MHMarkets:The U.S. dollar rose sharply during the day, non-US currencies and precious metals plummeted collectively, and U.S. crude oil shocked and consolidated in a small intraday range!

Sommario:On Tuesday (September 5), spot gold maintained its modest intraday decline during the Asian market, with gold prices now trading near $1937 per ounce. Anil Panchal, an analyst at leading financial website FXStreet, wrote in his latest article on Tuesday that gold bulls are losing momentum below the $1,950 per ounce mark. CNY Caixin Services PMI and USD Factory Orders will be the focus of the session in terms of economic data.

Market Overview

On Tuesday (September 5), spot gold maintained its modest intraday decline during the Asian market, with gold prices now trading near $1937 per ounce. Anil Panchal, an analyst at leading financial website FXStreet, wrote in his latest article on Tuesday that gold bulls are losing momentum below the $1,950 per ounce mark. CNY Caixin Services PMI and USD Factory Orders will be the focus of the session in terms of economic data.

Oil prices rose slightly as market sentiment was buoyed by positive economic data from China and the U.S., as well as expectations of continued crude supply cuts from major oil producers.

Looking ahead to the session, US traders will return after a long weekend. Market reactions to China August Caixin Services PMI and U.S. July Factory Orders will be important to watch for clear direction. Most importantly, the latest news on the Fed's next move, clues to China's economic recovery, and stimulus measures will be important for gold traders to focus on new dynamics.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on September 5, Beijing time.

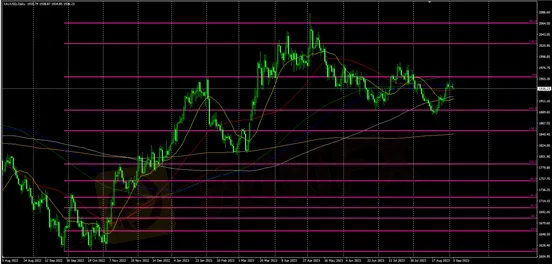

| ·Gold XAUUSD· | |

| High Probability Scenario | High throw and low suction in the1903-1919-1931-1945-1951-1960 range |

| Low Probability Scenario | Chase up and kill down outside the1903-1919-1931-1945-1951-1960 range |

| |

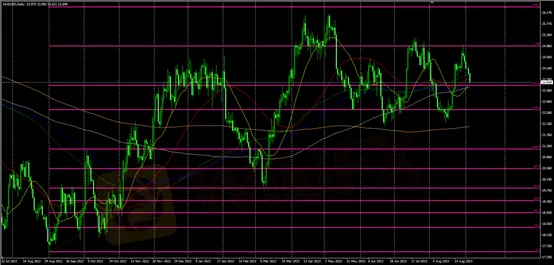

| ·Silver XAGUSD· | |

| High Probability Scenario | High throw and low suction in the21.5-22.3-23.1-23.9-24.5-25.3 range |

| Low Probability Scenario | Chase up and kill down outside the 21.5-22.3-23.1-23.9-24.5-25.3 range |

| |

| ·Crude Oil USOUSD· | |

| High Probability Scenario | High throw and low suction in the79.9-80.7-82.3-83.5-85.3-87.3-89.1 range |

| Low Probability Scenario | Chase up and kill down outside the79.9-80.7-82.3-83.5-85.3-87.3-89.1 range |

| |

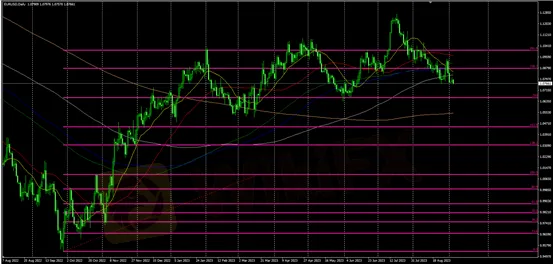

| ·EURUSD· | |

| High Probability Scenario | High throw and low suction in the1.0570-1.0690-1.0755-1.0830-1.0950 range |

| Low Probability Scenario | Chase up and kill down outside the1.0570-1.0690-1.0755-1.0830-1.0950 range |

| |

| ·GBPUSD· | |

| High Probability Scenario | High throw and low suction in the 1.2250-1.2400-1.2470-1.25460-1.26505-1.27000 range |

| Low Probability Scenario | Chase up and kill down outside the 1.2250-1.2400-1.2470-1.25460-1.26505-1.27000 range |

| |

WikiFX Trader

D prime

eightcap

GTCFX

FXTM

EBC

IC Markets Global

D prime

eightcap

GTCFX

FXTM

EBC

IC Markets Global

WikiFX Trader

D prime

eightcap

GTCFX

FXTM

EBC

IC Markets Global

D prime

eightcap

GTCFX

FXTM

EBC

IC Markets Global

Rate Calc