MHMarkets:The dollar daily line rose for five consecutive days, the pound was much stronger than the rest, and the US crude oil was back below $80!

Sommario:Spot gold extended overnight losses on Thursday (Aug 17) in Asia, hitting nearly five fresh lows at one point to $1,889.44 an ounce, as the minutes of the US Federal Reserve's July policy meeting highlighted that policymakers remain divided on the need to raise interest rates further.

Market Overview

Spot gold extended overnight losses on Thursday (Aug 17) in Asia, hitting nearly five fresh lows at one point to $1,889.44 an ounce, as the minutes of the US Federal Reserve's July policy meeting highlighted that policymakers remain divided on the need to raise interest rates further. In addition, US housing starts increased sharply in July, industrial output stopped falling and picked up, the Atlanta Fed model raised its third-quarter GDP growth forecast, and the market also lowered its expectations of a US recession. The dollar and US bond yields continued to rise, which significantly depressed gold prices. Gold is now back near $1,893.02 an ounce on bargain hunting and some short exits.

Minutes of the Fed's July 25-26 meeting showed that “a few participants” cited risks to the economy from raising interest rates too high, but that “most” policy makers continued to prioritize fighting inflation.

The dollar index continued to rise, hitting a more than one-month high of 103.56 at one point and now trading near 103.53. On Wednesday, the dollar index closed up 0.24% at 103.44, its highest close in nearly two months. Minutes of the Fed's July meeting, released early Thursday morning, showed officials were divided at their last meeting over whether more rate increases were needed.

According to CME's “Fed Watch” : there is an 88% chance that the Fed will keep interest rates unchanged at 5.25%-5.50% in September, and a 12% chance that the Fed will raise rates by 25 basis points to a range of 5.50%-5.75%; There is a 60.7% chance of holding rates steady by November, a 35.6% chance of a cumulative 25 basis point increase and a 3.7% chance of a cumulative 50 basis point increase.

U.S. crude oil edged lower, hitting a near two-week low near $78.94 a barrel at one point; Oil prices retreated more than 2% on Wednesday, as stocks fell despite a big drawdown in U.S. crude inventories and as investors weighed concerns about the economy against expectations of tighter U.S. supply.

This trading day, watch for changes in US Initial Jobless Claims and watch for changes in market expectations for the global economic outlook.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on August 17, Beijing time.

Intraday Oscillation Range: 1873-1889-1903-1919-1929-1937-1951-1960

Overall Oscillation Range: 1730-1756-1780-1801-1817-1833-1856-1873-1889-1903-1919-1929-1937-1951-1960-1977-1985-1998-2007-2016-2033-2046-2057-2066-2077-2089-2097-2100

In the subsequent period of spot gold, 1873-1889-1903-1919-1929-1937-1951-1960 can be operated as the bull and bear range; High throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 17. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 20.6-21.5-22.3-23.1-23.9-24.5

Overall Oscillation Range: 19.7-20.1-20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1-26.6-27.3

In the subsequent period of spot silver, 20.6-21.5-22.3-23.1-23.9-24.5 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 17. This policy is a daytime policy. Please pay attention to the policy release time.

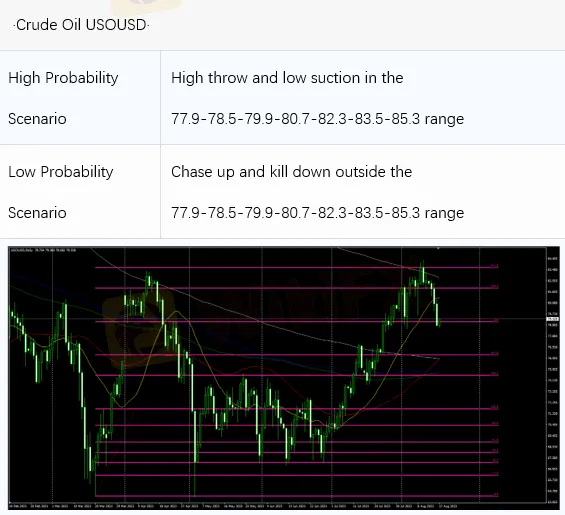

Intraday Oscillation Range: 77.9-78.5-79.9-80.7-82.3-83.5-85.3

Overall Oscillation Range: 62.1-63.7-64.5-65.8-66.9-67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3-89.1-90.7

In the subsequent period of crude oil, 77.9-78.5-79.9-80.7-82.3-83.5-85.3 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 17. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range:1.0755-1.0830-1.0950-1.1157-1.1220

Overall Oscillation Range: 1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0830-1.0950-1.1157-1.1220-1.1303-1.13340

In the subsequent period of EURUSD, 1.0755-1.0830-1.0950-1.1157-1.1220can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 17. This policy is a daytime policy. Please pay attention to the policy release time.

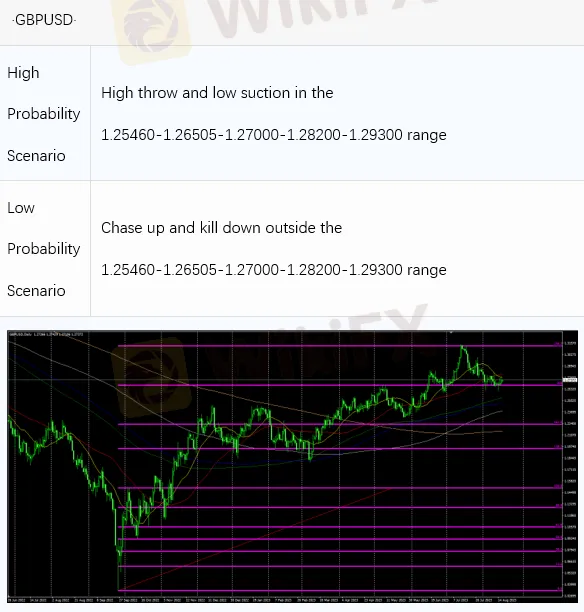

Intraday Oscillation Range:1.25460-1.26505-1.27000-1.28200-1.29300

Overall Oscillation Range: 1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2375-1.2400-1.2470-1.25460-1.26505-1.27000-1.28200-1.29300-1.30000-1.30600-1.31000-1.31660-132000

In the subsequent period of GBPUSD, 1.25460-1.26505-1.27000-1.28200-1.29300 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 17. This policy is a daytime policy. Please pay attention to the policy release time.

WikiFX Trader

IB

FOREX.com

FXTM

IC Markets Global

Exness

OANDA

IB

FOREX.com

FXTM

IC Markets Global

Exness

OANDA

WikiFX Trader

IB

FOREX.com

FXTM

IC Markets Global

Exness

OANDA

IB

FOREX.com

FXTM

IC Markets Global

Exness

OANDA

Rate Calc