Mohicans markets:Market Focuses on the Annual Rate of the US CPI in August is not Seasonally Adjusted

Sommario:On Monday September 11, spot gold rose and then fell. After the US market rose to a daily high of 1735.03, it gave up most of the previous gains and fell below the $1730 mark, and finally closed up 0.43% at $1727.47 per ounce;Spot silver once soared 6% during the day, and broke through the $20 mark, and finally closed up 4.99% at $19.78 per ounce.

At 20:30 tonight, the U.S. Department of Labor will announce the Consumer Price Index (CPI) report for August, which is currently expected to fall back to 8.1%. However, St. Louis Fed President Bullard said on Friday that the good CPI data should not affect the Fed's interest rate decision in September. According to CME's “Federal Reserve Watch”, the probability of the Fed raising interest rates by 75 basis points in September is 92%.

Today, OPEC will release its monthly crude oil market report. Investors can pay attention to the oil production of OPEC members and their production reduction rates.

Global Views - List of Major Markets

On Monday September 11, spot gold rose and then fell. After the US market rose to a daily high of 1735.03, it gave up most of the previous gains and fell below the $1730 mark, and finally closed up 0.43% at $1727.47 per ounce;Spot silver once soared 6% during the day, and broke through the $20 mark, and finally closed up 4.99% at $19.78 per ounce.

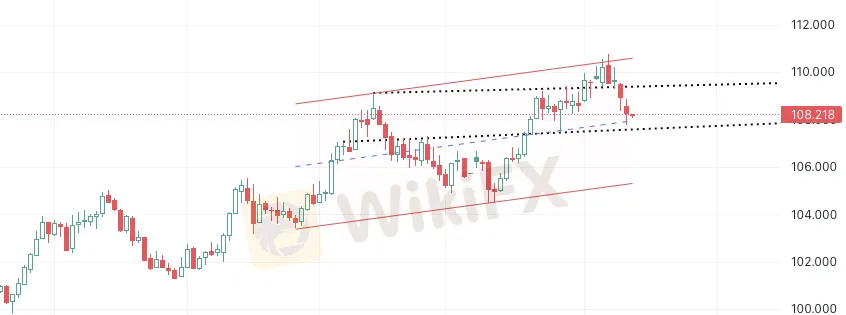

The U.S. dollar index dived sharply in the European market, and once fell below the 108 mark, and finally closed down 0.62% at 108.29; the 10-year U.S. bond yield fell first and then rose, and finally closed up 1.11% at 3.358%.

In terms of crude oil, the two oil prices rose more than 3% in intraday trading. WTI crude oil rebounded before the European market, rising to a high of US$89.04 per barrel, and finally closed up 2.15% at US$88.04 per barrel; Brent crude oil finally closed up 2.27% at US$94.20 per barrel.

The Dow closed up 0.71%, the Nasdaq closed up 1.27%, and the S&P 500 closed up 1.06%. Most of the popular Chinese concept stocks closed higher, NIO closed up about 14%, Bilibili closed up about 4%, and Alibaba closed up about 3%.

European stocks rose sharply.Germany's DAX closed up 2.40% at 13,402.27 points; the UK's FTSE 100 closed up 1.66% at 7,473.03 points; the European Stoxx 50 closed up 2.14% at 3,646.51 points.

Precious Metals

In early trading hours on Tuesday,September 13, Beijing time, spot gold fluctuated within a narrow range and is currently trading around US$1,722. The US dollar continued to retreat and weaken to a two-week low, continuing to provide gold prices with rebound momentum, and short-term bullish signals have increased.

This trading day ushered in the heavy US CPI data in August. The market generally expects that inflation growth will slow down, which may ease the pressure on the Fed to raise interest rates after September, and is expected to provide further upward momentum for gold prices.However, interest rate futures showed that the probability of the Federal Reserve raising interest rates by 75 basis points in September rose to 93%, which made gold bulls still have scruples.In addition, investors need to pay more attention to the geopolitical situation of Russia and Ukraine. The recent Ukraine counterattack has strengthened, and Russia may strengthen its attack, which is expected to provide safe-haven support for gold prices.

Bullish factors affecting gold

[U.S. dollar index fell to a near two-week low]

[Ukraine continued to counterattack to regain more than 20 towns, and the Russian army retreated from many places]

[Under inflation, the German economy is expected to shrink by 0.3% in 2023]

[The UK economy grew less than expected in July, and soaring prices caused pressure]

[New York Fed survey: U.S. consumer one-year inflation expectations in August further fell to the lowest since October last year]

Bearish factors affecting gold

[EU considers letting fossil fuel companies share excess profits to help consumers survive the energy crisis]

[US stocks rose for four consecutive days and hit a two-week high, focusing on US CPI data]

[U.S. Treasury yields are higher, and the CPI data is not expected to change the Feds aggressive rate hike path]

[New York Fed survey: high turnover rate is exacerbating labor market tightness]

On the whole, the impact of the US dollar on the gold price has increased recently. With the demand for position adjustment, the rebound of the euro, and the expected decline in inflation expectations, the US dollar has pulled back to near a two-week low, providing opportunities for gold prices to rebound; In addition, the deterioration of the geopolitical situation in Russia and Ukraine, and the lingering worries about the economic recession in the euro area and the United Kingdom, also provided safe-haven support for gold prices; The top is concerned about the resistance near the 21-day moving average at 1731.20. If it can break through the resistance, it will increase the bullish signal in the market outlook. The U.S. dollar has pulled back to near the middle rail of the Bollinger Bands. If the price of gold fails to break through the resistance of the 21-day moving average and the U.S. dollar ends the correction, the price of gold may return to the downward trend.

Crude Oil

In early trading on Tuesday, September 13, Beijing time, U.S. oil traded around $87.7 a barrel; oil prices closed higher on Monday, shrugging off weak demand expectations as supply concerns intensified as winter approaches.Data released by the U.S. Department of Energy (DOE) on Monday showed that inventories in the U.S. Strategic Petroleum Reserve fell by 8.4 million barrels in the week ended September 9 to 434.1 million barrels, the lowest level since October 1984; Iran's nuclear negotiations are deadlocked again, and Iranian crude oil may have no hope of returning to the market in the short term.

During the day, pay attention to the OPEC monthly report on the annual rate of the US CPI in August without seasonal adjustment; API data will be released at 4:30 on Wednesday.

Bullish factors affecting oil prices

[Supply concerns intensify as the heating season approaches]

[Iran says the U.S. must prove itself to be reliable to return to the Iran nuclear deal]

[The price limit of natural gas cannot solve the problem of gas shortage in Europe]

[Ukraine continues its strong counterattack and Russian troops withdraw from many places]

[Waiting for inflation data, U.S. stocks continue to rise]

Bearish factors affecting oil prices

[Cholera cases appear in many places in Syria]

[Indonesia will consider buying oil from Russia]

[Petrobras announces reduction in household LNG prices]

[The probability of the Fed raising interest rates by 75 basis points in September is 92%]

Overall, the unexpected increase in crude oil inventories in the United States, coupled with slowing demand in Europe, intensified worries about the economic outlook, and strong short positions in oil prices, waiting for the EU to implement price caps on Russian oil, Russia may introduce more countermeasures, and there will be further downside risks for oil prices.Intraday trading pays attention to EIA data, if it further shows an increase in inventories, oil prices may break below the 80 mark.

Foreign Exchange

In early trading on Tuesday, September 13,Beijing time, the US dollar index fell slightly and is currently trading around 108.27. U.S. CPI for August, due on Tuesday, will be closely watched for how aggressively the Federal Reserve may need to raise interest rates this week to combat high inflation, strategists said.

ECB officials advocated further aggressive tightening of the currency, supporting the euro against the dollar. Some analysts believe that the new British Prime Minister Truss, while promising to cut taxes, stressed that he will not cut public spending, which means that the government deficit may expand again, and investors are expected to be more cautious about the pound in the short term.

U.S. CPI for August, due on Tuesday, will be closely watched for how aggressively the Federal Reserve may need to raise interest rates this week to combat high inflation.

According to CME's “Federal Reserve Watch”: The probability of the Fed raising interest rates by 50 basis points by September is 8%, and the probability of raising interest rates by 75 basis points is 90%; By November, the probability of a cumulative rate hike of 75 basis points is 6.3%, the probability of a cumulative rate hike of 100 basis points is 73.8%, and the probability of a cumulative rate hike of 125 basis points is 20%.

USD/JPY closed up 0.13% at 142.83 on Monday. Over the weekend, Japanese officials hinted at intervention to stem the yen's decline.

The euro climbed to a more than three-week high of 1.0197 against the dollar on Monday as European Central Bank officials advocated for further aggressive currency tightening, before retreating to end up 0.76% at 1.0121.

Sterling touched a 37-year low of $1.1404 last week before rebounding, closing up 0.82% at $1.1680 on Monday.

According to the data released by the British Bureau of Statistics, the inflation rate of the United Kingdom in July this year was as high as 10.1%, a new high since February 1982. It is also the first country in the G7 whose inflation rate exceeded 10%. In addition, the UK is also facing economic growth pressure. The Organisation for Economic Co-operation and Development (OECD) predicted in June that UK economic growth would stall next year.

The Bank of England will make a difficult choice between “fighting inflation” and “stabilizing growth”. Two days before the Queen's death, Britain ushered in a new Prime Minister Truss, who pursued monetarism and was committed to helping people ease the pressure on living costs through tax cuts.

Institutional Currency Viewpoint

1.ING: The Bank of England is expected to raise interest rates by 50 basis points in September

2. Rabobank: The UK and EU face trade risks, which may push the pound lower

3. UBS: If the US CPI data weakens on Tuesday, it may stimulate a correction in the dollar against the yen

4. Mitsubishi UFJ: The yen resumes its decline and is expected to weaken further

5. Capital Economics: Aussie to weaken for the rest of 2022 and into 2023

6. National Bank of Canada Wealth Management (NBF): EUR/USD near parity in coming months

7. ANZ: The Fed is tightening, the New Zealand dollar is not worrying

Statement | Disclaimer

Disclaimer: The information contained in this material is for general advice only. It does not take into account your investment goals, financial situation or special needs. Mohicans Markets has made every effort to ensure the accuracy of the information as of the date of publication. Mohicans Markets makes no warranties or representations regarding this material. The examples in this material are for illustration only. To the extent permitted by law, Mohicans Markets and its employees shall not be liable for any loss or damage arising in any way, including negligence, from any information provided or omitted from this material.The features of Mohicans Markets products, including applicable fees and charges, are outlined in the product disclosure statements available on the Mohicans Markets website and should be considered before deciding to deal with these products. Derivatives can be risky and losses can exceed your initial payment. Mohicans Markets recommends that you seek independent advice.

Mohicans Markets, (Abbreviation: MHMarkets or MHM, Chinese name: Mai hui), Australian Financial Services License No. 001296777.

WikiFX Trader

WikiFX Trader

Rate Calc