MHMarkets:The CPI data was heavily positive, the dollar index soared and gold fell sharply.

Sommario:At the end of the Asian market on Friday (October 13), the US dollar index rose significantly yesterday due to the impact of US CPI data.

At the end of the Asian market on Friday (October 13), the US dollar index rose significantly yesterday due to the impact of US CPI data. Today, at the opening of the Asian market, it fell back to 106.41 and was hindered. The current price has slightly risen to 106.50. Gold rebounded and rose at the opening of the Asian market, with the current price at 1875.88. The trend of crude oil in yesterday's market showed an inverse V-shaped reversal, with a slight increase at the opening of the Asian market. The current price is at 82.87. EURUSD rebounded and rose to 1.0550 at the opening of the Asian market, but the correction was hindered. The current price is at 1.0542. USDJPY accelerated its decline at the opening of the Asian market, as the price approached 150. Investors were concerned that the Bank of Japan would intervene in market investment sentiment and were cautious. The current price of USDJPY is around 149.73.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on October 13, Beijing time.

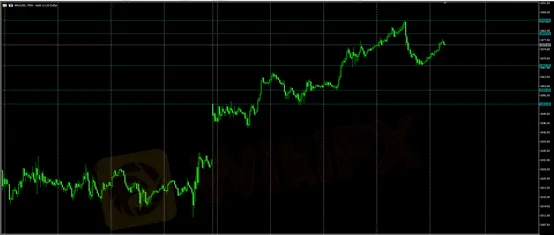

· Gold XAUUSD· | |

Resistance | 1879.91 – 1884.76 |

Support | 1867.78 – 1858.41 – 1853.15 |

Gold rebounded and rose in the Asian market and is likely to continue the downward trend of yesterday's US market in the future market. Intraday attention to the support of 1867.78 – 1858.41 – 1853.15 below and the resistance of 1879.91 – 1884.76 above. The market will be judged by whether to break through the upper and lower support and resistance. Note: The above strategy was updated at 15:00 on October 13. This policy is a daytime policy. Please pay attention to the policy release time. | |

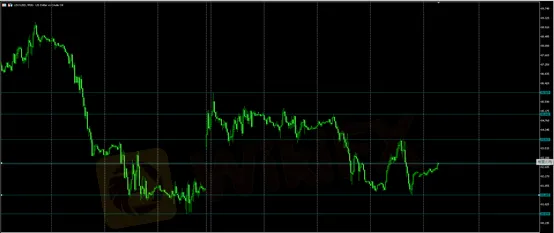

·Crude Oil USOUSD· | |

Resistance | 82.87—83.91—85.04 |

Support | 81.43—80.59 |

US crude oil rebounded and rose in the Asian market. Yesterday, it rose first and then fell and is likely to continue the downward trend of yesterday's US market in the future market. Intraday attention to the support of 81.43—80.59 below and the resistance of 82.87—83.91—85.04 above. The market will be judged by whether to break through the upper and lower support and resistance. Note: The above strategy was updated at 15:00 on October 13. This policy is a daytime policy. Please pay attention to the policy release time. | |

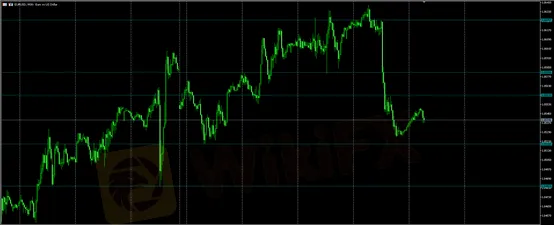

· EURUSD· | |

Resistance | 1.0561 - 1.0580 - 1.0625 |

Support | 1.0518 - 1.0482 |

EURUSD rebounded and rose in the Asian market and is likely to continue the downward trend of yesterday's US market in the future market. Intraday attention to the support of 1.0518 - 1.0482 below and the resistance of 1.0561 - 1.0580 - 1.0625 above. The market will be judged by whether to break through the upper and lower support and resistance. Note: The above strategy was updated at 15:00 on October 13. This policy is a daytime policy. Please pay attention to the policy release time. | |

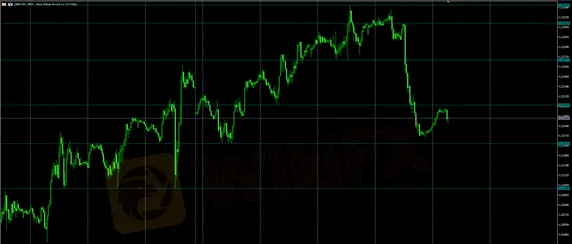

· GBPUSD· | |

Resistance | 1.2210 - 1.2267 – 1.2313 |

Support | 1.2161 - 1.2104 |

GBPUSD rebounded and rose after the opening of Asian market and is likely to continue the downward trend of yesterday's US market in the future market. Intraday attention to the support of 1.2161 - 1.2104 below and the resistance of 1.2210 - 1.2267 – 1.2313 above. The market will be judged by whether to break through the upper and lower support and resistance. Note: The above strategy was updated at 15:00 on October 13. This policy is a daytime policy. Please pay attention to the policy release time. | |

WikiFX Trader

XM

FXCM

JustMarkets

AvaTrade

FOREX.com

TMGM

XM

FXCM

JustMarkets

AvaTrade

FOREX.com

TMGM

WikiFX Trader

XM

FXCM

JustMarkets

AvaTrade

FOREX.com

TMGM

XM

FXCM

JustMarkets

AvaTrade

FOREX.com

TMGM

Rate Calc