Olympia Markets

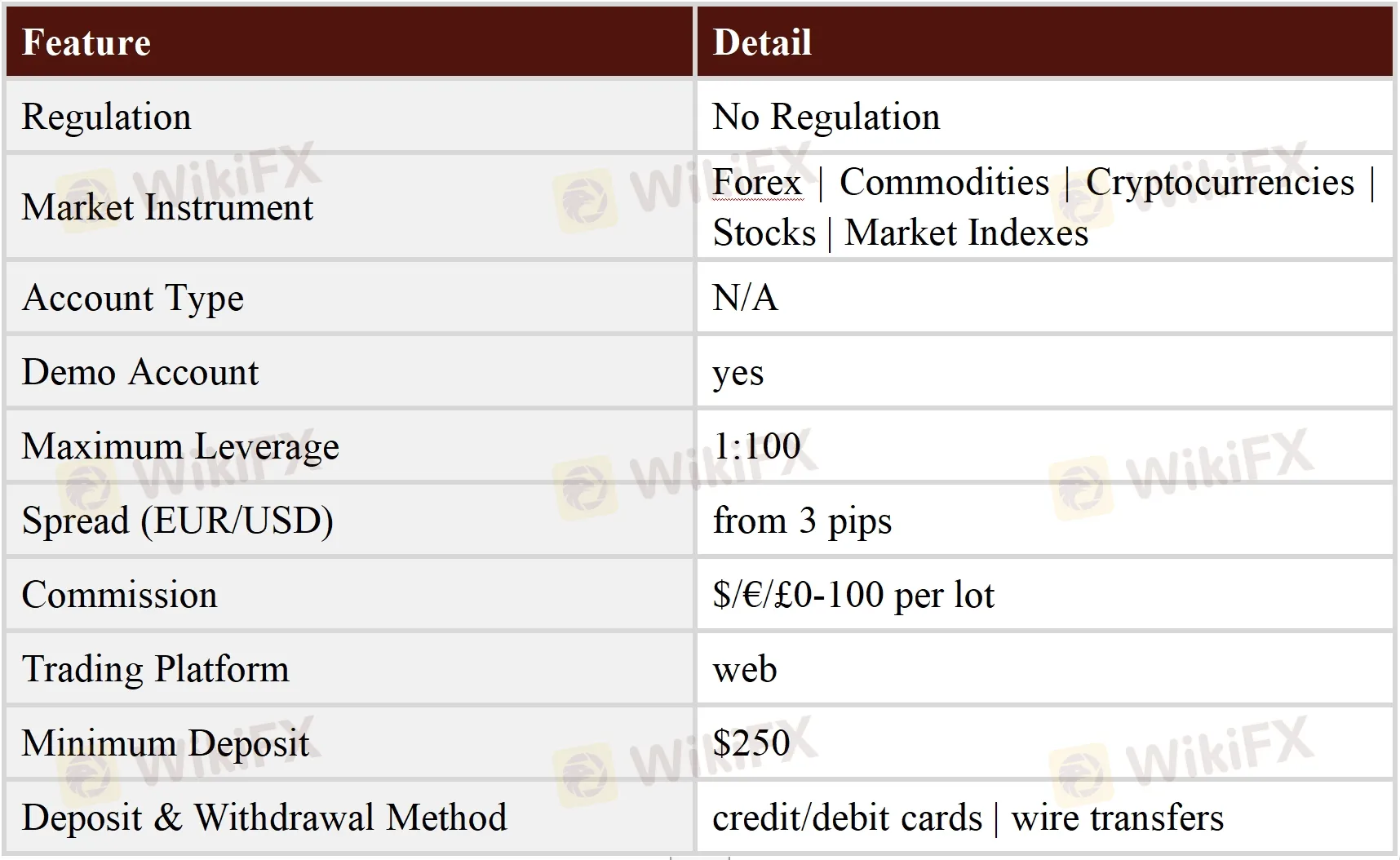

Sommario:Olympia Markets presents itself as a Forex / Crypto CFD broker that opened in April 2019 and registered in the United Kingdom. It claims to provide its clients with various tradable financial instruments with leverage up to 1:100 and floating spreads from 3 pips on the web-based trading platform.

Note: Olympia Markets is to operate via the website - https://olympiamarkets.com/, which is currently not yet functional and no information about the company was immediately available. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

General Information & Regulation

Olympia Markets presents itself as a Forex / Crypto CFD broker that opened in April 2019 and registered in the United Kingdom. It claims to provide its clients with various tradable financial instruments with leverage up to 1:100 and floating spreads from 3 pips on the web-based trading platform.

As for regulation, it has been verified that Olympia Markets does not fall under any valid regulations. That is why its regulatory status on WikiFX is listed as “No License” and receives a relatively low score of 1.43/10. Please be aware of the risk.

Market Instruments

Olympia Markets advertises that it offers CFD trading on more than 380 underlying assets including Forex, Commodities, Cryptocurrencies, Stocks and Market Indexes.

Account Types

Olympia Markets offer demo and live accounts, and the minimum initial deposit requirement to open an account is $250. In comparison, licensed brokers allow setting up a starter account with a minimum deposit of $100 or even less.

Leverage

The maximum leverage provided by Olympia Markets is up to 1:100. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads & Commissions

Olympia Markets claims that the spread on EUR/USD is 3 pips while the industry average is only 1.5 pips. While the commission is said to be $/€/£0-100 per lot.

Trading Platform Available

Instead of the world's most advanced and popularly-used MT4 and MT5 platforms, Olympia Markets gives traders a web-based trading platform. Traders had better choose the broker who offers MT4 and MT5, which are highly praised by traders and brokers alike due to their ease of use and great functionality. MT4 and MT5 offer top-notch charting and flexible customization options. They are especially popular for their automated trading bots, a.k.a. Expert Advisors.

Deposit & Withdrawal

Potential clients of Olympia Markets may deposit or withdraw only via standard credit/debit cards like Visa, MasterCard and Maestro, as well as wire transfers. The minimum initial deposit requirement is said to be $250, while the minimum withdrawal amount for wire transfers is £500 ($630). We could not find any withdrawal fee. This does not mean that there are no hidden ones. Withdrawals are processed between 5-10 days.

Bonuses

Olympia Markets appears to offer some bonuses, however, you should note that the bonus can only be withdrawn when a required trading volume is achieved. In any case, you should be very cautious if you receive a bonus. Bonuses aren't client funds, they're company funds, and fulfilling the heavy requirements that are usually attached to them can prove a very daunting and difficult task. Note that brokers are prohibited from using bonuses and promotions by all leading regulators.

Customer Support

Olympia Markets customer support can be reached by telephone: +44 203 954 6382, email: support@olympiamarkets.info. The broker lists an address of 14 Terbatas Street, 4th & 5th floors, Riga LV1011 Latvia. However, it seems to be just a Regus temporary office space.

Pros & Cons

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

Leggi di più

Aggiornamenti broker dal 7-13 dicembre

La bolletta denominata Stablecoin Tethering and Bank Licensing Enforcement Act., proposto da Rashida Tlaib, un democratico del Michigan, insieme ai membri del Congresso, Jesus García e Stephen Lynch, mira a proteggere i consumatori dalle minacce emergenti associate al mercato delle criptovalute e richiederà a chiunque che offre stablecoin l'approvazione della Federal Deposit Insurance Corporation (FDIC) e di altre agenzie governative competenti.

Aggiornamenti broker dal 30 novembre-6 dicembre

Le autorità cinesi hanno confiscato criptovalute per un valore di oltre 4,2 miliardi di dollari in relazione alla famigerata truffa Plus Token, rivelano i file del tribunale locale.

Aggiornamenti broker dal 23-29 novembre

Matthew Piercey, l'uomo dietro due società di investimento - Zolla e Family Wealth Legacy, è stato arrestato dagli agenti dell'FBI a Sacramento con l'accusa di frode telematica, manomissione di testimoni, frode postale e riciclaggio di denaro, che si è appropriata indebitamente di circa 35 milioni di dollari di fondi degli investitori, come affermato dalla corte degli Stati Uniti.

Aggiornamenti dei broker dal 9-15 novembre

Salgono a 323 i domini dei servizi finanziari bloccati da Consob.

WikiFX Trader

FP Markets

TMGM

FXCM

FOREX.com

Pepperstone

IB

FP Markets

TMGM

FXCM

FOREX.com

Pepperstone

IB

WikiFX Trader

FP Markets

TMGM

FXCM

FOREX.com

Pepperstone

IB

FP Markets

TMGM

FXCM

FOREX.com

Pepperstone

IB

Rate Calc