MHMarkets:The U.S. dollar dropped from high, silver was significantly stronger than gold, and U.S. crude oil's short momentum was unleashed!

Sommario:On Thursday (August 24), spot gold rose slightly during the Asian session, once hit a nearly two-week high of $1922.19 per ounce, and is currently trading at $1920.91 per ounce.

Market Overview

On Thursday (August 24), spot gold rose slightly during the Asian session, once hit a nearly two-week high of $1922.19 per ounce, and is currently trading at $1920.91 per ounce. The August PMI data released on Thursday in Europe and the United States performed poorly, on the one hand, boosting the safe-haven demand for gold, on the other hand, easing the pressure on the European and American central banks to raise interest rates further. The market even expects the Fed to have more rate cuts in 2024, which drags down the dollar and U.S. bond yields, attracting medium-and long-term gold buying.

U.S. crude traded near $78.53 per barrel; oil prices fell more than 1% on Wednesday as demand woes caused by a rise in U.S. gasoline inventories and weak global manufacturing data overshadowed optimism over a larger-than-expected drop in U.S. crude stockpiles.

This trading day will see the USD Initial Jobless Claims and USD Durable Goods Orders (JUL). The market is expected to Initial Jobless Claims will increase slightly to 240,000 people, but is expected to Durable Goods Orders fell 4% from the previous year. The expectation is expected to provide further rebound momentum to the gold price, investors need to pay attention to the specific performance of the data.

In addition, Philadelphia Fed President Harker and Boston Fed President Collins this trading day will also give the speeches, investors need to pay attention to.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on August 24, Beijing time.

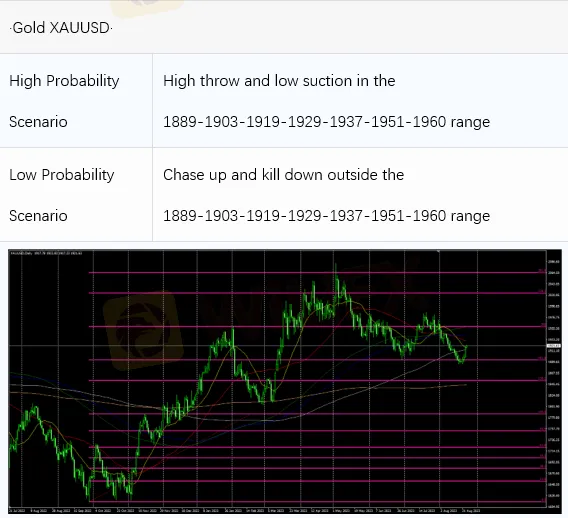

Intraday Oscillation Range: 1889-1903-1919-1929-1937-1951-1960

Overall Oscillation Range: 1730-1756-1780-1801-1817-1833-1856-1873-1889-1903-1919-1929-1937-1951-1960-1977-1985-1998-2007-2016-2033-2046-2057-2066-2077-2089-2097-2100

In the subsequent period of spot gold, 1889-1903-1919-1929-1937-1951-1960 can be operated as the bull and bear range; High throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 24. This policy is a daytime policy. Please pay attention to the policy release time.

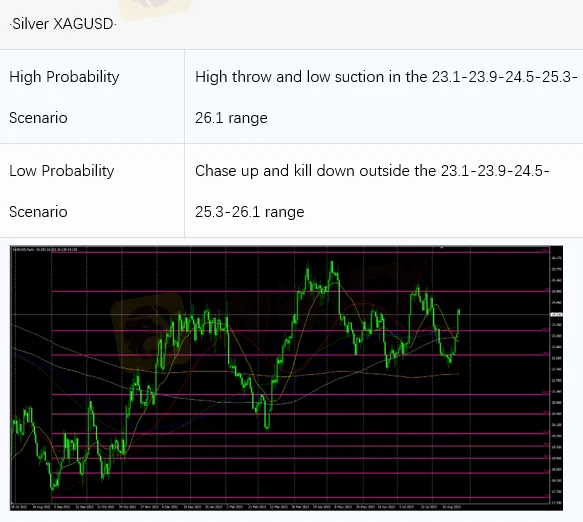

Intraday Oscillation Range: 23.1-23.9-24.5-25.3-26.1

Overall Oscillation Range: 19.7-20.1-20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1-26.6-27.3

In the subsequent period of spot silver, 23.1-23.9-24.5-25.3-26.1 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 24. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 73.8-75.1-77.9-78.5-79.9-80.7-82.3

Overall Oscillation Range: 62.1-63.7-64.5-65.8-66.9-67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3-89.1-90.7

In the subsequent period of crude oil, 73.8-75.1-77.9-78.5-79.9-80.7-82.3 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 24. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 1.0690-1.0755-1.0830-1.0950-1.1157

Overall Oscillation Range:

1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0830-1.0950-1.1157-1.1220-1.1303-1.13340

In the subsequent period of EURUSD, 1.0690-1.0755-1.0830-1.0950-1.1157 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 24. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 1.25460-1.26505-1.27000-1.28200-1.29300

Overall Oscillation Range: 1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2375-1.2400-1.2470-1.25460-1.26505-1.27000-1.28200-1.29300-1.30000-1.30600-1.31000-1.31660-132000

In the subsequent period of GBPUSD, 1.25460-1.26505-1.27000-1.28200-1.29300 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 24. This policy is a daytime policy. Please pay attention to the policy release time.

WikiFX Trader

STARTRADER

HFM

ATFX

FxPro

FXTM

FOREX.com

STARTRADER

HFM

ATFX

FxPro

FXTM

FOREX.com

WikiFX Trader

STARTRADER

HFM

ATFX

FxPro

FXTM

FOREX.com

STARTRADER

HFM

ATFX

FxPro

FXTM

FOREX.com

Rate Calc