Mohicans markets:Pay Attention to Initial Jobless Claims

Sommario:On Thursday September 1, spot gold remained in a narrow range before the European market, and is still under pressure below the pivot point. 1704.44 is the primary support, and the rebound should pay attention to the resistance at 1710.43.

Key Data

Fundamentals Overview

On Thursday September 1, spot gold remained in a narrow range before the European market, and is still under pressure below the pivot point. 1704.44 is the primary support, and the rebound should pay attention to the resistance at 1710.43. Spot silver fell by more than 1% in the day, and the short-term support below is hard to find. WTI crude oil turned down after approaching the pivot point, and is testing the first support at 88.53. The US dollar index has narrowed its gains, with resistance at 109.18. EUR/USD tested support at 1.0012 several times during the day. GBP/USD also tested its primary support at 1.1604. USD/JPY has ample room for upside.

The Mohicans Markets strategy is for reference only and not as investment advice. Please read the terms of the statement at the end of the article carefully. The following strategy was updated at 16:30 on September 1, 2022, Beijing time.

Technical View

ONE · Technical Level · International Gold

1733 Intraday Strong Resistance

1727 Intraday second resistance

1722 Intraday resistance

1710 Asia-Europe plate resistance

1705-1700 Asian-European disk support

1695-1690 Intraday support

1680 Key support for the year (mid-line)

Technical Analysis

Gold fell below the 1710 support and traded around 1700. There are many signs of a rebound near the current price, but the number is small and evenly distributed. The short-term bets near the current price are reduced, and the bets are concentrated on both ends. In the short term, there is still greater downward pressure on gold.

The large number of shorts above 1708 and 1718-1723 constitute resistance to the upward trend of gold. The non-agricultural data tomorrow night may disturb the trend of gold. However, when the interest rate hike cycle has not yet ended, the boost in gold prices can only be regarded as a staged rebound, and real interest rates still put pressure on gold.

During the day, you need to pay attention to the defense near 1700. There is a large stock of shorts near 1695-1700. If the position breaks, it may expand the downward momentum. Short bets around 1668-1673 will decrease, and put options will be added significantly at 1648. Gold still has downside risks.

Note: The above strategy was updated at 16:00 on September 1st. This strategy is a day strategy, please pay attention to the release time of the strategy.

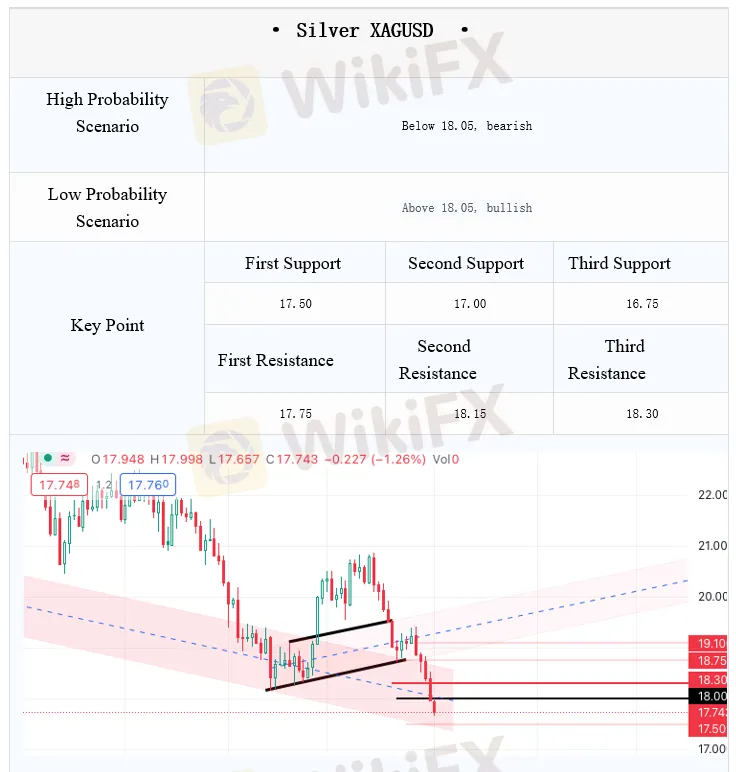

TWO · Technical Level · Spot Silver

18.55 Yesterday's high point, strong resistance

18.3 Intraday resistance

18 Bullish increase, bearish decrease sharply but there is stock, resistance decreases

17.75 Bullish unchanged, bearish reduced but there is stock, resistance

17.5 Bullish unchanged, bearish reduced, support level

17 .00 Bullish increase, bearish increase and large stock, short target is also intraday support

16.75 Bullish increase, bearish increase and large stock, bear target

Technical Analysis

Silver underperformed gold and stopped near 17.5 after further losses.

There was a small entry in the call options, but it is expected that it will be difficult to provide an effective boost, and the bears continue to bet heavily.

The starting point of the decline in early trading today was around 17.75, with a large stock of shorts. If silver rebounds, it may test this resistance. The next resistance is at 18, but some bears are already out here.

It is worth noting that the stock of bulls below 17.5 is weak, and if silver falls further, it will be difficult for bulls to give support. The bears broke a large number of bets at the 17 support, and at the same time, there were 384 put option bets at 16.75. In the case that silver failed to stabilize the support, it is necessary to be alert to the short counterattack.

Note: The above strategy was updated at 16:00 on September 1st. This strategy is a day strategy, please pay attention to the release time of the strategy.

THREE · Technical Level · US Crude Oil

95-96 Bullish increase and large stock, bearish increase and large stock, long target and resistance

93-94 Bullish increase and the stock is large, the bearish increase and the stock is large, the long target

90-92 Bullish increase and large stock, bearish increase and large stock, resistance level

88-89 Bullish increase and the stock is large, the bearish increase and the stock is large, the short target

85 Bullish increase, bearish decrease sharply large stock, support level

82.5 Bullish remains unchanged, the bearish increases significantly and the stock is large, the short target

Technical Analysis

In the early hours of Thursday morning, OPEC expected supply to tighten, which limited the decline in oil prices to a certain extent. However, the monthly crude oil price in August was not good, and it still faces certain pressure on the technical side. The strength of support is mainly reflected in the news of the fundamentals.

Specifically, crude oil bullish and put options have increased positions above the current price, and long and short sentiments coexist, and there may be a seesaw above the 90 mark. The key support is in the 88-89 range, here is the short target of option betting. If the decline can be stopped here to form support, there may be new upward opportunities for oil prices to test the long target, otherwise it may continue to decline and test the support strength of 86-85.

Note: The above strategy was updated at 16:00 on September 1st. This strategy is a day strategy, please pay attention to the release time of the strategy.

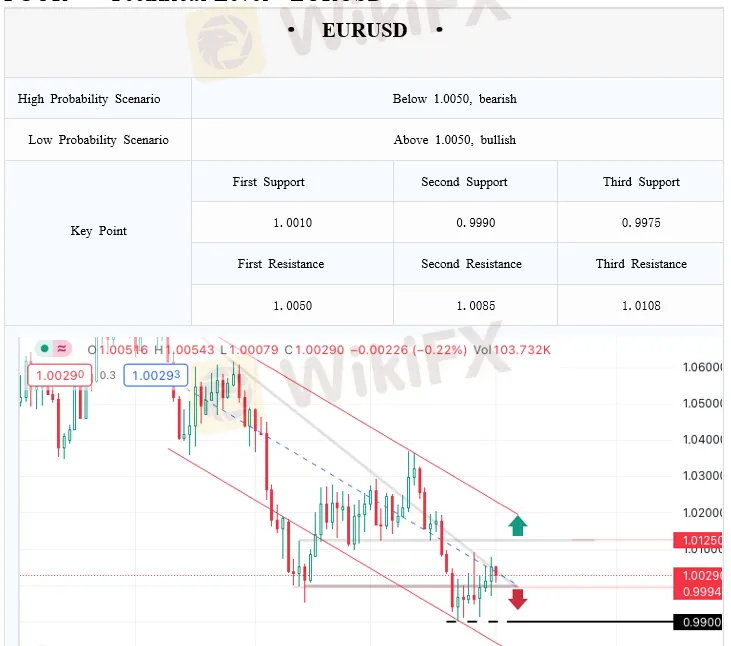

FOUR · Technical Level · EURUSD

1.01 Bullish decrease slightly but the stock is large, bearish increase sharply and the stock is large, long target and resistance

1.005 Bullish increase, bearish increase in equal volume, rebound resistance

1.00 Bullish decrease slightly and the stock is large, bearish decrease sharply and the stock is large, fall back support

0.9975 Bullish unchanged, bearish increase sharply, fall back target

0.99 Bullish unchanged, bearish decrease sharply, short target and support

Technical Analysis

EURUSD followed the trend of the dollar on Wednesday, continuing to maintain range oscillation. Although the U.S. market surged higher after, it still failed to stand on the recent long target of 1.01. And todays opening and began to fall, basically recovering yesterday's gains.

From the options distribution, EURUSD parity near short money is more active. Long positions are more concentrated in the long target 1.01 above the layout, and also only at 1.01 appear to leave, so there is still resistance at that position.

From the direction of the fall, the parity position has a number of bearish options leaving the market, which will be the first support for the fall; after that 0.9975 short funds added bets, and will be the recent fall target; if it further falls below, it may look further to the short target near 0.99.

Note: The above strategy was updated at 16:00 on September 1. This strategy is a day strategy, please pay attention to the release time of the strategy.

FIVE · Technical Level · GBPUSD

1.17 Bullish increase, bearish unchanged, long target and resistance

1.165 Bullish increase, bearish unchanged and the stock is large, rally target and resistance

1.16-1.162 Bullish unchanged, bearish increase and the stock is large, resistance range

1.157 Bullish unchanged, bearish increase, downside action strengthen

1.155 Bullish unchanged, bearish decrease, support

1.15 Bullish unchanged, bearish decrease, short target and support

1.145 Bullish unchanged, bearish increase, next short target

Technical Analysis

GBPUSD has been falling since the European session on Wednesday and the decline has continued into today. Although it was supported yesterday around the short target of 1.16, it has managed to fall below that target today. From the options, short money action is more frequent; from the upside direction, bearish money added bets around 1.16-1.162, which will be a resistance area; if it can further rise above, it may look to the rebound target 1.165, and long target 1.17, and both positions have some resistance. from the downside, downside momentum has increased around 1.157. If it breaks, it may test support at 1.155, where bearish money is leaving; and then short targets are at 1.15 and 1.145.

Note: The above strategy was updated at 16:00 on September 1. This strategy is a day strategy, please pay attention to the release time of the strategy.

SIX · Technical Level · AUDUSD

0.7 Bullish decrease, bearish unchanged, still strong resistance

0.69 Bullish unchanged, bearish decrease sharply but the stock is large, still key resistance

0.685 Bullish unchanged, bearish increase sharply and the stock is large, support becomes resistance

0.675 Bullish unchanged, bearish increase sharply, short target

Technical Analysis

The Australian dollar has continued to underperform recently, with weakness in the commodities markets still a major factor. Resistance around 0.69 is still unbreakable. Although there are bearish options here to reduce positions, the stock is still large. It is still a key resistance, and it is difficult to say that the long reversal if you can't stand on it. The Australian dollar extended its decline in Asian trading on Thursday, with 0.685 resistance temporarily difficult to break through. And it has approached 0.675 short target, and do not rule out the day will also approach again or even test the place. If the day can not stand 0.685 and 0.69, the Australian dollar in the short term may still have great selling pressure.

Note: The above strategy was updated at 16:00 on September 1. This strategy is a day strategy, please pay attention to the release time of the strategy.

Statement | Disclaimer

Disclaimer: The information contained in this material is for general advice only. It does not take into account your investment goals, financial situation or special needs. Mohicans Markets has made every effort to ensure the accuracy of the information as of the date of publication. Mohicans Markets makes no warranties or representations regarding this material. The examples in this material are for illustration only. To the extent permitted by law, Mohicans Markets and its employees shall not be liable for any loss or damage arising in any way, including negligence, from any information provided or omitted from this material.The features of Mohicans Markets products, including applicable fees and charges, are outlined in the product disclosure statements available on the Mohicans Markets website and should be considered before deciding to deal with these products. Derivatives can be risky and losses can exceed your initial payment. Mohicans Markets recommends that you seek independent advice.

Mohicans Markets, (Abbreviation: MHMarkets or MHM, Chinese name: Mai hui), Australian Financial Services License No. 001296777.

WikiFX Trader

FOREX.com

IC Markets Global

FXCM

EC markets

eightcap

HFM

FOREX.com

IC Markets Global

FXCM

EC markets

eightcap

HFM

WikiFX Trader

FOREX.com

IC Markets Global

FXCM

EC markets

eightcap

HFM

FOREX.com

IC Markets Global

FXCM

EC markets

eightcap

HFM

Rate Calc