MHMarkets:Us dollar yesterday gold needle bottom K line form, non-US currency precious metals overall weak, US crude oil fell sharply!

Sommario:Spot gold traded in a narrow range during Asian hours on Friday (August 11), trading around $1,915 an ounce, supported by weaker-than-expected US CPI data for July overnight and bets that Federal Reserve policy makers are unlikely to raise interest rates again in 2023 and may start cutting rates early next year.

Market Overview

Spot gold traded in a narrow range during Asian hours on Friday (August 11), trading around $1,915 an ounce, supported by weaker-than-expected US CPI data for July overnight and bets that Federal Reserve policy makers are unlikely to raise interest rates again in 2023 and may start cutting rates early next year.

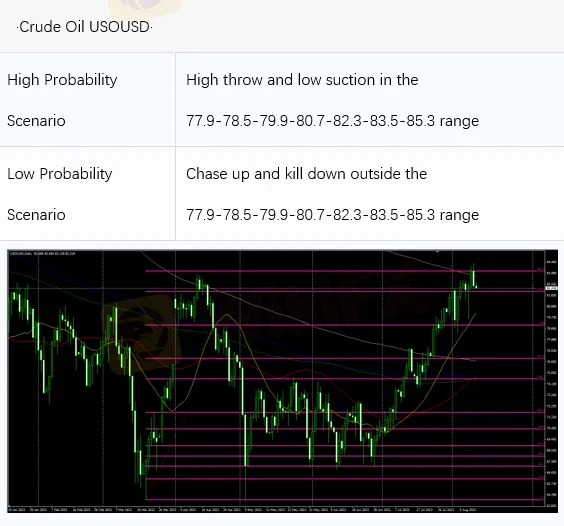

U.S. crude traded near $82.87 a barrel; Oil prices fell nearly 2% on Thursday after hitting a fresh nine-month high of $84.87 a barrel as OPEC remained upbeat on the outlook for oil demand and U.S. inflation data dampened forecasts for another U.S. interest rate hike, but concerns about Asian demand capped gains.

The day will focus on the IEA monthly crude oil market report, USD PPI Data (JUL) and the USD Michigan Consumer Sentiment Prel (AUG), which investors will need to focus on. In addition, they will need to pay attention to the geopolitical situation and Federal Reserve officials speaking.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on August 11, Beijing time.

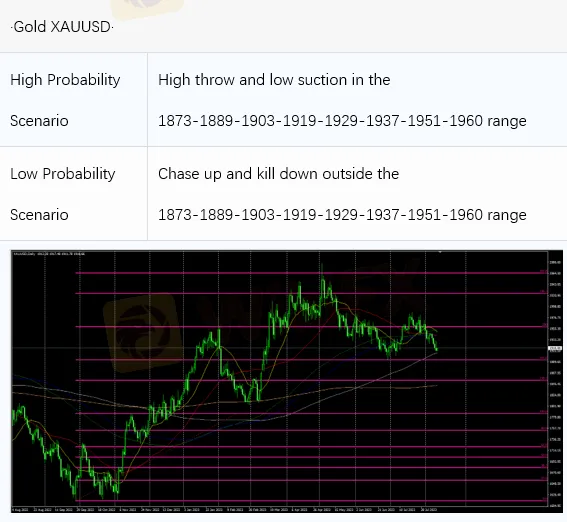

Intraday Oscillation Range: 1873-1889-1903-1919-1929-1937-1951-1960

Overall Oscillation Range: 1730-1756-1780-1801-1817-1833-1856-1873-1889-1903-1919-1929-1937-1951-1960-1977-1985-1998-2007-2016-2033-2046-2057-2066-2077-2089-2097-2100

In the subsequent period of spot gold, 1873-1889-1903-1919-1929-1937-1951-1960 can be operated as the bull and bear range; High throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 11. This policy is a daytime policy. Please pay attention to the policy release time.

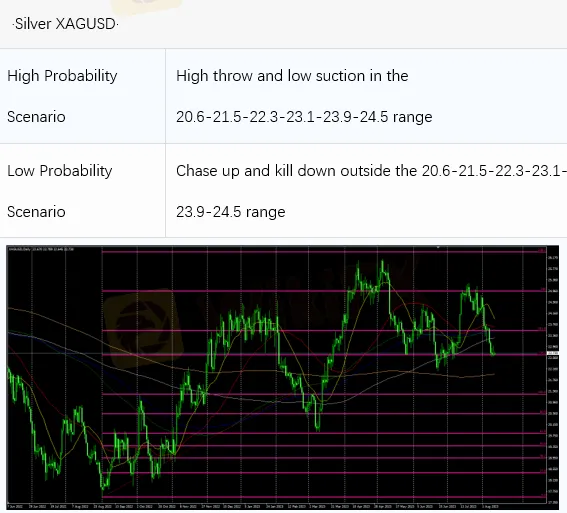

Intraday Oscillation Range: 20.6-21.5-22.3-23.1-23.9-24.5

Overall Oscillation Range: 19.7-20.1-20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1-26.6-27.3

In the subsequent period of spot silver, 20.6-21.5-22.3-23.1-23.9-24.5 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 11. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 77.9-78.5-79.9-80.7-82.3-83.5-85.3

Overall Oscillation Range: 62.1-63.7-64.5-65.8-66.9-67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3-89.1-90.7

In the subsequent period of crude oil, 77.9-78.5-79.9-80.7-82.3-83.5-85.3 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 11. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range:1.0755-1.0830-1.0950-1.1157-1.1220

Overall Oscillation Range: 1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0830-1.0950-1.1157-1.1220-1.1303-1.13340

In the subsequent period of EURUSD, 1.0755-1.0830-1.0950-1.1157-1.1220can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 11. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range:1.25460-1.26505-1.27000-1.28200-1.29300

Overall Oscillation Range: 1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2375-1.2400-1.2470-1.25460-1.26505-1.27000-1.28200-1.29300-1.30000-1.30600-1.31000-1.31660-132000

In the subsequent period of GBPUSD, 1.25460-1.26505-1.27000-1.28200-1.29300 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 11. This policy is a daytime policy. Please pay attention to the policy release time.

WikiFX Trader

FXCM

STARTRADER

TMGM

FXTM

IC Markets Global

EC markets

FXCM

STARTRADER

TMGM

FXTM

IC Markets Global

EC markets

WikiFX Trader

FXCM

STARTRADER

TMGM

FXTM

IC Markets Global

EC markets

FXCM

STARTRADER

TMGM

FXTM

IC Markets Global

EC markets

Rate Calc