Mohicans markets:0930 European Market Viewpoint

Sommario:On Thursday, September 29, during the Asia-Europe period, spot gold fluctuated and rose, and is currently trading around $1,673.02 per ounce. U.S. crude oil rebounded from a low level and is currently trading around $81.28 a barrel, recovering a sharp overnight gain.

The opinions and strategies provided in this article are for reference only. The data are all from large brokers. Please check them according to your needs and do not serve as any investment advice. Please read the statement terms at the end of the article carefully.

On Thursday, September 29, during the Asia-Europe period, spot gold fluctuated and rose, and is currently trading around $1,673.02 per ounce. U.S. crude oil rebounded from a low level and is currently trading around $81.28 a barrel, recovering a sharp overnight gain.

Gold and silver prices have rebounded to a certain extent in this week. Although ETF funds have been flowing out a few days ago, gold and silver ETFs finally increased their holdings yesterday. On the whole, this is good news for the rebound of gold and silver prices, but the increase in holdings this time is still too small, which can only prove that the willingness of capital outflow has slowed down. Therefore, although the downside risk has been reduced, it still exists.

Yesterday, both oil prices and US oil cracking spreads fell. It seems that the market's concerns about the outlook for demand still exist, especially since the global central banks are simultaneously tightening policies, further suppressing economic demand.

The economic sentiment index in the euro zone in September has continued to decline in recent months, indicating that the risk of recession in the euro zone is increasing. Therefore, the impact of weak demand on oil prices cannot be ignored at the moment.

Mohicans Markets strategy is for reference only and not as investment advice. Please read the terms of the statement at the end of the article carefully. The following strategy was updated at 15:30 on September 30, 2022, Beijing time.

CME Group options layout changes:

1700 Bullish increase sharply, bearish decrease slightly, long target

1680 Bullish slightly increased, bearish decreased significantly, resistance weakened

1675 Bullish increase, bearish decrease slightly, bulls and bears compete for points

1650 Bullish increase, bearish decrease sharply, and the action can expand under the vigilance of breaking the position

1630 Bullish unchanged, bearish increase, bearish target

Order flow key point labeling (spot price):

1691 Key level of the daily line--the breakthrough to stabilize may mean that the daily bear trend of gold has been suspended

1675.45 The key positive level this week, the daily line closing above this means gold will continue to rebound

1668 Trend rebound key resistance

1662 Asian market first support

1658 Upside minor support

1642-1643 The key support of the rebound trend

Note: The above strategy was updated at 15:00 on September 30. This strategy is a day strategy, please pay attention to the release time of the strategy.

CME Group options layout changes:

19.2-19.25 Bullish increase sharply, bearish unchanged, long target

19 Bullish increase, bearish unchanged, long target

18.75 Bullish increase, bearish decrease, support level

18.5 Bullish increase slightly, bearish decrease slightly, and the action can expand under the vigilance of breaking the position

18 Bullish slightly increased, bearish increased, bears target

Order flow key point labeling(spot price)

19.7 Strong resistance

19.45 Rebound target

19-19.2 Key Resistance

18.8 Ultra-short-term support (Asian Market)

18.37-18.5 Key support during the day

18-18.2 Daily trend key support

Note: The above strategy was updated at 15:00 on September 30. This strategy is a day strategy, please pay attention to the release time of the strategy.

Order flow key point labeling (spot price):

85 Bullish increase and large stock, bearish decrease, long target

83 Bullish increase, bearish increase, next resistance

81.5 Bullish increase, bearish increase, resistance level

80 Bullish increase, bearish increase sharply, fall back target and support

77-77.5 Bullish increase, bearish increase sharply, bear target and support

76 Bullish increase, bearish decrease, key support

Order flow key point labeling

86.4 Strong resistance

85 Second resistance

83-day Key resistance

80.5-81 Key support in the day, falling below and returning to the 76.5-80.5 shock range

78 Short-term support

76.5 Range key support

Special Note:

At present, the market continues to question the economic management of the UK and the prospects for global economic growth. The easing effect of the Bank of England's intervention in the bond market has subsided, and the global market is still volatile, which makes the bulls have some scruples, which may limit the rebound space and speed of oil prices. Investors need to pay close attention to changes in European and American stock markets and market sentiment.

Note: The above strategy was updated at 15:00 on September 30. This strategy is a day strategy, please pay attention to the release time of the strategy.

CME Group options layout changes:

1.01 Bullish increase, bearish decrease slightly, rebound target level

1.00 Bullish increase sharply, bearish decrease slightly but the stock is large, rebound target level, resistance

0.99 Bullish increase sharply, bearish increase slightly, rebound target, resistance

0.9825-0.9875 Bullish unchanged, bearish increase sharply, short defensive zone

0.98 Bullish increase, bearish decrease sharply, support

0.9775 Bullish decrease slightly, bearish increase sharply, short target

Note: The above strategy was updated at 15:00 on September 30. This strategy is a day strategy, please pay attention to the release time of the strategy.

CME Group options layout changes:

1.1220 Bullish decrease, bearish unchanged, resistance

1.1150 Bullish increase slightly, bearish decrease, resistance weaken

1.11 Bullish increase, bearish unchanged, support

1.10 Bullish increase slightly, bearish unchanged, support

1.07 Bullish increase sharply, bearish increase sharply, key long-short contention level

Note: The above strategy was updated at 15:00 on September 30. This strategy is a day strategy, please pay attention to the release time of the strategy.

Description:

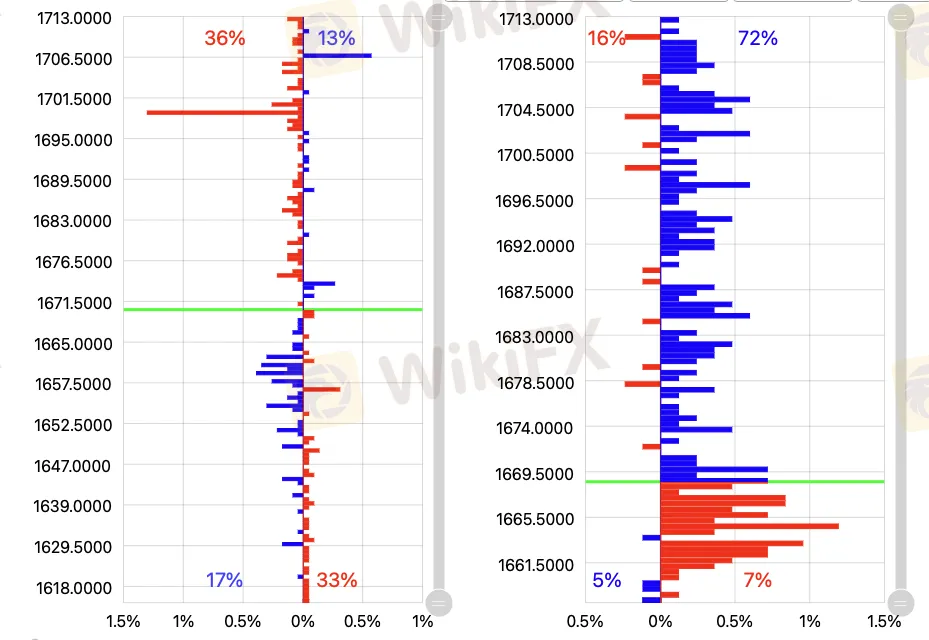

Reminder: This article involves the key point labeling and technical analysis of spot gold, spot silver, and U.S. crude oil. With reference to the change data of options positions published on the CME official website, the average order flow change data of large brokers in the industry is superimposed. Starting from the distribution of market chips, it is more accurate to calculate Mark the sentiment of the market in important price ranges.

The order flow mainly refers to the following Oder Book data, which is updated every 20 minutes, taking XAUUSD international gold as an example:

Statement | Disclaimer

Disclaimer: The information contained in this material is for general advice only. It does not take into account your investment goals, financial situation or special needs. We have made every effort to ensure the accuracy of the information as of the date of publication. MHMarkets makes no warranties or representations about this material. The examples in this material are for illustration only. To the extent permitted by law, MHMarkets and its employees shall not be liable for any loss or damage arising in any way, including negligence, from any information provided or omitted from this material. The features of MHMarkets products, including applicable fees and charges, are outlined in the product disclosure statements available on the MHMarkets website. Derivatives can be risky and losses can exceed your initial payment. MHMarkets recommends that you seek independent advice.

Mohicans Markets, (Abbreviation: MHMarkets or MHM, Chinese name: Maihui), Australian Financial Services License No. 001296777.

WikiFX Trader

IC Markets Global

EC markets

FOREX.com

Ultima

JustMarkets

fpmarkets

IC Markets Global

EC markets

FOREX.com

Ultima

JustMarkets

fpmarkets

WikiFX Trader

IC Markets Global

EC markets

FOREX.com

Ultima

JustMarkets

fpmarkets

IC Markets Global

EC markets

FOREX.com

Ultima

JustMarkets

fpmarkets

Rate Calc