EIE Trading Market

Sommario:EIE Trading Market is a brokerage firm operating in the United States. It was founded approximately 1-2 years ago and operates under the name EIE Trading Market. However, it's important to note that the claimed regulation by NFA (National Futures Association) is suspicious and may not be authentic. Traders should exercise caution and conduct thorough research before engaging with this broker.

| EIE Trading Market | Basic Information |

| Registered Country | United States |

| Founded Year | 1-2 years |

| Company Name | EIE Trading Market |

| Regulation | NFA ( suspicious clone) |

| Minimum Deposit | Basic ($500), Advanced ($2,000), VIP ($10,000) |

| Maximum Leverage | Basic (1:50), Advanced (1:200), VIP (Personalized ) |

| Spreads | Information not available |

| Trading Platforms | Desktop platform for Windows, Android, Apple |

| Tradable Assets | Not specified |

| Account Types | Basic, Advanced, VIP |

| Demo Account | Availability not specified |

| Islamic Account | Availability not specified |

| Customer Support | Email: support@eietradingmarket.com Whatsapp: 1 518 460 8203 |

| Payment Methods | Cryptocurrencies, Bank Wire |

| Educational Tools | Information not available |

Overview

EIE Trading Market is a brokerage firm operating in the United States. It was founded approximately 1-2 years ago and operates under the name EIE Trading Market. However, it's important to note that the claimed regulation by NFA (National Futures Association) is suspicious and may not be authentic. Traders should exercise caution and conduct thorough research before engaging with this broker.

The minimum deposit required by EIE Trading Market varies based on the account type. For the Basic account, the minimum deposit is $500, for the Advanced account it is $2,000, and for the VIP account, it is $10,000. These account types also come with different maximum leverage options. The Basic account offers leverage of up to 1:50, the Advanced account offers leverage of up to 1:200, and the VIP account provides personalized leverage options.

Unfortunately, information about the spreads offered by EIE Trading Market is not available. This lack of transparency regarding spreads makes it difficult for traders to assess the cost-effectiveness of trading with this broker. Additionally, the specific range of tradable assets is not specified, leaving traders uncertain about the available options for investment.

EIE Trading Market offers a desktop trading platform that is compatible with Windows, Android, and Apple devices. However, popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are not mentioned, which can be considered a drawback for traders who prefer these widely used platforms. Customer support for EIE Trading Market can be reached through email at support@eietradingmarket.com and via WhatsApp at 1 518 460 8203. However, it's important to note that the availability and responsiveness of customer support may vary.

Overall, it's important for traders to approach the EIE Trading Market with caution due to the lack of regulation and limited information available.

Is legit or a scam?

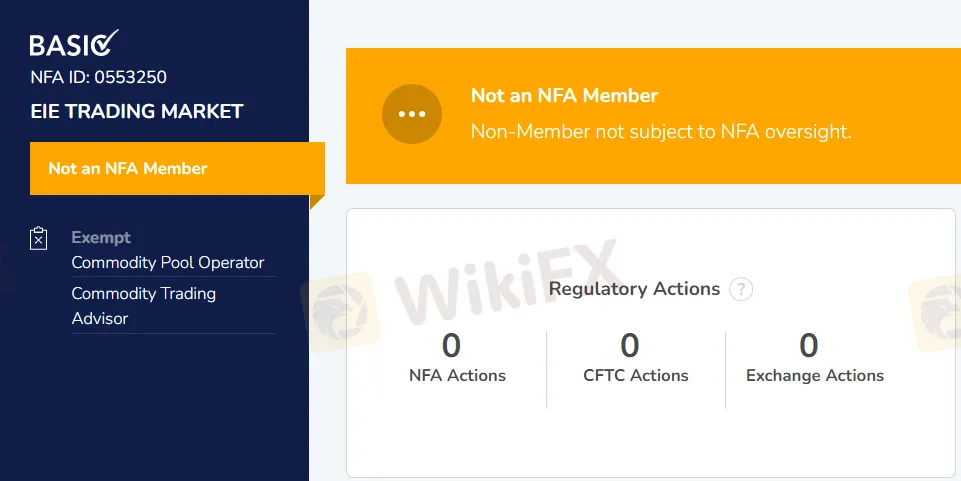

EIE Trading Market asserts its regulatory affiliation with the National Futures Association (NFA), a well-respected regulatory body in the financial sector. However, upon thorough investigation, it has come to light that the NFA license displayed by EIE Trading Market is highly suspicious and appears to be a deceptive replica or imitation. This revelation raises serious doubts about the broker's integrity and the authenticity of its claimed regulatory status.

Regulation holds immense significance in the forex industry as it establishes stringent guidelines for brokers, safeguards clients' funds, and ensures transparency and accountability. In the case of EIE Trading Market, the absence of genuine regulation presents a substantial risk for traders. Without proper oversight and adherence to industry standards, there is no guarantee that the broker operates with integrity or follows established best practices.

In short, traders must exercise utmost caution when dealing with brokers that are either unregulated or possess questionable regulatory credentials.

Pros and Cons

EIE Trading Market presents a number of concerns and drawbacks that traders should carefully consider. Firstly, the broker lacks regulation, as its claim of being regulated by the NFA is suspicious and unverified.

Additionally, the broker lacks transparency regarding spreads and tradable assets, which hinders traders' ability to assess the cost-effectiveness and range of available instruments. Furthermore, the limited trading platforms offered, without the mention of popular options like MT4 or MT5, may disappoint traders seeking familiar and widely-used platforms. Lastly, the lack of detailed information on payment methods and associated fees, as well as the absence of educational tools and resources, further detract from the overall appeal of EIE Trading Market as a reliable and comprehensive brokerage option.

| Pros | Cons |

| None | Lack of regulation and suspicious NFA claim |

| Lack of transparency in spreads and tradable assets | |

| Limited trading platforms, no mention of MT4 or MT5 | |

| Uncertainty about the availability of demo and Islamic accounts | |

| Limited information on customer support availability and responsiveness | |

| Lack of detailed information on payment methods and associated fees | |

| Absence of educational tools and resources |

Market Instruments

Failling get access to the official website or any reliable information sources, it is not possible to provide a detailed description of the market instruments offered by EIE Trading Market.

As a trader, it is essential to have a clear understanding of the available trading assets before engaging with a broker. The range of market instruments typically includes stocks, indices, commodities, forex currency pairs, and cryptocurrencies. However, without specific information about EIE Trading Market's offerings, it is advisable to seek alternative brokers or platforms that provide transparent and easily accessible information regarding their market instruments.

Account Types

EIE Trading Market offers three tiered trading accounts to cater to the varying needs of traders.

The Basic account is designed for novice traders and requires a minimum deposit of $500. It provides access to a limited range of tradable assets, standard leverage options, and basic customer support.

The Advanced account is geared towards intermediate traders and requires a minimum deposit of $2,000. With the Advanced account, traders have access to a wider selection of tradable instruments, competitive leverage options of up to 1:200, advanced trading tools, and additional customer support channels.

The VIP account is the highest tier and is tailored for experienced traders or high-net-worth individuals. It requires a minimum deposit of $10,000 and offers a comprehensive range of tradable assets across various markets, personalized leverage options, dedicated customer support, priority access to new features and promotions, and exclusive trading resources.

| Account Type | Minimum Deposit | Tradable Assets | Leverage | Additional Benefits |

| Basic | $500 | Limited | Up to 1:50 | Basic customer support, standard leverage options |

| Advanced | $2,000 | Expanded | Up to 1:200 | Advanced trading tools, additional customer support channels |

| VIP | $10,000 | Extensive | Personalized | Dedicated customer support, priority access to new features and promotions, exclusive trading resources |

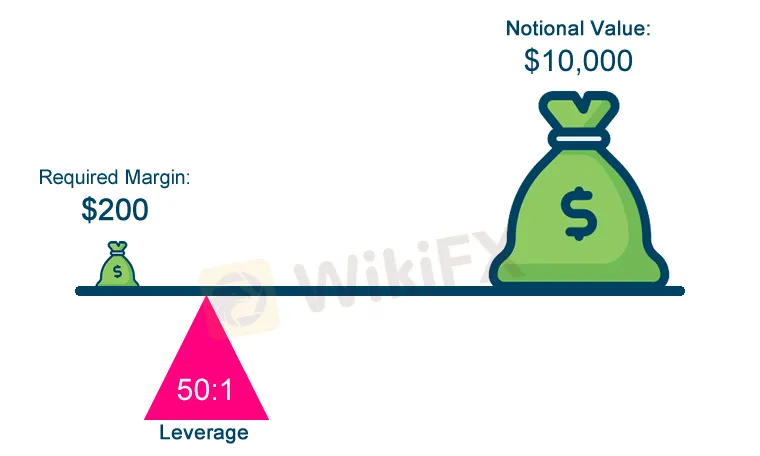

Leverage

EIE Trading Market offers different leverage options for each of its account types. The leverage provided depends on the account type chosen by the trader. The available leverage levels are as follows:

Basic Account: Up to 1:50 leverage

Advanced Account: Up to 1:200 leverage

VIP Account: Personalized leverage

Leverage is a powerful tool that enables traders to amplify their positions and potentially increase their profits. However, it's important to note that higher leverage also carries a higher level of risk. Traders should exercise caution and carefully consider their risk tolerance and trading strategy when utilizing leverage. EIE Trading Market provides varying leverage options to cater to the different needs and preferences of traders.

Spreads & Commissions

EIE Trading Market does not openly disclose the details of its spreads and commissions on its website or other accessible platforms. The absence of transparent information regarding spreads and commissions may present a challenge for traders who rely on this data to assess the cost-effectiveness of trading with the broker.

Non-trading Fees

Unfortunately, due to the lack of available information on EIE Trading Market's website or other sources, we could not find specific details regarding the other fees charged by the broker. This includes fees such as overnight interest fees, deposit and withdrawal fees, and inactivity fees.

Deposit & Withdrawal

EIE Trading Market only supports payment options for deposits and withdrawals through cryptocurrencies and bank wire transfers. However, specific details regarding the minimum deposit requirements, associated trading fees, and processing times are not provided. It's important to note that using cryptocurrencies for financial transactions carries inherent risks.

When depositing or withdrawing funds through cryptocurrencies, there are potential risks such as price volatility, transaction delays, and security vulnerabilities. The value of cryptocurrencies can fluctuate rapidly, which means the amount of funds you deposit or withdraw may vary significantly based on market conditions. Additionally, transaction confirmations can take varying amounts of time, depending on the cryptocurrency network's congestion. Furthermore, the security of cryptocurrency transactions relies heavily on the user's adherence to proper security practices. It is crucial to ensure the safety of your cryptocurrency wallet, use secure networks for transactions, and be cautious of potential phishing attempts or hacking risks.

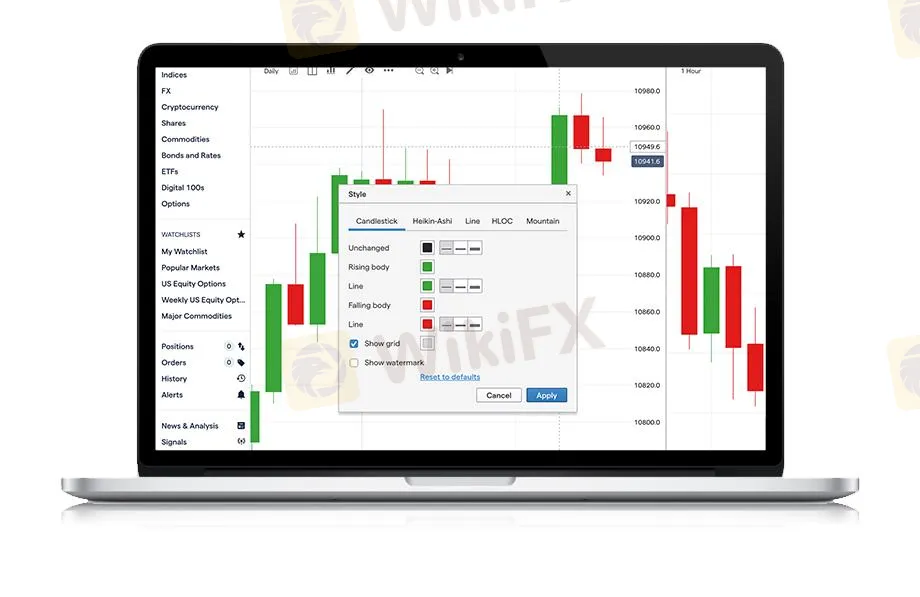

Trading Platforms

EIE Trading Market provides a desktop trading platform that is compatible with Windows, Android, and Apple devices. While the availability of a proprietary trading platform offers convenience and accessibility to traders using different operating systems, it is worth noting that the absence of popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) can be considered a drawback for some traders.

MT4 and MT5 are widely recognized and preferred by traders globally due to their advanced charting tools, extensive technical indicators, and automated trading capabilities. These platforms have established a reputation for their stability, reliability, and user-friendly interface, making them popular choices among traders of various experience levels.

Customer Support

EIE Trading Market offers customer support through two primary channels: email and WhatsApp. Traders can reach out to the broker's support team via email at support@eietradingmarket.com.

Additionally, EIE Trading Market also provides a WhatsApp contact number: +1 518 460 8203. This allows traders to connect with the support team through the popular instant messaging platform, enabling quick and direct communication.

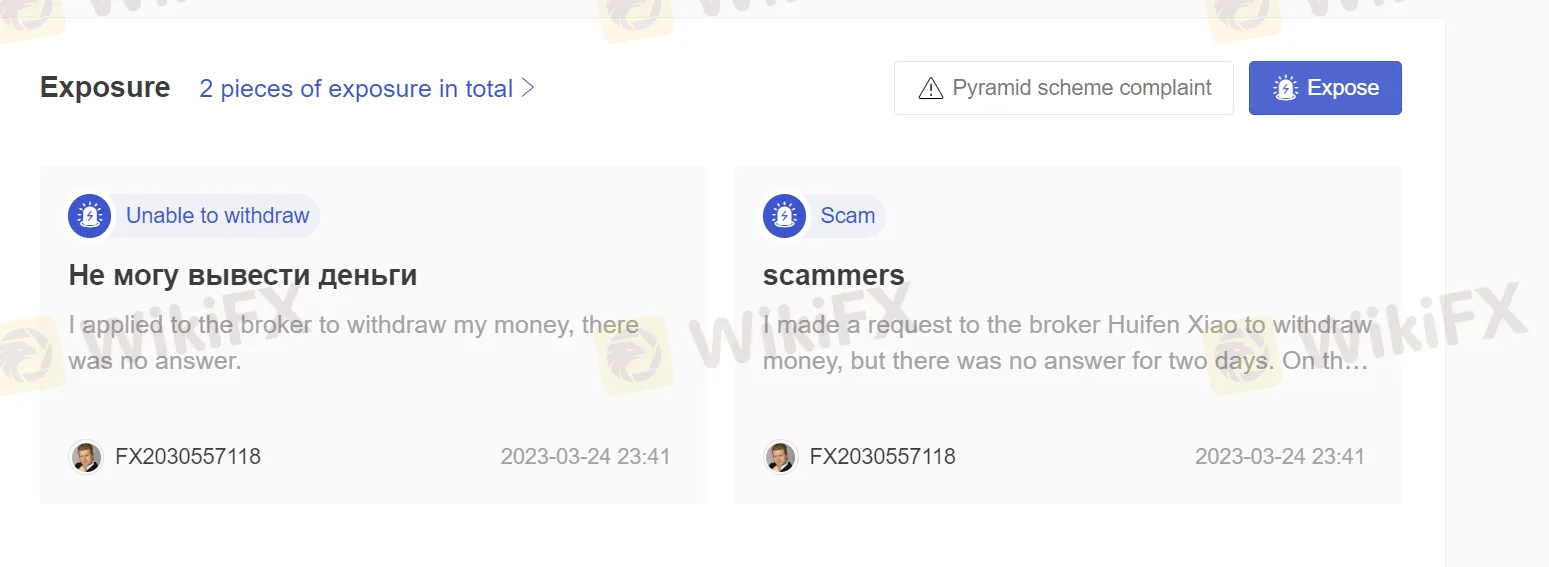

User Exposure

EIE Trading Market has faced criticism and negative reviews from certain individuals who have alleged that the broker engaged in fraudulent activities and manipulative practices. These reviews highlight concerns regarding the integrity and trustworthiness of the broker.

Conclusion

In conclusion, EIE Trading Market raises several red flags and concerns that potential traders should take into consideration. The lack of regulation and questionable claim of NFA regulation raises doubts about the broker's credibility and the security of clients' funds. The absence of transparent information regarding spreads, tradable assets, and available trading platforms makes it difficult for traders to assess the suitability and competitiveness of the broker. Furthermore, the uncertainty surrounding the availability of demo and Islamic accounts, limited customer support information, and the lack of detailed payment method and educational tool information further contribute to the overall uncertainty and potential risks associated with EIE Trading Market.

FAQs

Q: Is EIE Trading Market a regulated broker?

A: EIE Trading Market claims to be regulated by the NFA, but further investigation reveals that the NFA license is suspicious and possibly a clone, raising concerns about the broker's actual regulatory status.

Q: What is the minimum deposit required to open an account with EIE Trading Market?

A: The minimum deposit required varies based on the account type. The Basic account requires a minimum deposit of $500, the Advanced account requires $2,000, and the VIP account requires $10,000.

Q: What leverage options are available at EIE Trading Market?

A: The leverage offered by EIE Trading Market depends on the chosen account type. The Basic account offers a maximum leverage of 1:50, the Advanced account offers 1:200, and the VIP account provides personalized leverage.

Q: Are demo accounts available for practice trading?

A: The availability of demo accounts is not specified on EIE Trading Market's website. Traders should contact the broker directly to inquire about the availability of demo accounts.

Q: What customer support options are available at EIE Trading Market?

A: EIE Trading Market can be contacted via email at support@eietradingmarket.com and through WhatsApp at +1 518 460 8203. However, the availability of customer support and response times are not clearly stated.

Leggi di più

Aggiornamenti broker dal 7-13 dicembre

La bolletta denominata Stablecoin Tethering and Bank Licensing Enforcement Act., proposto da Rashida Tlaib, un democratico del Michigan, insieme ai membri del Congresso, Jesus García e Stephen Lynch, mira a proteggere i consumatori dalle minacce emergenti associate al mercato delle criptovalute e richiederà a chiunque che offre stablecoin l'approvazione della Federal Deposit Insurance Corporation (FDIC) e di altre agenzie governative competenti.

Aggiornamenti broker dal 30 novembre-6 dicembre

Le autorità cinesi hanno confiscato criptovalute per un valore di oltre 4,2 miliardi di dollari in relazione alla famigerata truffa Plus Token, rivelano i file del tribunale locale.

Aggiornamenti broker dal 23-29 novembre

Matthew Piercey, l'uomo dietro due società di investimento - Zolla e Family Wealth Legacy, è stato arrestato dagli agenti dell'FBI a Sacramento con l'accusa di frode telematica, manomissione di testimoni, frode postale e riciclaggio di denaro, che si è appropriata indebitamente di circa 35 milioni di dollari di fondi degli investitori, come affermato dalla corte degli Stati Uniti.

Aggiornamenti dei broker dal 9-15 novembre

Salgono a 323 i domini dei servizi finanziari bloccati da Consob.

WikiFX Trader

XM

HFM

Exness

Ultima

EC Markets

FXTM

XM

HFM

Exness

Ultima

EC Markets

FXTM

WikiFX Trader

XM

HFM

Exness

Ultima

EC Markets

FXTM

XM

HFM

Exness

Ultima

EC Markets

FXTM

Rate Calc