MHMarkets:The US dollar rises again after dropping from high, the Euro leads gains, and US crude oil is about to hit a key historical level!

Sommario:On Wednesday (September 13), spot gold fluctuated and fell slightly during the Asian and European session and is currently trading near $1909.58 per ounce.

Market Overview

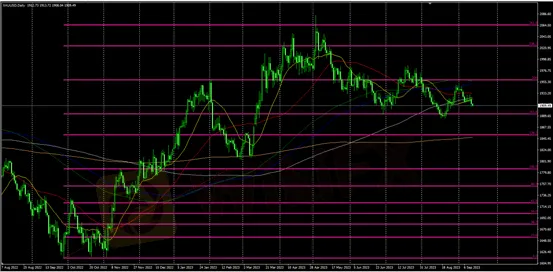

On Wednesday (September 13), spot gold fluctuated and fell slightly during the Asian and European session and is currently trading near $1909.58 per ounce. Goldman Sachs CEO Su Dewei said the chances of the U.S. economy achieving a soft landing increased dramatically, but he warned that inflation may be more persistent than market participants currently expect, and the Fed may need to take further action. This gave support to the dollar index and pressured gold prices.

Gold prices lost two key supports, the 200-day SMA and the 21-day SMA, on Tuesday, and short-term bearish signals have increased, and the market may further test the support of the 1900 mark, or even fall to the lower Bollinger Bands near 1884.14, where the recent low support is also located.

Investors await U.S. inflation data that could influence expectations for the Fed's interest rate outlook. U.S. August consumer price is expected to have risen the most in 14 months on a month-on-month basis as gasoline costs soared. Although core inflation is expected to remain moderate, which may encourage the Fed to keep interest rates unchanged at its meeting next Wednesday, the market expects the probability of another Fed rate hike in November to be close to 50%.

The U.S. Labor Department on Wednesday will release the consumer price report, and the Fed meeting next week only a week apart. Data released earlier this month showed that the tightness of the job market in August has eased. August core inflation is expected to remain moderate for the third consecutive month, the forecast will be the lowest in nearly two years. Core inflation excludes volatile food and energy items.

According to a survey of economists, the U.S. August Consumer Price Index (CPI) is expected to rise 0.6% from the previous month. This would be the biggest month-on-month increase since June 2022, following two consecutive monthly gains of 0.2%.

According to the U.S. Energy Information Administration (EIA), gasoline prices rose in August, reaching a high of $3.984 per gallon in the third week of August. This compares to $3.676 per gallon during the same period in July.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on September 13, Beijing time.

| ·Gold XAUUSD· | |

| High Probability Scenario | High throw and low suction in the 1892-1903-1919-1931-1945-1951 range |

| Low Probability Scenario | Chase up and kill down outside the 1892-1903-1919-1931-1945-1951 range |

| |

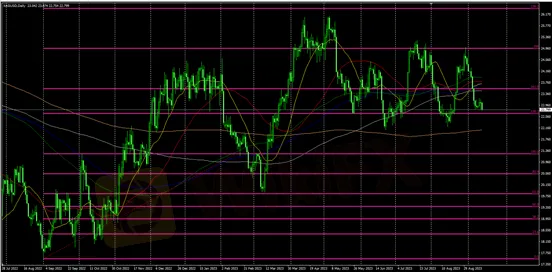

| ·SilverXAGUSD· | |

| High Probability Scenario | High throw and low suction in the 21.5-22.3-23.1-23.9-24.5-25.3 range |

| Low Probability Scenario | Chase up and kill down outside the 21.5-22.3-23.1-23.9-24.5-25.3 range |

| |

| ·Crude OilUSOUSD· | |

| High Probability Scenario | High throw and low suction in the 83.5-85.3-87.3-89.1-90.7-91.5-92.6 range |

| Low Probability Scenario | Chase up and kill down outside the 83.5-85.3-87.3-89.1-90.7-91.5-92.6 range |

| |

| ·EURUSD· | |

| High Probability Scenario | High throw and low suction in the 1.0570-1.0690-1.0755-1.0830-1.0950 range |

| Low Probability Scenario | Chase up and kill down outside the1.0570-1.0690-1.0755-1.0830-1.0950 range |

| |

| ·GBPUSD· | |

| High Probability Scenario | High throw and low suction in the 1.2250-1.2400-1.2470-1.25460-1.26505-1.27000 range |

| Low Probability Scenario | Chase up and kill down outside the 1.2250-1.2400-1.2470-1.25460-1.26505-1.27000 range |

| |

WikiFX Trader

Vantage

FBS

FP Markets

EC Markets

AvaTrade

FOREX.com

Vantage

FBS

FP Markets

EC Markets

AvaTrade

FOREX.com

WikiFX Trader

Vantage

FBS

FP Markets

EC Markets

AvaTrade

FOREX.com

Vantage

FBS

FP Markets

EC Markets

AvaTrade

FOREX.com

Rate Calc