Mohicans markets:MHM European Market

Sommario:On Monday (January 9) in Asia, spot gold rose in shock, hitting an eight month high of 1879.36 US dollars/ounce. Due to the poor performance of the US economic data last week, the Federal Reserve in the market will narrow the interest rate increase in January, and the yield of US bonds fell to a low level in nearly two weeks.

Market Overview

On Monday (January 9) in Asia, spot gold rose in shock, hitting an eight month high of 1879.36 US dollars/ounce. Due to the poor performance of the US economic data last week, the Federal Reserve in the market will narrow the interest rate increase in January, and the yield of US bonds fell to a low level in nearly two weeks. After the sharp fall of the US dollar index last Friday, the decline continued on Monday, approaching a low level for more than half a year, providing momentum for the gold price to rise.

The market began to turn its attention to the US December CPI data to be released on Thursday. This trading day focused on the speech of Fed officials, news related to geographical situation and changes in market risk appetite.

Mohicans Markets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on January 9, 2023 Beijing time.

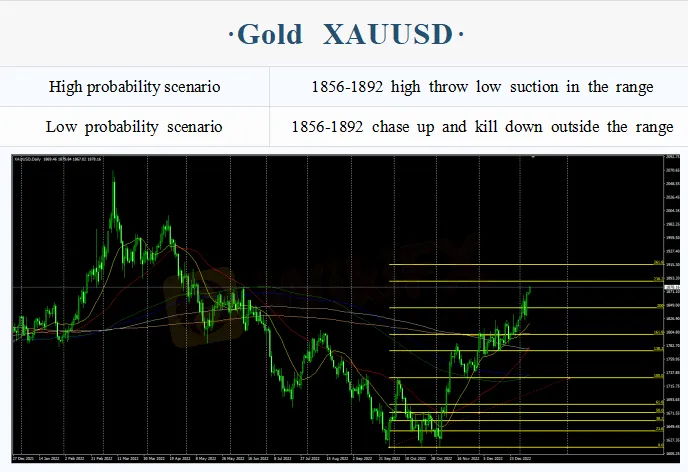

Intraday Oscillation Range: 1833-1856-1873-1890

Overall Large Oscillation Range: 1730-1756-1780-1801-1817-1833-1856-1873-1890-1911

Spot gold in the subsequent period, 1833-1856-1873-1890 can be operated as an intraday range of bullish and bearish; high throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on January 9. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 23.1-23.9-24.5-25.3

Overall Large Oscillation Range: 20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1

Spot silver in the subsequent period, 23.1-23.9-24.5-25.3 can be operated as an intraday range of bullish and bearish; high throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on January 9. This policy is a daytime policy. Please pay attention to the policy release time.

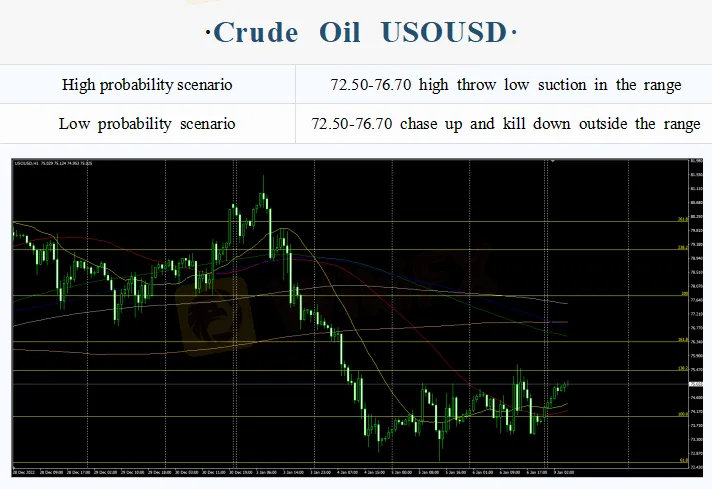

Intraday Oscillation Range: 72.3-73.1-73.8-75.1-77.3

Overall Large Oscillation Range:

70.1-71.2-72.3-73.1-73.8-75.1-77.3-78.5-79.9-81.3-82.1-83.5

Crude Oil in the subsequent period, 72.3-73.1-73.8-75.1-77.3 can be operated as an intraday range of bullish and bearish; high throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on January 9. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 1.0570-1.0690-1.0755

Overall Large Oscillation Range:

1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0910

EURUSD in the subsequent period, 1.0570-1.0690-1.0755 can be operated as an intraday range of bullish and bearish; high throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on January 9. This policy is a daytime policy. Please pay attention to the policy release time.

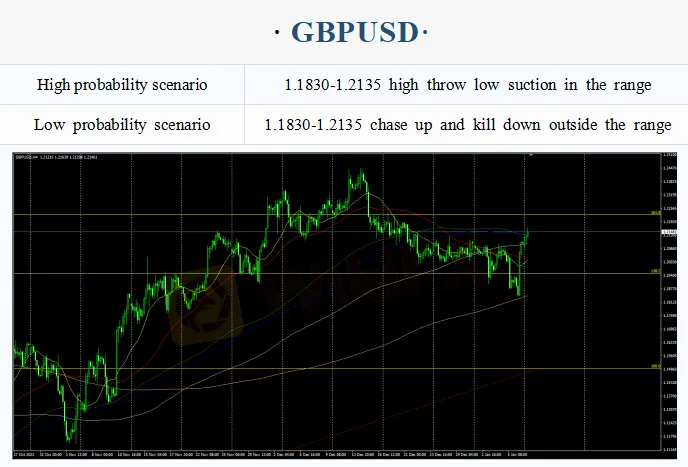

Intraday Oscillation Range: 1.1920-1.2030-1.2135-1.2250

Overall Large Oscillation Range:

1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2400-1.2470

GBPUSD in the subsequent period, 1.1920-1.2030-1.2135-1.2250 can be operated as an intraday range of bullish and bearish; high throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on January 9. This policy is a daytime policy. Please pay attention to the policy release time.

WikiFX Trader

IB

FXCM

STARTRADER

IC Markets Global

FOREX.com

EC Markets

IB

FXCM

STARTRADER

IC Markets Global

FOREX.com

EC Markets

WikiFX Trader

IB

FXCM

STARTRADER

IC Markets Global

FOREX.com

EC Markets

IB

FXCM

STARTRADER

IC Markets Global

FOREX.com

EC Markets

Rate Calc