DCMGROUP.IO

Sommario:Dcmgroup.io is allegedly a forex broker registered in Cyprus that claims to provide its clients with various tradable financial instruments with flexible leverage up to 1:500, competitive spreads and no commissions on the MT4 for Windows, Mac, iPhone, Android and Webtrader trading platforms, as well as a choice of four different live account types.

General Information & Regulation

Dcmgroup.io is allegedly a forex broker registered in Cyprus that claims to provide its clients with various tradable financial instruments with flexible leverage up to 1:500, competitive spreads and no commissions on the MT4 for Windows, Mac, iPhone, Android and Webtrader trading platforms, as well as a choice of four different live account types. Here is the home page of this brokers official site:

As for regulation, it has been verified that Dcmgroup.io does not fall under any valid regulations. That is why its regulatory status on WikiFX is listed as “No License” and receives a relatively low score of 1.18/10. Please be aware of the risk.

Market Instruments

Dcmgroup.io advertises that it mainly offers four different asset classes, which include cryptocurrencies, forex, commodities and stocks.

Account Types

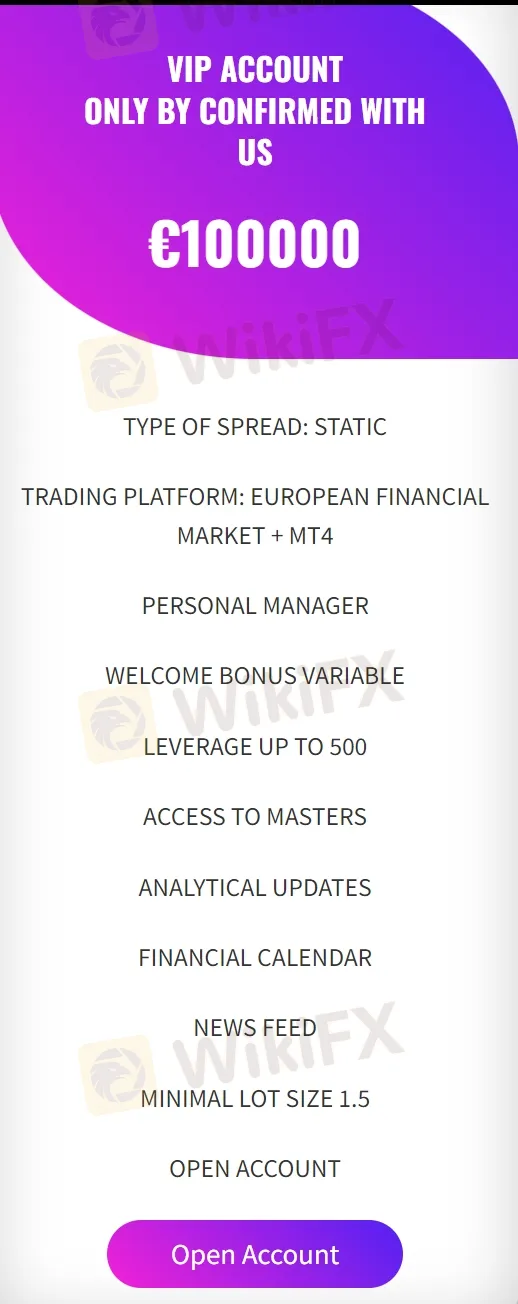

Dcmgroup.io claims to offer four types of trading accounts - Basic, Standard, Pro and VIP, with minimum initial deposit requirements of €3,500, €7,000, €25,000 and €100,000 respectively. In comparison, licensed brokers allow setting up a starter account with a minimum deposit of $100 or even less.

Leverage

The specified leverage for different account types at Dcmgroup.io varies between 1:200 and 1:500. For instance, clients on the Basic account can experience leverage of 1:200, while the Standard, Pro and VIP accounts can enjoy higher leverage ratios of 1:300, 1:400 and 1:500 separately. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads & Commissions

Dcmgroup.io claims to offer competitive spreads and no commissions will be charged.

Trading Platform Available

Platforms available for trading at Dcmgroup.io seem to be MT4 for Windows, Mac, iPhone, Android and Webtrader. In any case, we recommend using MT4 or MT5 for your trading platform. Forex traders praise MetaTrader's stability and trustworthiness as the most popular forex trading platform. Expert Advisors, Algo trading, Complex indicators, and Strategy testers are some of the sophisticated trading tools available on this platform. There are currently 10,000+ trading apps available on the Metatrader marketplace that traders can use to improve their performance. By using the right mobile terminals, including iOS and Android devices, you can trade from anywhere and at any time through MT4 and MT5.

Deposit & Withdrawal

The only payment method available on the Dcmgroup.io deposit menu is the provider PayBox. However, the terms state that the minimum withdrawal amount for wire transfers is $/€/£250, while on any other method is $/€/£100. The stated minimum deposit for the Basic account is extremely high - €3500. Elsewhere on the website, a minimum deposit amount of $250 is stated.

The broker also charges a withdrawal fee. Specifically, “a levy of 10% of the withdrawal amount will be charged to any withdrawal from an account that has not executed more than 200 in turnover”.

Bonuses & Fees

DCMGROUP.IO claims to offer a welcome bonus of up to 25% on the Standard account and 50% on the Pro account. In any case, you should be very cautious if you receive a bonus. Bonuses aren't client funds, they're company funds, and fulfilling the heavy requirements that are usually attached to them can prove a very daunting and difficult task. Note that brokers are prohibited from using bonuses and promotions by all leading regulators.

The broker also charges a 10% monthly fee for accounts that are inactive for six months.

Customer Support

DCMGROUP.IOs customer support can be reached by telephone: +357 22278306, email: support@dcmgroup.io or send messages online to get in touch. Company address: 99, Ayias Sofias street (Limassol Cyprus).

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

Leggi di più

Aggiornamenti broker dal 7-13 dicembre

La bolletta denominata Stablecoin Tethering and Bank Licensing Enforcement Act., proposto da Rashida Tlaib, un democratico del Michigan, insieme ai membri del Congresso, Jesus García e Stephen Lynch, mira a proteggere i consumatori dalle minacce emergenti associate al mercato delle criptovalute e richiederà a chiunque che offre stablecoin l'approvazione della Federal Deposit Insurance Corporation (FDIC) e di altre agenzie governative competenti.

Aggiornamenti broker dal 30 novembre-6 dicembre

Le autorità cinesi hanno confiscato criptovalute per un valore di oltre 4,2 miliardi di dollari in relazione alla famigerata truffa Plus Token, rivelano i file del tribunale locale.

Aggiornamenti broker dal 23-29 novembre

Matthew Piercey, l'uomo dietro due società di investimento - Zolla e Family Wealth Legacy, è stato arrestato dagli agenti dell'FBI a Sacramento con l'accusa di frode telematica, manomissione di testimoni, frode postale e riciclaggio di denaro, che si è appropriata indebitamente di circa 35 milioni di dollari di fondi degli investitori, come affermato dalla corte degli Stati Uniti.

Aggiornamenti dei broker dal 9-15 novembre

Salgono a 323 i domini dei servizi finanziari bloccati da Consob.

WikiFX Trader

TMGM

AvaTrade

EC Markets

Exness

GO MARKETS

STARTRADER

TMGM

AvaTrade

EC Markets

Exness

GO MARKETS

STARTRADER

WikiFX Trader

TMGM

AvaTrade

EC Markets

Exness

GO MARKETS

STARTRADER

TMGM

AvaTrade

EC Markets

Exness

GO MARKETS

STARTRADER

Rate Calc