REVO TRADE

Sommario:REVO TRADE is an unregulated brokerage company registered in the United States. While the broker's official website has been closed, so traders cannot obtain more security information.

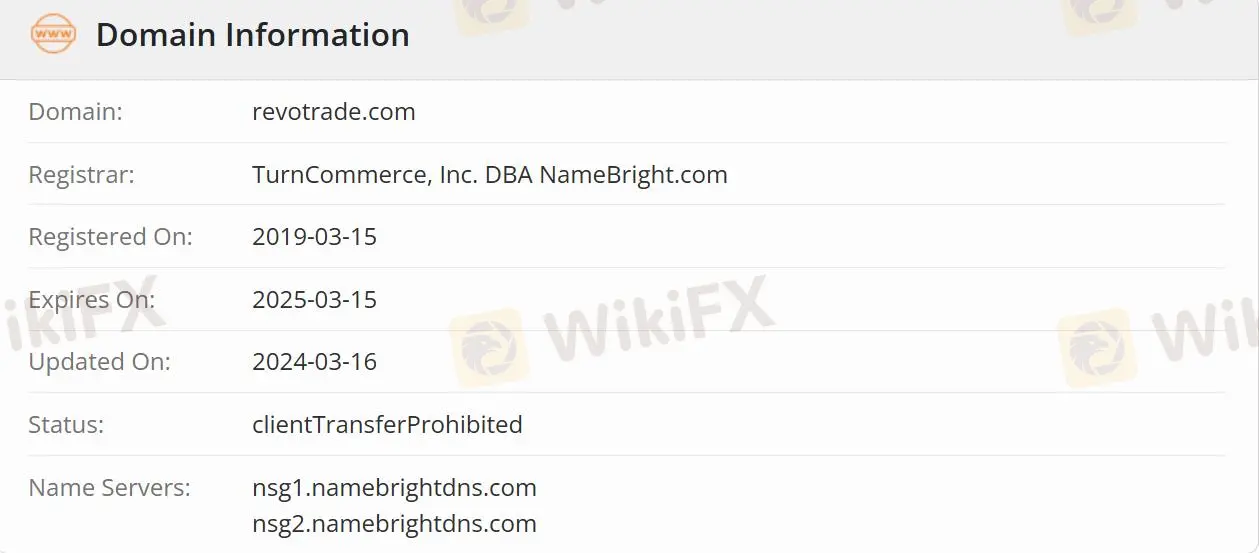

Note: REVO TRADE's official website: xx is normally inaccessible.

REVO TRADE Information

REVO TRADE is an unregulated brokerage company registered in the United States. While the broker's official website has been closed, so traders cannot obtain more security information.

Is REVO TRADE Legit?

REVO TRADE is not regulated, which will increase trading non-compliance and reduce traders investment security. Caution is advised when dealing with the company.

Downsides of REVO TRADE

- Unavailable Website

The website of REVO TRADE is inaccessible, raising concerns about its reliability and accessibility.

- Lack of Transparency

Since REVO TRADE does not explain more transaction information, especially regarding fees and services, this will bring huge risks and reduce transaction security.

- Regulatory Concerns

REVO TRADE is not regulated, which is less safe than a regulated one.

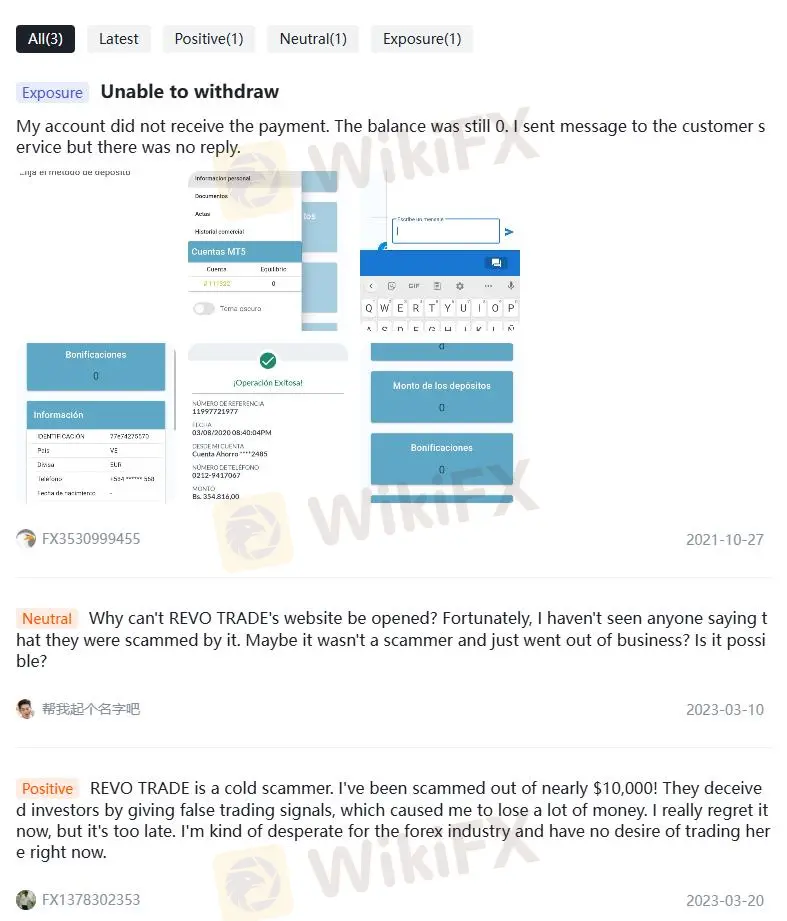

- Withdrawal Difficulty

According to a report on WikiFX, a user encountered significant difficulties with fund withdrawals. The issue remained unresolved despite the request being pending for a long time.

Negative REVO TRADE Reviews on WikiFX

On WikiFX, “Exposure” is posted as a word of mouth received from users.

Traders must review the information and assess risks before trading on unregulated platforms. Please consult our platform for related details. Report fraudulent brokers in our Exposure section and our team will work to resolve any issues you encounter.

There is 1 piece of REVO TRADE exposure and 1 comment about the user suspecting that the broker was a scam because of the loss caused by the staff's immature advice.

Exposure. Cannot withdraw

| Classification | Unable to Withdraw |

| Date | 2021-2023 |

| Post Country | Argentina/United States |

You may visit: https://www.wikifx.com/en/comments/detail/202110271852320356.html https://www.wikifx.com/en/comments/detail/Co202303204531520484.html.

Conclusion

REVO TRADE Since the official website cannot be opened, traders cannot get more information about security services. In addition, the unregulated status indicates that the broker's trading risks are high. It is advisable to choose regulated brokers with transparent operations to ensure the safety of your investments and compliance with legal standards. Traders can learn more about other brokers through WikiFX. Information improves transaction security.

Leggi di più

Aggiornamenti broker dal 7-13 dicembre

La bolletta denominata Stablecoin Tethering and Bank Licensing Enforcement Act., proposto da Rashida Tlaib, un democratico del Michigan, insieme ai membri del Congresso, Jesus García e Stephen Lynch, mira a proteggere i consumatori dalle minacce emergenti associate al mercato delle criptovalute e richiederà a chiunque che offre stablecoin l'approvazione della Federal Deposit Insurance Corporation (FDIC) e di altre agenzie governative competenti.

Aggiornamenti broker dal 30 novembre-6 dicembre

Le autorità cinesi hanno confiscato criptovalute per un valore di oltre 4,2 miliardi di dollari in relazione alla famigerata truffa Plus Token, rivelano i file del tribunale locale.

Aggiornamenti broker dal 23-29 novembre

Matthew Piercey, l'uomo dietro due società di investimento - Zolla e Family Wealth Legacy, è stato arrestato dagli agenti dell'FBI a Sacramento con l'accusa di frode telematica, manomissione di testimoni, frode postale e riciclaggio di denaro, che si è appropriata indebitamente di circa 35 milioni di dollari di fondi degli investitori, come affermato dalla corte degli Stati Uniti.

Aggiornamenti dei broker dal 9-15 novembre

Salgono a 323 i domini dei servizi finanziari bloccati da Consob.

WikiFX Trader

HFM

FBS

FXTM

Exness

FXCM

Pepperstone

HFM

FBS

FXTM

Exness

FXCM

Pepperstone

WikiFX Trader

HFM

FBS

FXTM

Exness

FXCM

Pepperstone

HFM

FBS

FXTM

Exness

FXCM

Pepperstone

Rate Calc