MHMarkets:The dollar rose slightly, the euro was significantly weak, and US crude oil continued to weaken!

Sommario:Spot gold rose slightly in Asia on Wednesday (August 23), trading near $1,902.74 / oz ahead of the Jackson Hole annual meeting. The market is in a more bearish mood, with the dollar index and Treasury yields falling, with the dollar index moving away from a near 2-1/2-month high and the 10-year Treasury yield moving away from a near 16-year high hit on Tuesday, providing support for gold. Gold was also supported by some bargain hunting after it stabilized below 1,890.

Market Overview

Spot gold rose slightly in Asia on Wednesday (August 23), trading near $1,902.74 / oz ahead of the Jackson Hole annual meeting. The market is in a more bearish mood, with the dollar index and Treasury yields falling, with the dollar index moving away from a near 2-1/2-month high and the 10-year Treasury yield moving away from a near 16-year high hit on Tuesday, providing support for gold. Gold was also supported by some bargain hunting after it stabilized below 1,890.

This trading day will usher in the PMI data of European and American countries in August, the market is expected to be generally lower than the 50 line between expansion and contraction, investors need to pay attention. Also, watch for the performance of the seasonally adjusted annualized total of new home sales in the US in July.

U.S. crude traded near $79.50 a barrel; Oil prices fell more than 1.5% on Tuesday as investors remained concerned about weakening demand and the odds the Federal Reserve will hold interest rates steady in September declined, capping gains despite a smaller-than-expected drop in U.S. inventories on the morning API.

The day focuses on the USD Building Permits MOM 2nd Est (JUL) and USD EIA Crude Oil Stocks Change (AUG/18).

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on August 23, Beijing time.

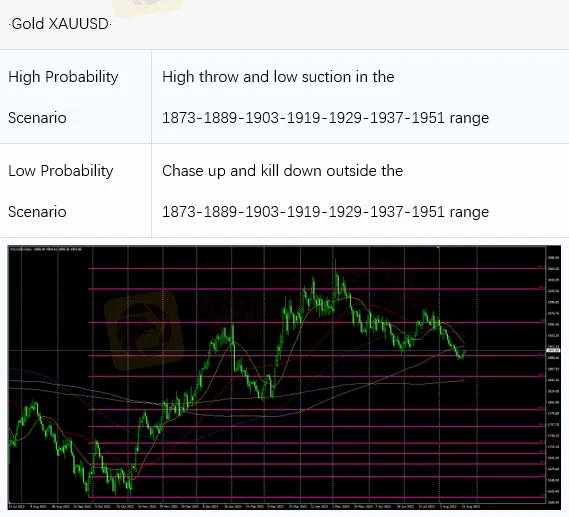

Intraday Oscillation Range: 1873-1889-1903-1919-1929-1937-1951

Overall Oscillation Range: 1730-1756-1780-1801-1817-1833-1856-1873-1889-1903-1919-1929-1937-1951-1960-1977-1985-1998-2007-2016-2033-2046-2057-2066-2077-2089-2097-2100

In the subsequent period of spot gold, 1873-1889-1903-1919-1929-1937-1951 can be operated as the bull and bear range; High throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 23. This policy is a daytime policy. Please pay attention to the policy release time.

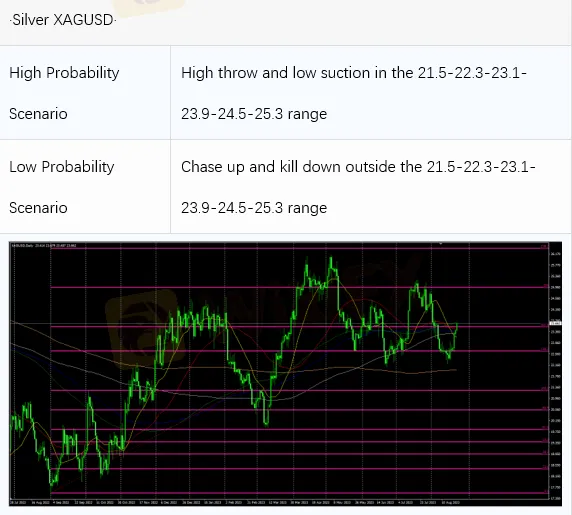

Intraday Oscillation Range: 21.5-22.3-23.1-23.9-24.5-25.3

Overall Oscillation Range: 19.7-20.1-20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1-26.6-27.3

In the subsequent period of spot silver, 21.5-22.3-23.1-23.9-24.5-25.3 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 23. This policy is a daytime policy. Please pay attention to the policy release time.

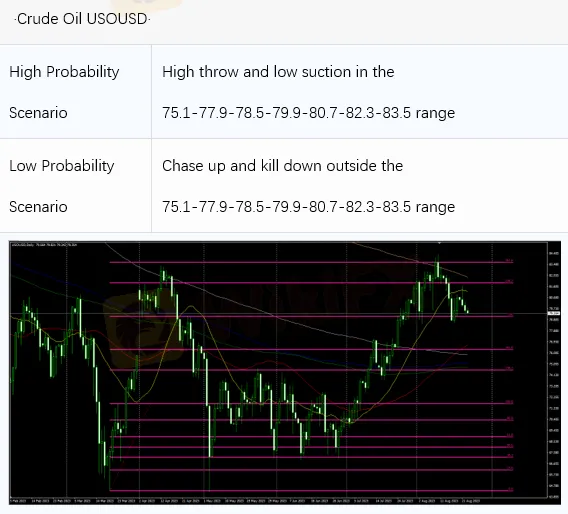

Intraday Oscillation Range: 75.1-77.9-78.5-79.9-80.7-82.3-83.5

Overall Oscillation Range: 62.1-63.7-64.5-65.8-66.9-67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3-89.1-90.7

In the subsequent period of crude oil, 75.1-77.9-78.5-79.9-80.7-82.3-83.5 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 23. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range:1.0690-1.0755-1.0830-1.0950-1.1157

Overall Oscillation Range:

1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0830-1.0950-1.1157-1.1220-1.1303-1.13340

In the subsequent period of EURUSD, 1.0690-1.0755-1.0830-1.0950-1.1157can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 23. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range:1.25460-1.26505-1.27000-1.28200-1.29300

Overall Oscillation Range: 1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2375-1.2400-1.2470-1.25460-1.26505-1.27000-1.28200-1.29300-1.30000-1.30600-1.31000-1.31660-132000

In the subsequent period of GBPUSD, 1.25460-1.26505-1.27000-1.28200-1.29300 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 23. This policy is a daytime policy. Please pay attention to the policy release time.

WikiFX Trader

AvaTrade

Vantage

Exness

FBS

TMGM

FP Markets

AvaTrade

Vantage

Exness

FBS

TMGM

FP Markets

WikiFX Trader

AvaTrade

Vantage

Exness

FBS

TMGM

FP Markets

AvaTrade

Vantage

Exness

FBS

TMGM

FP Markets

Rate Calc