Big-Tech leads US Stocks lower, Gold slides again, Bonds bid ahead of CPI

Sommario:The key US stock indices experienced a volatile session on Wednesday due to traders adjusting their positions in anticipation of yesterday's crucial US CPI data release.

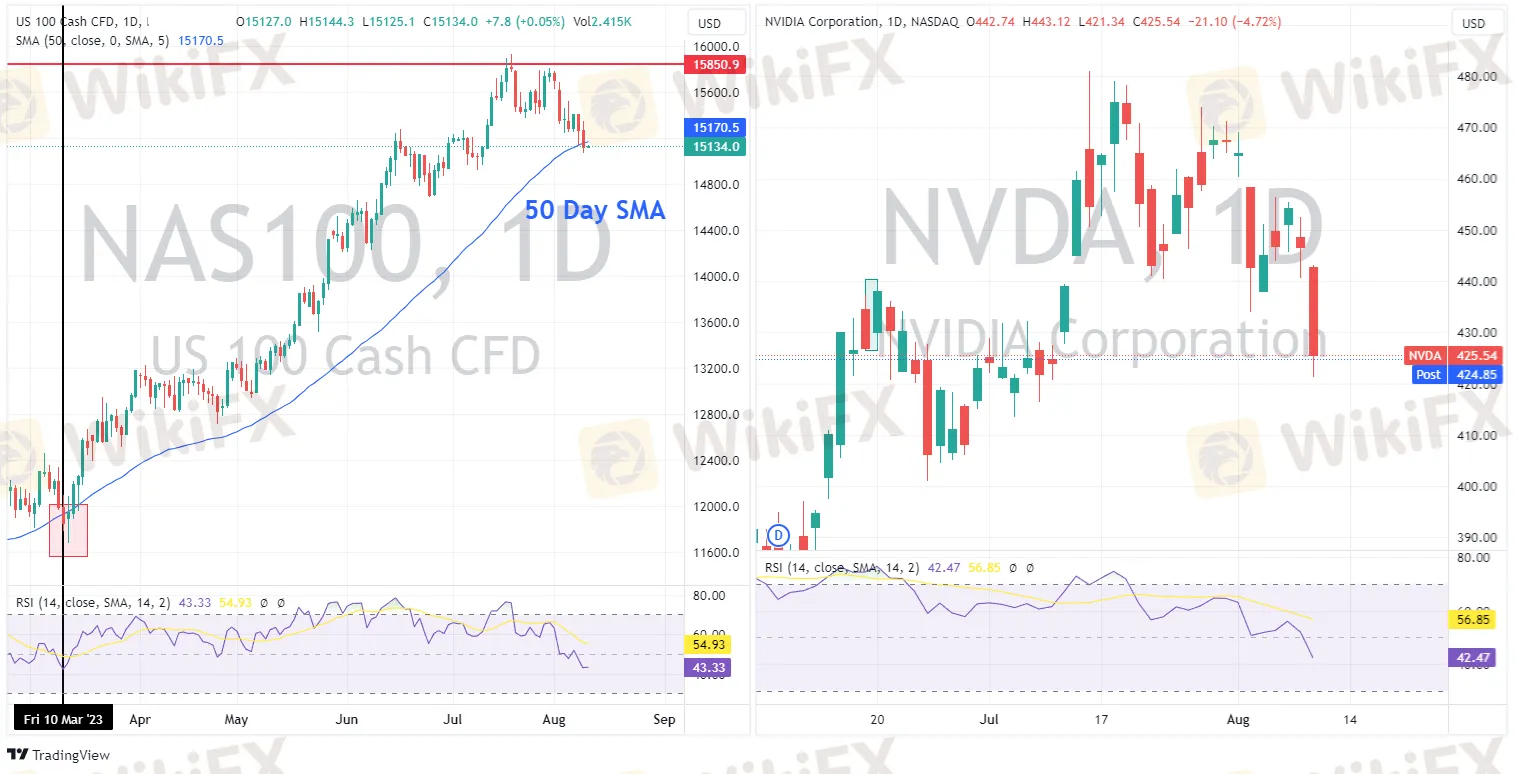

The key US stock indices experienced a volatile session on Wednesday due to traders adjusting their positions in anticipation of yesterday's crucial US CPI data release. Tech led the declines with the Nasdaq being the worst performing index, dropping 162 points (-1.17%), the NDX100 closing below its 50 Day MA for the first time since early March. AI exuberance seeming to lose steam with industry bellwether SMCI tumbling after releasing earnings, dragging down heavyweight NVDA almost 5%.

FX Markets

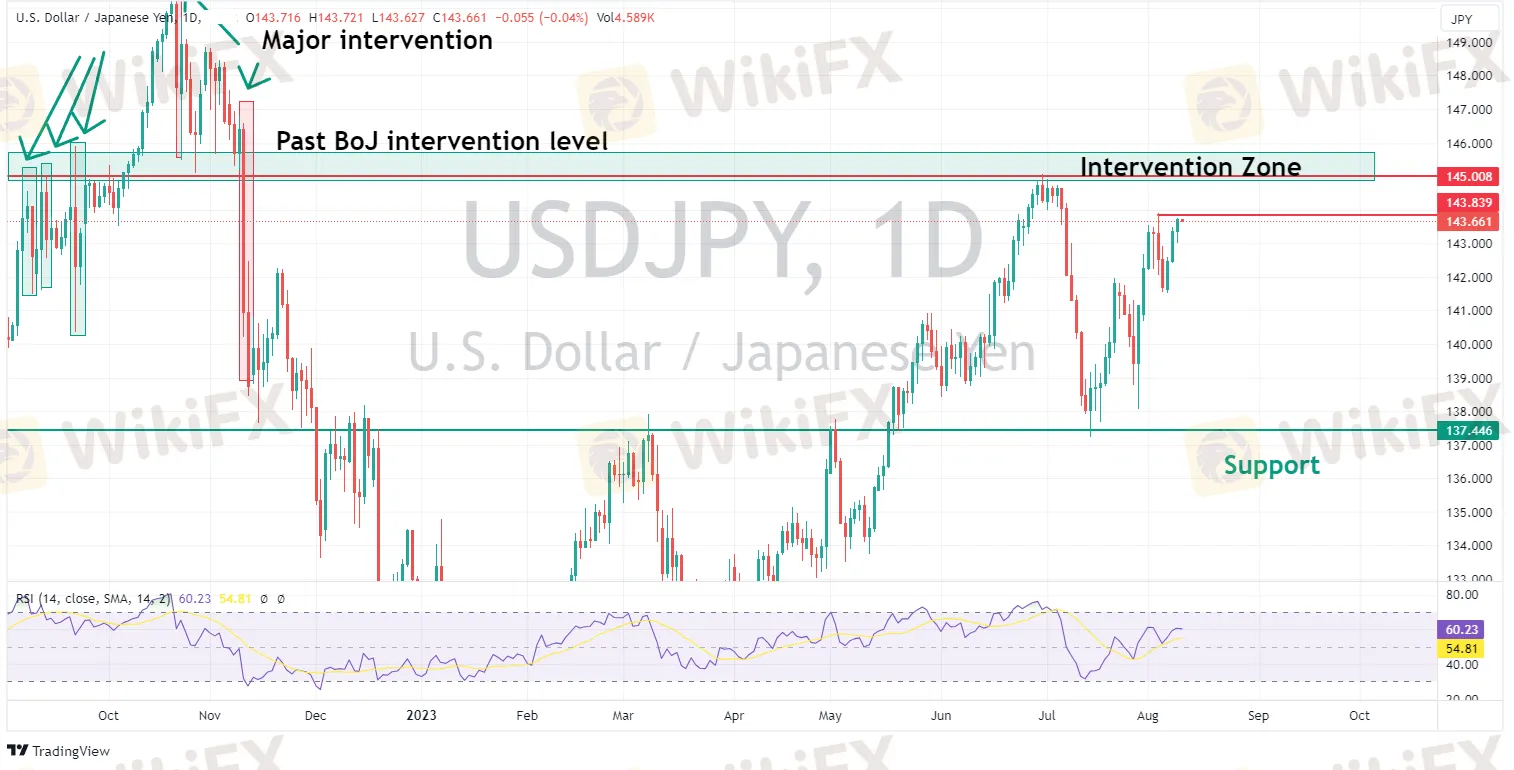

It was a quiet session in FX with most majors fairly flat on Wednesday ahead of today‘s US CPI which is likely to see a more exciting session on Thursday. Highlights were JPY still grinding lower, USDJPY pushing to test the August highs and continuing its seemingly inevitable march to test the BoJ resolve at the 145 mark, though today’s CPI will play a big part in that in the near term.

AUDUSD drifted lower on the sour risk sentiment, though still stubbornly holding on to the major support at the big figure at 0.6500, we could see a serious test of AUD bulls resolve at this level if US CPI comes in hot later today.

Commodities

Continuing high yields and a USD grinding higher saw Gold continue its downtrend, XAUUSD pushing lower through the 1920 level, into the chop range we saw it trade in June/July. 1902 the next major support level, and from a technical point of view, fresh air below that, 1902 will be a critical level to watch.

Crude Oil surged again on Wednesday, breaking through the major resistance at 83.68 and hitting highs not seen since November 22. The Daily RSI moving to an extreme overbought level.

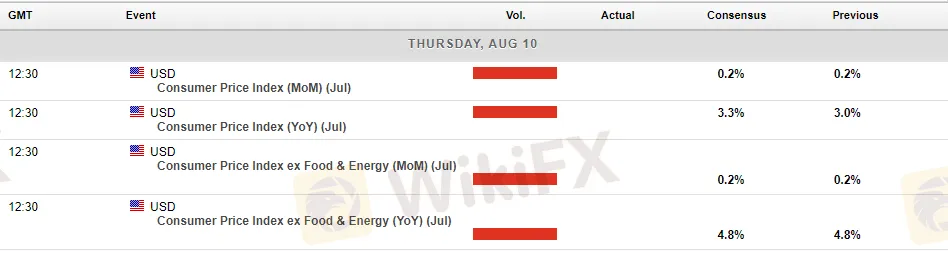

Todays calendar is dominated by the much awaited US CPI, while there are a multiple tier one US releases between now and the next FOMC meeting, this will be one of the big ones to shape the markets expectations of the Feds move at that meeting, big volatility across all markets is very likely on its release.

WikiFX Trader

octa

GTCFX

STARTRADER

EBC

ZFX

VT Markets

octa

GTCFX

STARTRADER

EBC

ZFX

VT Markets

WikiFX Trader

octa

GTCFX

STARTRADER

EBC

ZFX

VT Markets

octa

GTCFX

STARTRADER

EBC

ZFX

VT Markets

Rate Calc