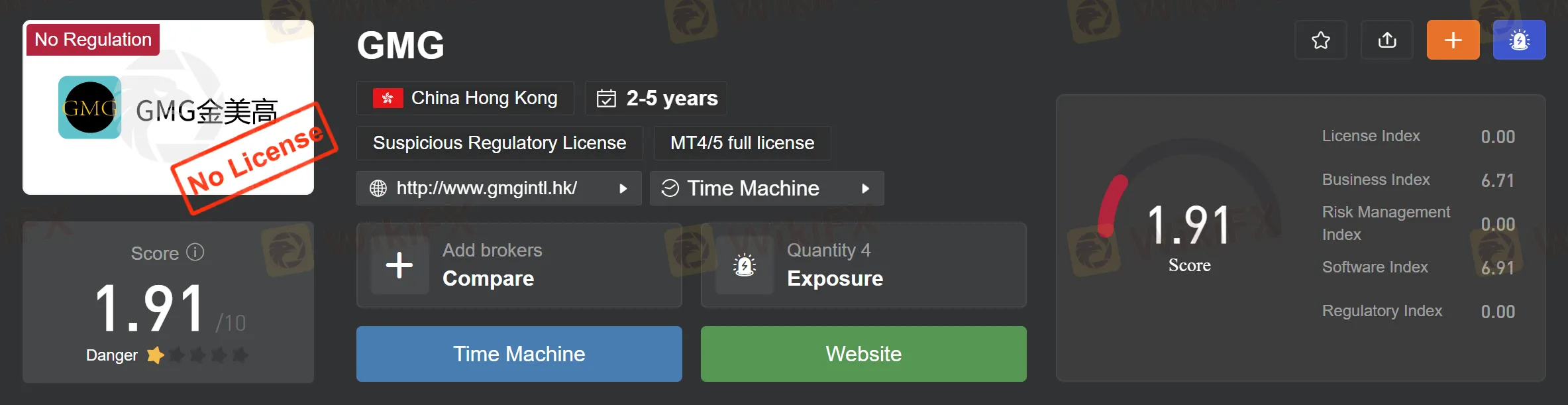

Is GMG legit or a scam?

As of the current status, GMG operates without being subject to any valid regulatory oversight. It's important to note that regulatory oversight plays a significant role in the financial industry as it helps ensure transparency, security, and fair practices for both traders and the brokerage itself. Regulatory authorities impose guidelines and standards that brokers are required to adhere to, fostering a level of trust within the trading community.

Traders should exercise caution and conduct thorough due diligence when considering trading with an unregulated broker. While not all unregulated brokers engage in unethical practices, the absence of regulatory oversight inherently presents an additional level of risk for traders. It's recommended that traders opt for brokers that are licensed and regulated by established financial authorities, as this typically provides an added layer of protection and oversight.

Pros and Cons

| Pros | Cons |

| High Leverage | Unregulated |

| Well-Known Trading Platform | Lack of Educational Resources |

| Limited Customer Service | |

| Limited Trading Tools |

GMG International presents some advantages, including the availability of high leverage and the utilization of a well-known trading platform. However, it's important to consider the drawbacks. The company operates without regulatory oversight, potentially raising concerns about consumer protection. Moreover, the absence of educational resources can limit traders seeking to enhance their skills and knowledge. The customer service offered by GMG International is limited, and the range of trading tools at the trader's disposal is also restricted. As such, traders should weigh the benefits against the limitations to make informed decisions about engaging with GMG International as a brokerage.

Market Instruments

GMG offers market instruments including forex currency pairs, equities, and precious metals, providing traders with options to engage in different financial markets.

Forex currency pairs constitute a significant portion of GMG's trading offerings. Traders can access a wide array of major, minor, and exotic currency pairs, allowing them to speculate on the fluctuations in exchange rates between different countries' currencies.

Equities also form a core component of GMG's market instruments. The brokerage offers a selection of stocks from various exchanges, enabling traders to participate in the performance of individual companies.

In addition to forex and equities, GMG extends its offerings to include precious metals trading. This encompasses commodities such as gold, silver, platinum, and palladium. Precious metals are known for their historical value and safe-haven status during times of market uncertainty.

Account Types

GMG offers a selection of distinct account types tailored to accommodate diverse trading preferences and experience levels. Traders can choose from different account types, each with its own unique features and specifications. The range of account options may include variations in minimum deposit requirements, leverage levels, and spreads.

GMG's account types include standard accounts, which are suitable for traders seeking a balanced approach to trading, and potentially offer a mix of trading instruments. Moreover, more advanced account types, such as VIP and premium accounts, could be available to experienced traders, potentially offering lower spreads and higher leverage.

It's crucial for traders to carefully evaluate the account types and associated features offered by GMG to select the one that aligns with their trading goals, risk tolerance, and level of expertise.

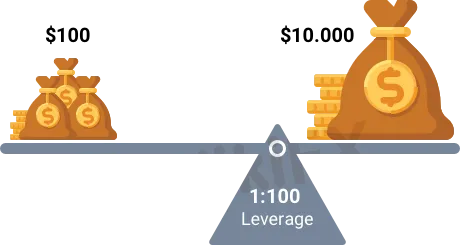

Leverage

GMG offers leverage to traders with a maximum ratio of up to 1:100. Leverage is a tool that allows traders to control larger positions in the market with a smaller amount of capital. In this case, a leverage ratio of 1:100 implies that for every unit of capital deposited by the trader, they can control a position that is a hundred times larger in the market.

Leverage can amplify both potential profits and losses, as trading positions are magnified based on the leverage ratio chosen. While it provides the opportunity to access larger market positions and potentially generate higher returns, it's important to note that higher leverage also carries a heightened level of risk. Traders should exercise caution and fully understand the implications of using leverage in their trading activities.

Spreads & Commissions (Trading Fees)

GMG presents spreads and commissions as part of its trading structure. Spreads refer to the difference between the bid and ask prices of a trading instrument. It represents the cost of entering a trade and can vary depending on market conditions, trading instrument, and account type. Generally, major currency pairs tend to have lower spreads compared to exotic or minor currency pairs. Commissions, on the other hand, can apply to certain account types or trading activities. A commission is a fee charged by the broker for facilitating the trade.

Trading Platform

GMG provides its clients with access to the MetaTrader 4 (MT4) trading platform. MT4 is a widely recognized and established trading platform in the industry, known for its comprehensive features and user-friendly interface. This platform offers traders various tools for technical analysis, charting, and order execution, enhancing their ability to make informed trading decisions.

Deposit & Withdrawal

GMG International offers a variety of options for depositing and withdrawing funds from trading accounts. Traders can choose from several payment methods to facilitate their financial transactions.

Deposits can typically be made using methods such as bank wire transfers, credit/debit cards, and online payment processors. Withdrawals from GMG accounts are generally processed through the same methods used for deposits. This ensures that traders can receive their funds in a manner consistent with their chosen deposit method. It's important to note that withdrawal processing times may vary based on the selected method and the necessary verification procedures.

Customer Support

GMG provides customer support services for its clients, traders can contact the broker's customer support team via phone or email. For phone inquiries, clients can reach GMG's customer support by dialing +1-888-3415-740. This contact number allows traders to communicate directly with the support team to address their questions, concerns, or inquiries related to trading accounts, platform usage, technical issues, and other relevant matters.

In addition to phone support, GMG offers email support as an alternative means of communication. Clients can send their queries or requests to the designated email address: support@gmgintl.net.

Educational Resources

Unfortunately, GMG currently does not offer any educational resources for traders.

Conclusion

In conclusion, GMG operates as an unregulated brokerage, offering traders access to the MetaTrader 4 (MT4) platform with a maximum leverage of up to 1:100. While it provides potential advantages such as high leverage and a range of account types tailored to various trading preferences, its lack of regulatory oversight raises concerns regarding consumer protection and adherence to industry standards. The absence of educational resources may limit the support available for traders seeking knowledge enhancement. Additionally, the potential absence of clear information about deposit and withdrawal methods, spreads, and tradable assets could affect traders' ability to make fully informed decisions. It's essential for traders to carefully consider these factors when evaluating GMG's suitability for their trading needs.

FAQs

Q: What is the regulatory status of GMG International?

A: GMG International is currently not regulated by any valid regulatory authority.

Q: What is the maximum leverage offered by GMG International?

A: GMG International provides traders with a maximum leverage of up to 1:100.

Q: Does GMG International offer educational resources?

A: No, GMG International does not provide educational resources.

Q: What trading platform does GMG International offer?

A: GMG International offers the MetaTrader 4 (MT4) trading platform.

Q: What are the customer support options at GMG International?

A: GMG International offers customer support through phone (dialing +1-888-3415-740) and email (support@gmgintl.net).

Leggi di più

Aggiornamenti broker dal 7-13 dicembre

La bolletta denominata Stablecoin Tethering and Bank Licensing Enforcement Act., proposto da Rashida Tlaib, un democratico del Michigan, insieme ai membri del Congresso, Jesus García e Stephen Lynch, mira a proteggere i consumatori dalle minacce emergenti associate al mercato delle criptovalute e richiederà a chiunque che offre stablecoin l'approvazione della Federal Deposit Insurance Corporation (FDIC) e di altre agenzie governative competenti.

Aggiornamenti broker dal 30 novembre-6 dicembre

Le autorità cinesi hanno confiscato criptovalute per un valore di oltre 4,2 miliardi di dollari in relazione alla famigerata truffa Plus Token, rivelano i file del tribunale locale.

Aggiornamenti broker dal 23-29 novembre

Matthew Piercey, l'uomo dietro due società di investimento - Zolla e Family Wealth Legacy, è stato arrestato dagli agenti dell'FBI a Sacramento con l'accusa di frode telematica, manomissione di testimoni, frode postale e riciclaggio di denaro, che si è appropriata indebitamente di circa 35 milioni di dollari di fondi degli investitori, come affermato dalla corte degli Stati Uniti.

Aggiornamenti dei broker dal 9-15 novembre

Salgono a 323 i domini dei servizi finanziari bloccati da Consob.

WikiFX Trader

ATFX

GO MARKETS

Vantage

IB

IC Markets Global

Neex

ATFX

GO MARKETS

Vantage

IB

IC Markets Global

Neex

WikiFX Trader

ATFX

GO MARKETS

Vantage

IB

IC Markets Global

Neex

ATFX

GO MARKETS

Vantage

IB

IC Markets Global

Neex

Rate Calc