Elite Trade Union-Overview of Minimum Deposit, Leverage, Spreads

Sommario:Elite Trade Union is allegedly an unregulated forex broker registered in the United States that claims to provide its clients with a variety of tradable assets with leverage up to 1:200. Unluckily, other more detailed information about this broker is not available on the Internet.

| Aspect | Details |

| Company Name | Elite Trade Union |

| Registered Country/Area | United States |

| Founded Year | 2-5 years ago |

| Regulation | Unregulated |

| Market Instruments | Cryptocurrencies, Forex, Stocks, Commodities, NFTs |

| Account Types | N/A |

| Minimum Deposit | N/A |

| Maximum Leverage | 30:1 |

| Spreads | N/A |

| Trading Platforms | Not provided |

| Customer Support | submit their queries |

| Copy Trading | Yes |

Overview of Elite Trade Union

Elite Trade Union, founded 2-5 years ago in the United States, offers a wide range of trading assets including cryptocurrencies, forex, stocks, commodities, and NFTs.

The platform provides high leverage options, up to 30:1 for major currency pairs. A notable feature is Copy Trading, enabling users to replicate the trades of experienced traders.

However, the union operates without regulatory oversight, which could impact user security. Detailed contact information is limited, and there is a lack of comprehensive fee transparency.

Regulatory Status

The Elite Trade Union operates without regulation. This lack of oversight raises risks about potential exploitation of workers and unfair labor practices.

Pros and Cons

| Pros | Cons |

| Wide range of assets | Unregulated |

| Copy Trading feature | Limited detailed contact information |

| Lack information on fees |

Pros

Wide Range of Assets: Elite Trade Union offers a wide range of trading assets including cryptocurrencies, forex, stocks, commodities, and NFTs.

Copy Trading Feature: Allows users to replicate the trades of experienced traders automatically.

Cons

Unregulated: Operates without regulatory supervision, posing risks to financial security and user protection.

Limited Detailed Contact Information: Lacks a detailed contact number, making direct communication for urgent issues difficult.

Lack of Information on Fees:Does not provide comprehensive details on trading or withdrawal fees, leading to potential unexpected charges.

Market Instruments

Elite Trade Union offers a range of tradeable assets including Crypto Currencies, Forex, Stocks, NFTs, and Options. These assets provide opportunities for traders to engage in various financial markets, potentially earning profits through buying and selling.

Cryptocurrencies offer digital currency trading, while Forex involves foreign exchange trading. Stocks represent ownership in companies, NFTs are unique digital assets, and Options provide the right to buy or sell assets at a predetermined price.

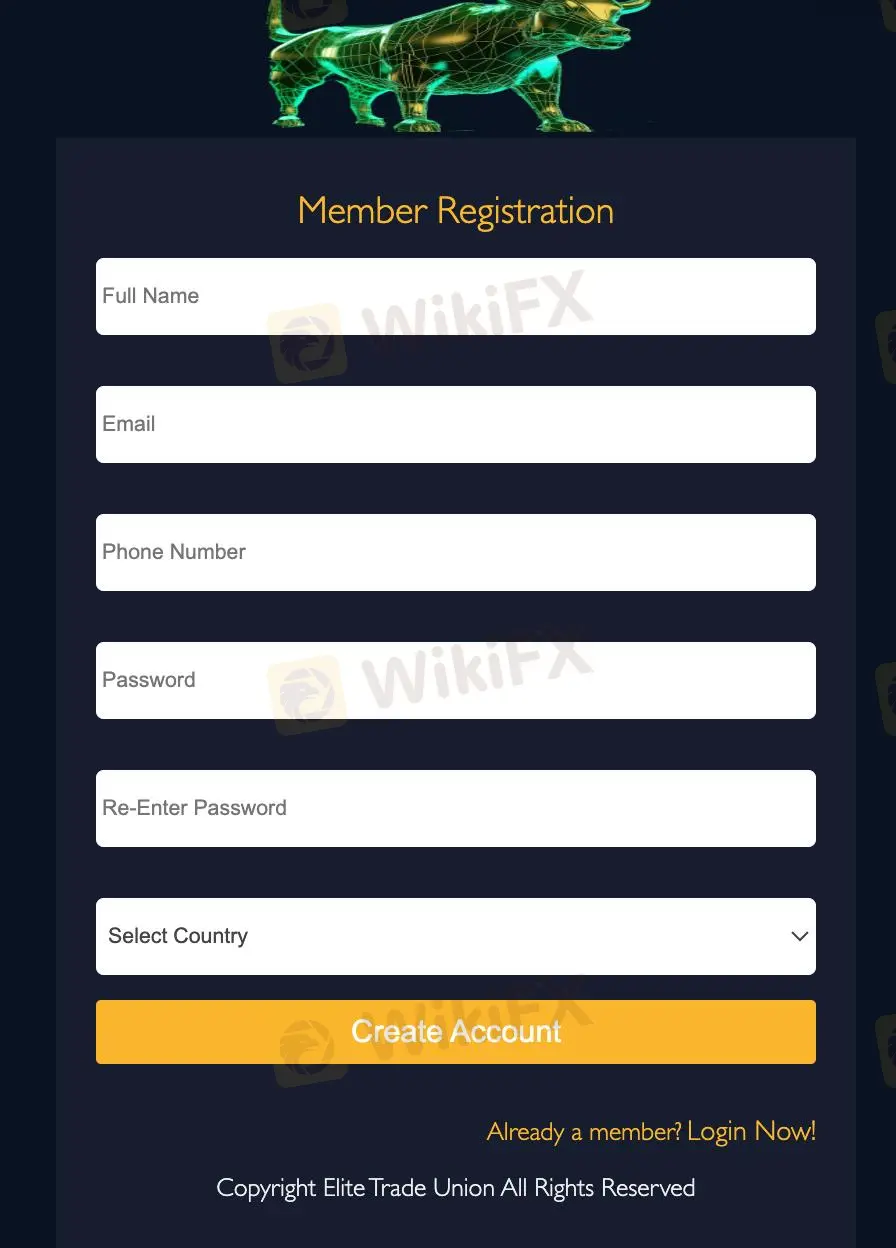

How to Open an Account?

Visit the Website: Go to the Elite Trade Union official website.

Sign Up: Click on the “Create account” button located at the top right corner of the homepage.

Fill in Personal Information: Enter your personal details including your full name, email address, phone number, and residential address.

Verify Your Identity: Upload required documents for identity verification, such as a government-issued ID and proof of address.

Create Login Credentials: Set up your username and password for secure access to your account.

Fund Your Account: Choose a payment method and deposit funds into your account to start trading.

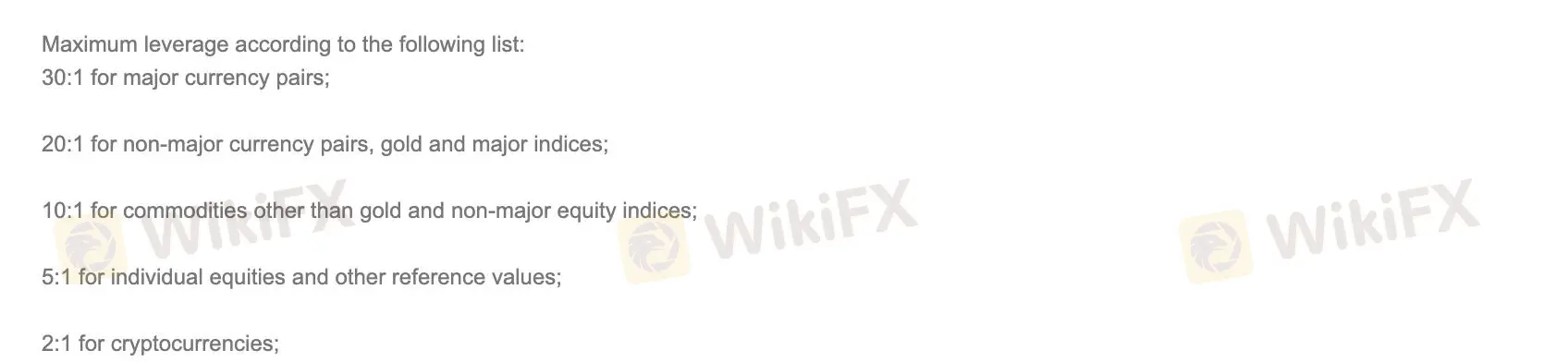

Leverage

Elite Trade Union offers maximum leverage of 30:1 for major currency pairs, 20:1 for non-major currency pairs, gold, and major indices, 10:1 for other commodities and non-major equity indices, 5:1 for individual equities and other reference values, and 2:1 for cryptocurrencies.

Copy Trading

A key feature of Elite Trade Union is Copy Trading, which allows users to automatically replicate the trades of experienced traders in real-time. This tool requires no advanced market knowledge from the user, as it mirrors the chosen trader's actions and results. The platform supports various asset classes including cryptocurrencies, forex, and stocks. Users can benefit from the expertise of seasoned traders while maintaining control over their funds. Additionally, Elite Trade Union provides resources and guides on topics such as cryptocurrency wallets, options trading, and leverage, aiding users in their trading endeavors.

Customer Support

Elite Trade Union offers customer support to assist with trading inquiries and issues. Users can contact customer support through the “Contact Us” page on their website. For direct assistance, the detailed contact number is not provided, but users can submit their queries via the contact form available on the site.

Conclusion

Elite Trade Union offers a wide range of trading assets and high leverage options, with up to 30:1 for major currency pairs. The Copy Trading feature simplifies trading for beginners.

However, operating without regulation poses risks to user security. Limited contact information and transparency on fees can hinder customer support and lead to unexpected charges.

Despite these drawbacks, the platform's flexibility in leverage and various asset offerings provide opportunities for traders.

FAQs

Question: What assets can be traded on Elite Trade Union?

Answer: Users can trade cryptocurrencies, forex, stocks, commodities, and NFTs on Elite Trade Union.

Question: What is the maximum leverage available on Elite Trade Union?

Answer: The maximum leverage varies from 2:1 for cryptocurrencies to 30:1 for major currency pairs.

Question: Is Elite Trade Union regulated by any authority?

Answer: No, Elite Trade Union operates without regulatory oversight.

Question: How does Copy Trading work on Elite Trade Union?

Answer: Copy Trading allows users to replicate the trades of experienced traders automatically in real-time.

Leggi di più

Aggiornamenti broker dal 7-13 dicembre

La bolletta denominata Stablecoin Tethering and Bank Licensing Enforcement Act., proposto da Rashida Tlaib, un democratico del Michigan, insieme ai membri del Congresso, Jesus García e Stephen Lynch, mira a proteggere i consumatori dalle minacce emergenti associate al mercato delle criptovalute e richiederà a chiunque che offre stablecoin l'approvazione della Federal Deposit Insurance Corporation (FDIC) e di altre agenzie governative competenti.

Aggiornamenti broker dal 30 novembre-6 dicembre

Le autorità cinesi hanno confiscato criptovalute per un valore di oltre 4,2 miliardi di dollari in relazione alla famigerata truffa Plus Token, rivelano i file del tribunale locale.

Aggiornamenti broker dal 23-29 novembre

Matthew Piercey, l'uomo dietro due società di investimento - Zolla e Family Wealth Legacy, è stato arrestato dagli agenti dell'FBI a Sacramento con l'accusa di frode telematica, manomissione di testimoni, frode postale e riciclaggio di denaro, che si è appropriata indebitamente di circa 35 milioni di dollari di fondi degli investitori, come affermato dalla corte degli Stati Uniti.

Aggiornamenti dei broker dal 9-15 novembre

Salgono a 323 i domini dei servizi finanziari bloccati da Consob.

WikiFX Trader

Rate Calc