Gold buy bias if there is a big US Core PCE miss

Sommario:Gold has been gaining this week on a miss in the US JOLTS job openings print and a miss in the US consumer confidence print on Tuesday. A slowdown in the US job market aligns with the Federal Reserve’s objectives, indicating that the impact of interest rate hikes is beginning to cool the US economy. The miss in these two data points sent gold surging higher on Tuesday, as yields and the dollar fell.

Gold has been gaining this week on a miss in the US JOLTS job openings print and a miss in the US consumer confidence print on Tuesday. A slowdown in the US job market aligns with the Federal Reserves objectives, indicating that the impact of interest rate hikes is beginning to cool the US economy. The miss in these two data points sent gold surging higher on Tuesday, as yields and the dollar fell.

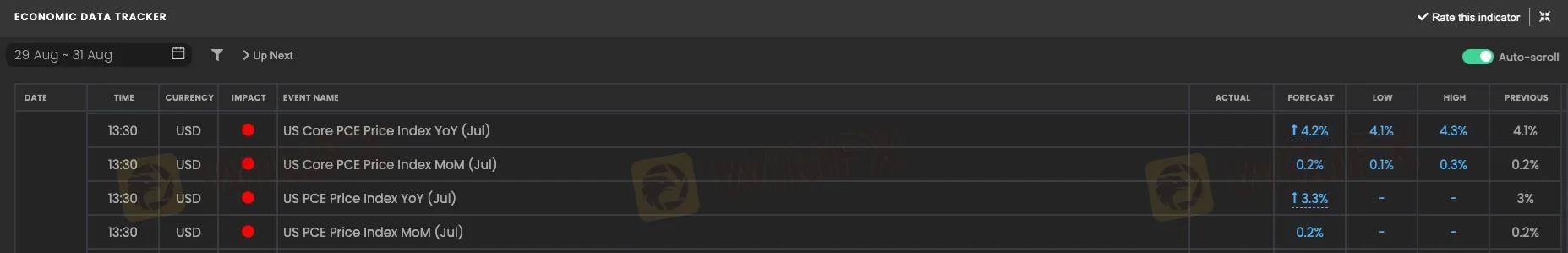

Anticipating Thursday's PCE Data Release and Its Influence on Gold There's another chance for gold to attract significant buyers as we anticipate this Thursdays PCE print. Should the PCE print fall below the lower limit of market expectations, we're likely to witness a drop in yields once more, parallel to the dollar. This scenario will consequently boost gold. The Core PCE print is projected to register at 4.2%, slightly above June's reading of 4.1%. The headline print, on the other hand, is anticipated to reach 3.3%, an increase from the previous figure of 3%. It's important to note that PCE inflation data is the Federal Reserve's favored measure of inflation, thus they'll be closely monitoring this data. Please, see the data expectations given below.

What to expect

Opportunities for purchasing gold are likely to arise if significant discrepancies occur in the data. How do we define discrepancies? Indicators would include a headline figure below 3% and a core reading less than 4.1%. These parameters would ease the burden on the Federal Reserve to increase interest rates, subsequently instigating a decrease in yields and the dollar, while pushing the value of gold upwards. Additionally, data discrepancies as specified could also positively influence the EURUSD, and might even boost US stocks. Nevertheless, market responses are unpredictable, therefore this should always be considered.

WikiFX Trader

ZFX

AVATRADE

octa

GTCFX

HFM

D prime

ZFX

AVATRADE

octa

GTCFX

HFM

D prime

WikiFX Trader

ZFX

AVATRADE

octa

GTCFX

HFM

D prime

ZFX

AVATRADE

octa

GTCFX

HFM

D prime

Rate Calc