FX Global

Sommario:TopTrader, founded in 2014 and registered in Cyprus, is an online broker that is regulated by CySEC. Traders can access a diverse range of tradable instruments on the platform, including stocks, ETFs, indices, commodities, and forex, providing ample opportunities for portfolio diversification. TopTrader offers two trading platforms: MetaTrader5 (MT5) and their proprietary TopTrader platform. Both platforms are user-friendly and equipped with advanced features to facilitate efficient trading. The broker does not impose any minimum deposit requirements, allowing traders of all financial capabilities to participate in the market. Traders can also enjoy generous leverage options of up to 1:500, which can potentially amplify their trading positions. The broker provides three account types: Standard, Pro, and VIP, catering to the diverse needs of traders. Spreads start from as low as 0.1 pips, providing competitive pricing for traders. TopTrader offers a variety of deposit and withdrawal me

| Information | Details |

| Company Name | TopTrader |

| Registered Country/Region | Cyprus |

| Founded in | 2014 |

| Regulation | CySEC |

| Tradable Instruments | Stocks, ETFS, Indices,Commodities, and Forex |

| Trading Platforms | MetaTrader5 and TopTrader platform |

| Minimum Deposit | No requirements |

| Maximum Leverage | 1:500 |

| Account Types | Standard, pro, and VIP |

| Spreads | From 0.1 pips |

| Commission | Not specific |

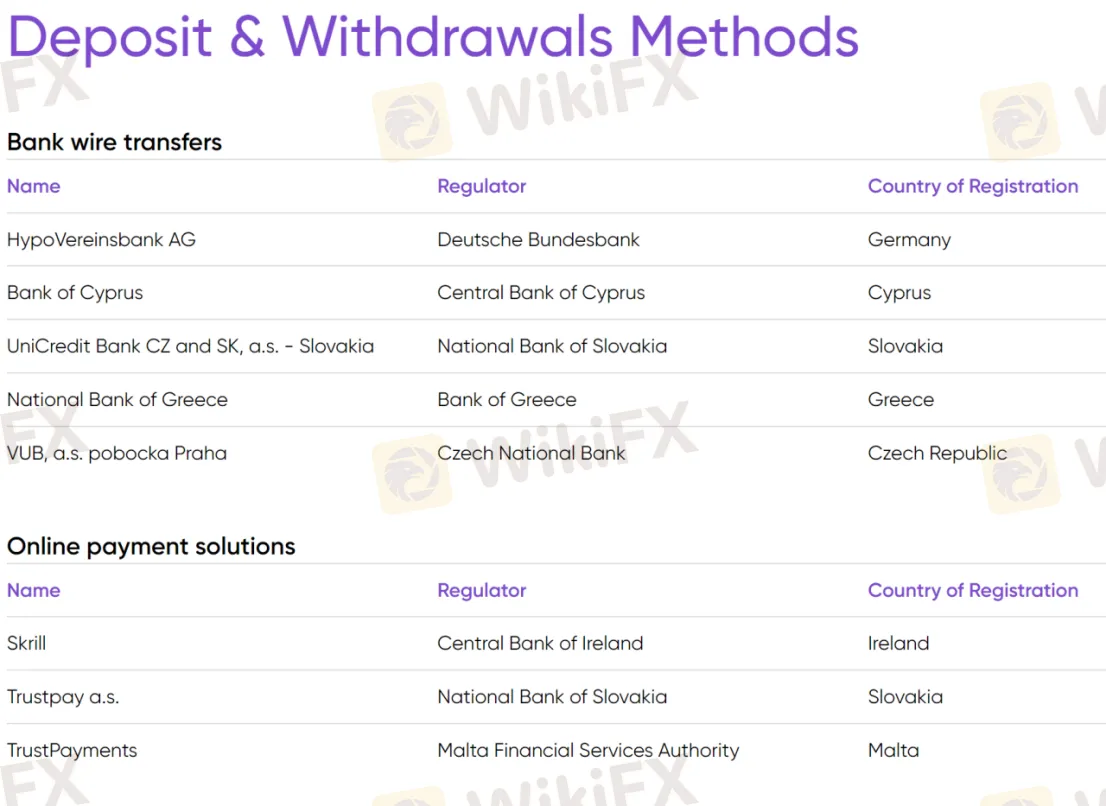

| Deposit& Withdrawal Methods | 13 categories including INFINOX, Skrill, TrustPay, Yourfintech, MetaQuotes, and Sumsub |

| Education | eBooks, Video Academy, and economic calendar |

| Customer Support | Live chat, phone, and email |

Please note that Goldenburg Group Limited no longer offers its services on this brand. However, you can use the services of Top Trader by visiting the website https://toptrader.eu/

Overview of TopTrader

TopTrader, founded in 2014 and registered in Cyprus, is an online broker that is regulated by CySEC. Traders can access a diverse range of tradable instruments on the platform, including stocks, ETFs, indices, commodities, and forex, providing ample opportunities for portfolio diversification.

TopTrader offers two trading platforms: MetaTrader5 (MT5) and their proprietary TopTrader platform. Both platforms are user-friendly and equipped with advanced features to facilitate efficient trading. The broker does not impose any minimum deposit requirements, allowing traders of all financial capabilities to participate in the market. Traders can also enjoy generous leverage options of up to 1:500, which can potentially amplify their trading positions.

The broker provides three account types: Standard, Pro, and VIP, catering to the diverse needs of traders. Spreads start from as low as 0.1 pips, providing competitive pricing for traders. TopTrader offers a variety of deposit and withdrawal methods, with 13 categories available, including well-known options such as INFINOX, Skrill, and MetaQuotes.

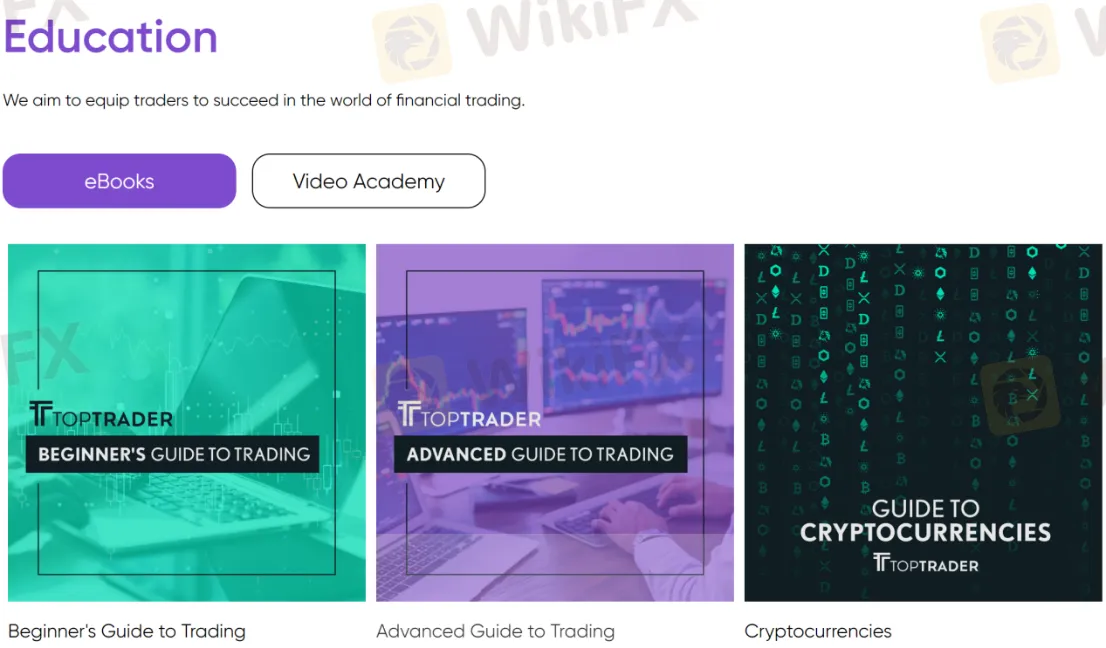

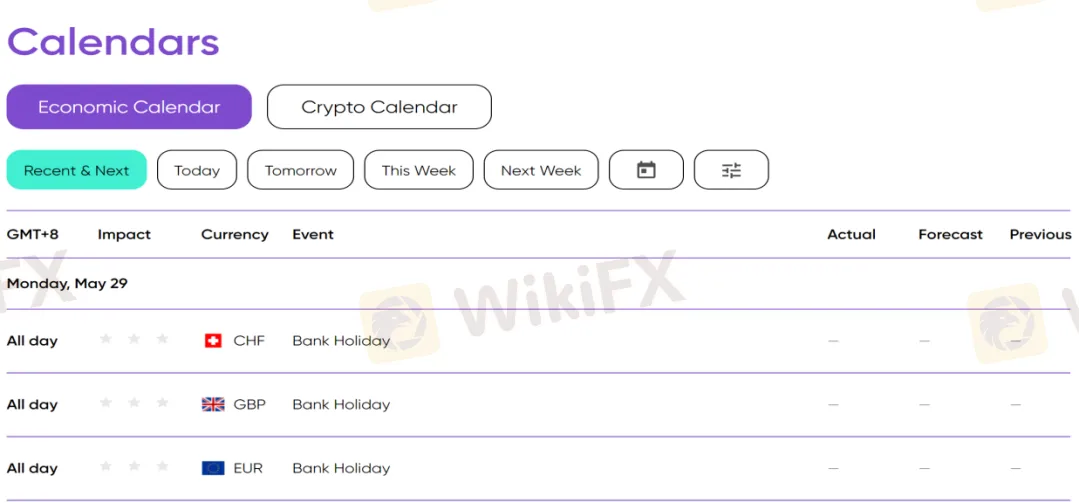

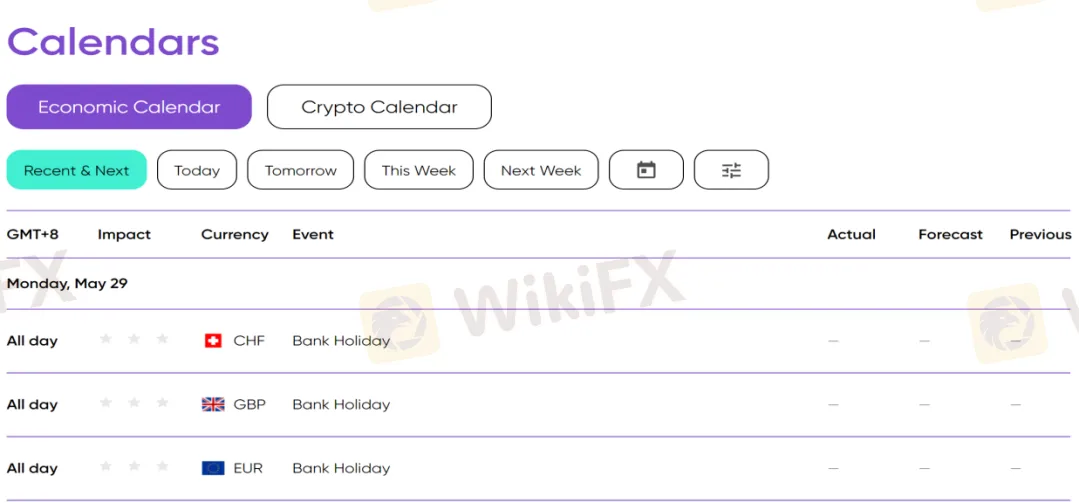

To support traders' educational needs, TopTrader provides a range of educational resources, including eBooks, a Video Academy, and an economic calendar. This helps traders stay informed about market events and enhance their trading knowledge. Customer support at TopTrader is available via live chat, phone, and email.

Is TopTrader legit or a scam?

TopTrader is a trusted and legitimate broker, and it operates in compliance with the regulations set by CySEC (Cyprus Securities and Exchange Commission). CySEC is a reputable European regulatory authority that oversees and supervises the activities of financial service providers to ensure fair and transparent practices in the financial markets.

The regulatory oversight provides an added layer of protection for traders, as it ensures that the broker operates by industry standards and safeguards the interests of its clients. Traders can have confidence in TopTrader's operations, knowing that the broker operates within the regulatory framework set by CySEC. It is always recommended to choose regulated brokers as they are subject to regular audits and monitoring, which helps maintain a higher level of safety and accountability.

Pros and Cons

TopTrader has several advantages that make it an attractive choice for traders. Firstly, the broker is regulated by CYSEC, and it offers a wide range of trading instruments, allowing traders to diversify their portfolios and access various markets. Additionally, the broker does not impose a minimum deposit requirement, making it accessible to traders with different financial capabilities. Moreover, TopTrader offers relatively low spreads starting from 0.1 pips and a generous leverage of up to 1:500, which can be advantageous for traders seeking cost-effective trading opportunities, amplifying potential profits for traders.

Furthermore, TopTrader offers three account types to cater to different trading needs, with its comprehensive customer support services letting traders receive assistance and guidance when needed. The user-friendly MT5 trading platform enhances the trading experience, offering advanced features and tools for analysis and execution. Lastly, TopTrader provides free educational materials such as eBooks, Video Academy, and an economic calendar, helping traders expand their knowledge and make informed trading decisions.

However, there are a couple of drawbacks to consider. Firstly, TopTrader does not offer 24/7 customer support, which can be inconvenient for traders who require immediate help outside of regular support hours. It is important for traders to take these factors into account and plan accordingly when considering their trading activities with TopTrader.

| Pros | Cons |

| Regulated by CYSEC | Swap fees for the Standard Account |

| Wide range of trading instruments available | Limited customer support hours |

| No minimum deposit requirement | No 7/24 customer support |

| Relatively low spreads from 0.1 pips | |

| Generous leverage up to 1:500 | |

| Three account types to suit different needs | |

| Comprehensive customer support offered | |

| The user-friendly trading platform MT5 | |

| Free education materials, including eBooks, Video Academy, and economic calendar | |

| A demo account provided |

Market Instruments

The broker provides a diverse range of trading opportunities with a wide selection of options including Stocks, ETFs, Indices, Commodities, Cryptocurrencies, and Forex. This allows clients to have exposure to different markets and diversify their trading portfolio. Additionally, traders can conveniently access and trade these markets 24/7 from a single trading platform, offering flexibility and accessibility.

Account Types

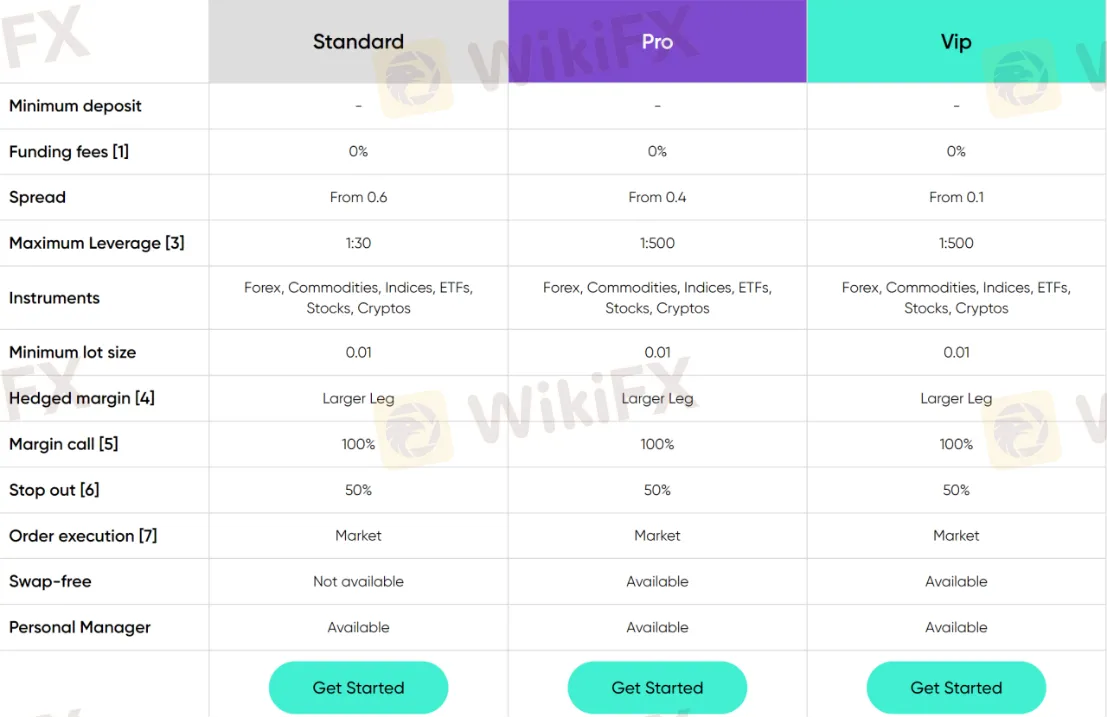

TopTrader offers traders three account types, including Standard, pro, and VIP accounts.

The Standard Account offered by TopTrader requires no minimum deposit and has no funding fees. The spread starts from 0.6, providing competitive pricing for traders. The maximum leverage for this account type is 1:30, allowing for a moderate level of risk management. However, swap-free options are not available for the Standard account.

TopTrader's Pro Account also does not have a minimum deposit requirement and does not charge funding fees. The spread for this account type starts from 0.4, offering tighter pricing compared to the Standard account. Traders can enjoy a higher maximum leverage of 1:500, which provides greater trading flexibility. Swap-free options are available for those who require them.

TopTrader's VIP Account has no minimum deposit requirement and does not charge funding fees. With a spread starting from 0.1, traders can benefit from tighter pricing and potentially lower trading costs. The maximum leverage for the VIP account is 1:500, providing high trading power and flexibility. Swap-free options are also available for traders who prefer them.

The three account types all give traders access to a wide range of instruments, including Forex, Commodities, Indices, ETFs, Stocks, and Cryptos. The minimum lot size is 0.01, providing flexibility in position sizing. Additionally, new traders have the opportunity to use a demo account for free, allowing them to practice trading and make trial trades.

How to Open an Account?

Opening an account with TopTrader just needs very simple procedures.

1. Visit the TopTrader website at https://toptrader.eu/.

2. Click on the “Get Started” button, typically located in the top-right corner of the website.

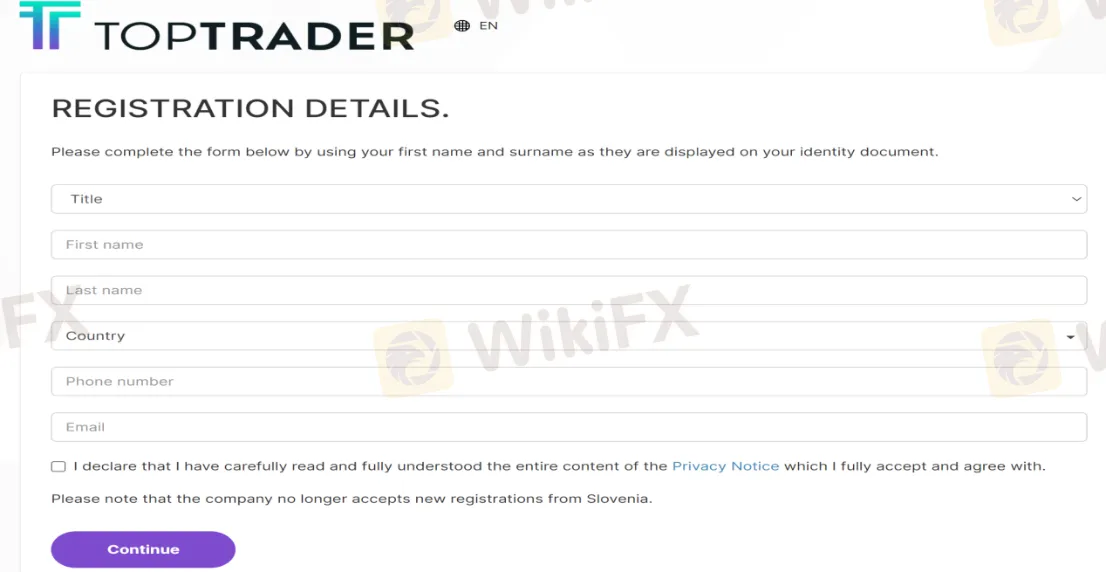

3. You will be directed to the account registration page. Fill in the required information, including your name, email address, country of residence, and preferred account type.

4. Choose your preferred funding method and provide the necessary details for depositing funds into your trading account.

5. Once your account registration is complete and your information is verified, you will receive login credentials to access your account.

6. Log in to your TopTrader account using the provided credentials. Familiarize yourself with the platform, explore available trading tools, and consider setting up any additional preferences or settings.

Leverage

TopTrader offers a maximum leverage level of 1:500, which is a relatively high ratio in the FX market. However, it is important to recognize that higher leverage levels come with increased risk. Leverage allows traders to access the market with a smaller capital investment, but it also amplifies both potential profits and losses.

While leverage can be a valuable tool, it is crucial for traders to have a thorough understanding of how it works and the potential outcomes associated with its use. The use of leverage requires careful risk management and consideration of one's trading strategy.

Spreads & Commissions

TopTrader provides its clients with competitive and floating spreads for specific account types and trading instruments. For instance, the popular EUR/USD currency pair in Forex trading typically has an average spread of 0.7 pips, which is considered favorable for traders. Furthermore, TopTrader offers competitive spreads for other financial instruments as well. This means that traders operating in different markets, such as stocks, commodities, or cryptocurrencies, can benefit from attractive spreads when trading with TopTrader. The availability of competitive spreads across multiple markets enhances the overall trading experience and can be a significant factor in selecting a broker.

As for commission information, TopTrader does not list a separate section to clearly inform users, but states in the FAQ section that it does not charge commissions.

Non-trading Fees

In addition to trading fees, brokers may also charge non-trading fees, which are fees that are not directly related to trading activities. These fees can include withdrawal fees, inactivity fees, and account maintenance fees, among others.

It is important for traders to be aware that TopTrader imposes an inactivity fee of $100 if an account remains inactive for a month. This fee is intended to encourage active trading and account usage. Additionally, swap or rollover fees are applied to positions that are held open overnight. These fees represent the opportunity cost associated with holding a position beyond the trading day.

By understanding and considering these non-trading fees, traders can make informed decisions and effectively manage their trading accounts. It is recommended to review the fee structure provided by the broker and familiarize oneself with the specific details and conditions associated with each fee.

Trading Platforms

TopTrader offers its clients two advanced and user-friendly trading platforms: MetaTrader 5 (MT5) and its proprietary platform. These platforms are available on desktop, web, and mobile devices, ensuring traders can stay connected to the markets and trade at their convenience. This flexibility makes them suitable for a wide range of traders.

The MT5 platform is an upgraded and more advanced version of its predecessor, MT4. It offers traders additional features and tools to enhance their trading experience. These include advanced charting capabilities, a broader selection of financial instruments, and improved functionality. Traders can access various chart types, multiple timeframes, and a wide range of technical indicators to aid in their market analysis.

On the other hand, TopTrader's proprietary platform is designed with user-friendliness in mind. It provides traders with advanced trading features, such as social trading, which allows them to follow and copy the trades of successful traders. Additionally, algorithmic trading capabilities are available, enabling traders to automate their strategies. The platform also offers various order types to suit different trading preferences.

Deposit & Withdrawal

While TopTrader does not impose deposit or withdrawal fees, it is important to note that the payment providers used for these transactions may charge fees. These fees are determined by the payment provider itself and are beyond the control of the broker. Traders are advised to check with their respective payment providers to determine if any fees will be incurred during deposit or withdrawal transactions.

TopTrader offers clients various funding options, including bank wire transfers, credit/debit cards, and online payment systems such as Skrill and Neteller. It is important to be aware that each funding method may have specific requirements and limitations based on the financial institution involved and the client's country of residence. Traders should familiarize themselves with the terms and conditions of their chosen funding method to ensure a smooth and hassle-free transaction process.

Minimum Deposit

TopTrader offers a flexible option for traders as there is no minimum deposit requirement to open a trading account. This means that individuals with varying financial capabilities can access the platform and start trading. However, it is important to note that certain funding methods may have their own minimum deposit amounts or fees associated with them.

To ensure transparency and avoid any surprises, it is recommended to review the details regarding minimum deposit amounts and fees associated with specific funding methods. This information can typically be found on the TopTrader website or by contacting their customer support.

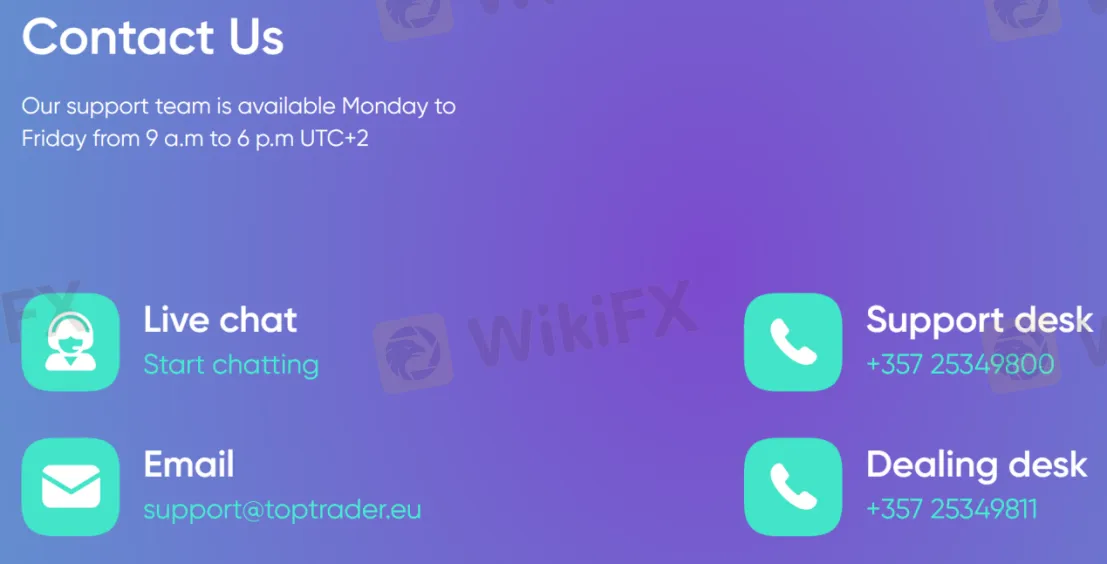

Customer Support

It is worth mentioning that although TopTrader's customer support is very diverse and comprehensive, it offers help and questions 24/5, with a specific time limit. Traders at TopTrader have access to 24/5 customer support through various channels, including Live chat, Email, Support desk, and Dealing desk.

Whether you require assistance with technical difficulties, analysis advice, general questions, or operational issues, the support team at TopTrader is available to provide prompt and helpful support.

Educational Resources

Finally, it is worth mentioning that TopTrader has a dedicated “Learn Center” section on its website, offering a range of educational resources for traders. These resources include eBooks and a Video Academy, catering to traders at various skill levels, from beginners to advanced. Additionally, they provide specialized courses on topics like cryptocurrencies and MetaTrader5.

Furthermore, TopTrader offers Economic and Crypto calendars, allowing traders to stay updated with important events and announcements that may impact the markets. To assist traders in honing their skills and testing strategies, the broker provides a free demo account. This allows traders to practice trading in a risk-free environment before committing real funds.

Conclusion

In conclusion, TopTrader is a well-regulated online broker that offers traders a range of trading instruments, competitive spreads and fees, multiple funding methods, and advanced trading platforms. The brokers proprietary trading platform and the MT5 platform provide traders with a user-friendly interface and advanced trading features, including algorithmic trading, social trading, and a range of order types.

TopTrader also provides reliable customer support and its education section provides good learning materials, yet not as comprehensive as other popular Brokers. We have also found that it lacks research materials, seminars, and webinars.

Overall, TopTrader is a trustworthy and affordable choice for traders seeking a licensed broker to manage their trades. However, we recommend conducting thorough research before choosing TopTrader as your broker to ensure that it suits your trading requirements.

FAQs

Q: What is TopTrader?

A: TopTrader is an online trading platform that provides access to a wide range of financial markets, including forex, stocks, commodities, and cryptocurrencies.

Q: What financial instruments can I trade on TopTrader?

A: TopTrader offers a diverse range of financial instruments, including major and minor currency pairs, stocks of leading companies, commodities like gold and oil, and popular cryptocurrencies such as Bitcoin and Ethereum.

Q: What are the deposit and withdrawal methods available?

A: TopTrader supports various convenient and secure payment methods, including INFINOX, Skrill, TrustPay, Yourfintech, MetaQuotes, and Sumsub.

Q: Is there a minimum deposit requirement?

A: No, TopTrader does not have the minimum deposit requirement.

Q: Is there customer support available?

A: Yes, TopTrader provides customer support to assist traders with any questions or issues they may encounter. Its support team can be reached through various channels, including live chat, email, and phone.

Q: Does TopTrader offer educational resources for traders?

A: Yes, it provides a range of educational resources, including eBooks, Video Academy, and an economic calendar.

WikiFX Trader

IC Markets Global

OANDA

FXTM

EC Markets

IB

FP Markets

IC Markets Global

OANDA

FXTM

EC Markets

IB

FP Markets

WikiFX Trader

IC Markets Global

OANDA

FXTM

EC Markets

IB

FP Markets

IC Markets Global

OANDA

FXTM

EC Markets

IB

FP Markets

Rate Calc